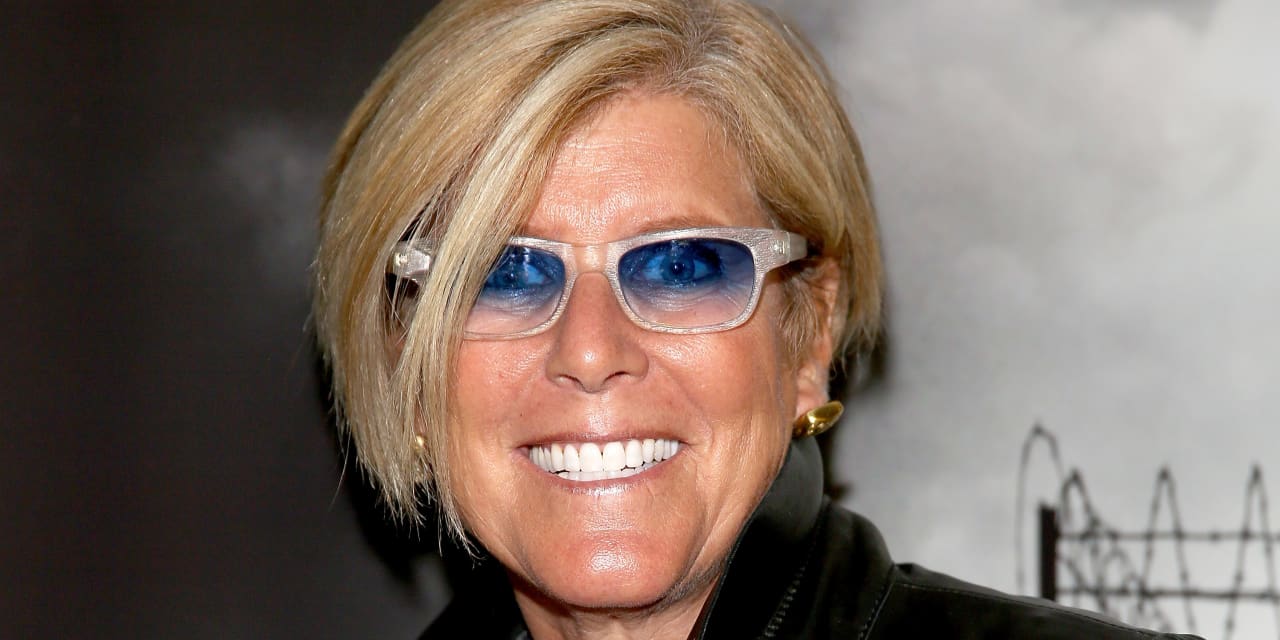

Suze Orman

Getty Photos

Finance expert Suze Orman is not shy about sharing her distaste for credit score cards. In a weblog post previously this 12 months, she wrote that a lot more than a quarter of Us citizens surveyed mentioned they experienced utilized for a new credit card in the earlier 12 months, and that statistic designed her incredibly fearful. “Using funds or a debit card is my preferred way to include the vast majority of your everyday paying. When you know your paying will be constrained to the funds you have in your wallet or in your examining account, you will possible curtail pointless shelling out,” suggests Orman.

She undoubtedly has a place. But pros say individuals of you who know you can usually pay off your credit card balance in complete and on time could probably financially reward — perhaps to the tune of thousands of bucks — from a credit card that delivers significant rewards. (If you’re in that group, you can see some of the best hard cash-back credit history cards of December 2022 right here.)

In a typical 12 months, Ted Rossman, senior market analyst at CreditCards.com claims he earns among $1,500 and $2,000 in funds again from his credit rating playing cards without paying a cent in fascination. My editor – who is rabid about constantly spending her bill in total and on time – notes that she’s a admirer of credit rating playing cards for the exact same explanation. “I know lots of folks who have taken incredible journeys all more than the earth for free of charge or quite near to it due to the fact of credit score card rewards,” claims Rossman.

Adds Matt Schulz, chief credit score analyst at LendingTree: “The proper credit card, employed sensibly, can essentially be an incredibly useful instrument … It can give you absolutely free plane flights and resort rooms and it can put cash back again in your pocket for points that you buy.” Adds Senitra Horbrook, credit rating playing cards editor at The Details Dude, “Using credit score playing cards sensibly can support you create a high credit rating score, which indicates you can obtain decreased fascination fees on a house loan or auto personal loan.” (See some of the best income-again credit history cards of December 2022 here.)

Even now, we have to once again warning: If you have credit history card credit card debt, forget about about benefits and as an alternative prioritize your curiosity level. It may well be handy, Rossman states, to consider of credit rating playing cards like power equipment: “They can be really beneficial, but they can also be harmful. That explained, I imagine experts like Suze Orman and Dave Ramsey go also considerably in their criticism of credit history cards,” says Rossman.

In fact, credit playing cards can be perilous for a wide range of factors — but the gains can also outweigh the pitfalls. “They can make it way also straightforward for you to spend your self into financial debt that you may perhaps have to shell out many years digging your self out of. If you are even just 30 days late with a payment, it can do critical problems to your credit history. Which is why I usually say that if you really do not want to get a credit rating card, really do not get 1,” claims Schulz.

Responsible shelling out suggests not charging much more than you can spend back again when the invoice is thanks. “If you have personal debt, the higher desire charges on rewards playing cards are generally not really worth the card positive aspects been given,” suggests Horbrook. Or as Schulz places it: “If you have a equilibrium, your concentration ought to be on shelling out that equilibrium down with a % equilibrium transfer credit card or even a private bank loan instead than chasing rewards. You really do not have to be an accountant to realize that spending 22% in desire on a obtain in order to get 2% income back is a lousy offer,” suggests Schulz.

While it is not that credit rating cards are bad, you just need to imagine about how any individual card fits into your over-all economical image. “Before you fill out any card apps, talk to by yourself a several inquiries: What types of cards are you most very likely to qualify for thinking about your credit history rating, revenue and other financial facts? How would you use any benefits you’d gain? Do you really feel comfortable running far more than a person credit card at a time? Is an annual rate a dealbreaker for you?,” states Sara Rathner, credit history card expert at NerdWallet.

At the end of the working day, if a card does not meet up with your demands, it is not the appropriate card for you. “That may possibly mean it earns benefits in sites you never basically commit a lot of revenue or it costs higher service fees in trade for high quality travel benefits, which are ineffective if you don’t vacation typically. Take into account the price of carrying a card when compared to the worth of any benefits and other benefits you’d get as a cardholder,” suggests Rathner.

The advice, recommendations or rankings expressed in this post are people of MarketWatch Picks, and have not been reviewed or endorsed by our industrial associates.