Shares of Opendoor Technologies ($OPEN) surged 15% during today’s trading session, backed by a significant trading volume of approximately $134.7 million.

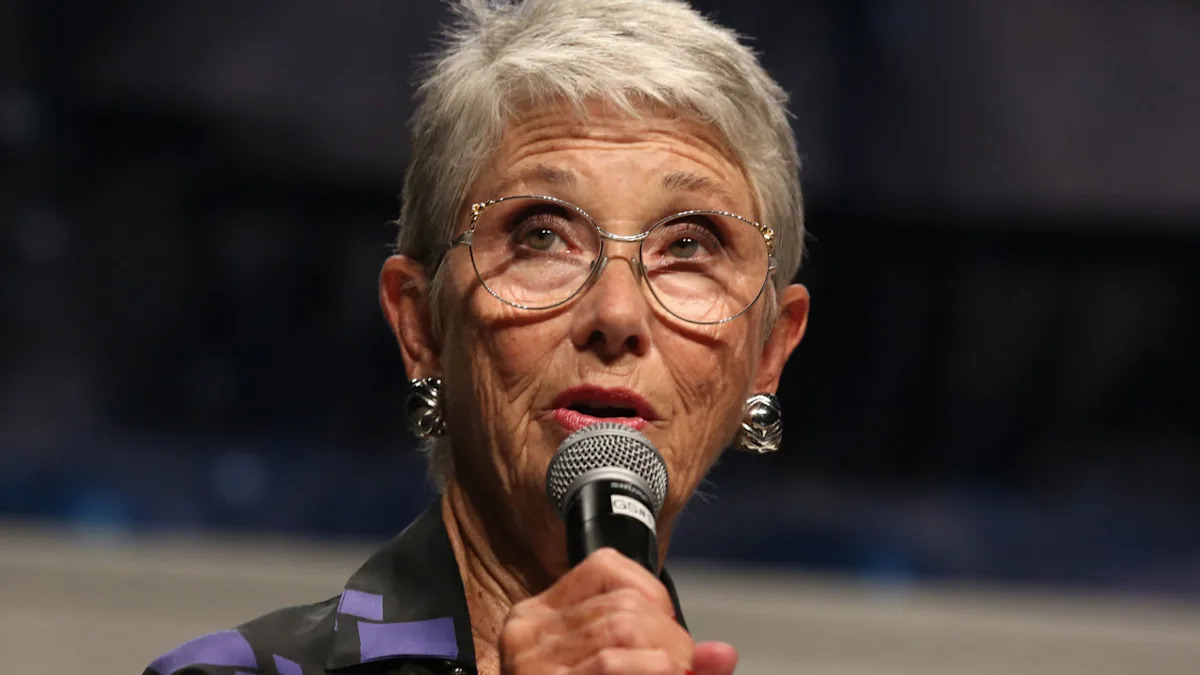

This price increase comes amid consistent selling from company insiders. Over the last six months, insiders have conducted 13 open-market transactions, all of which were sales. Chief Executive Officer Carrie Wheeler sold 1,232,401 shares for an estimated $1,003,034, while Chief Legal Officer Sydney Schaub sold 240,660 shares valued at approximately $212,459.

Institutional sentiment on the stock appears mixed, based on the most recent quarterly filings. While 123 firms added $OPEN to their portfolios, 121 decreased their positions. Notable activity included American Century Companies liquidating its entire $17.9 million position and Renaissance Technologies reducing its holdings by 56.9%. Conversely, Millennium Management and BNP Paribas Financial Markets substantially increased their stakes by 7,880% and 1,280%, respectively. Other major funds, including Morgan Stanley and Dimensional Fund Advisors, also reduced their holdings.

Wall Street analysts have maintained a cautious outlook. Three analysts have issued price targets for $OPEN in the past six months, with a median target of $1.40. Recent targets include $1.20 from UBS, $1.55 from Keefe, Bruyette & Woods, and $1.40 from Citigroup.

Source link