(Bloomberg) — The conventional knowledge with inventory bulls is that price ranges will take off when the Federal Reserve wins its fight against inflation. But the stop of surging consumer expenses could unleash one more spherical of undesirable news.

Most Study from Bloomberg

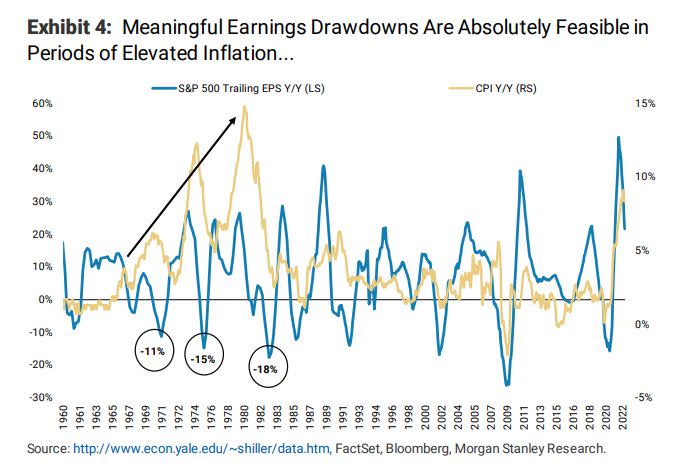

A small chorus of researchers has for months warned of a probable hazard to earnings should the marketing campaign to tamp down inflation realize success. Precisely, the squeeze on margins that could take place ought to an indicator acknowledged as corporate working leverage suffer in an ecosystem wherever gross sales flatten out.

The indicator is a evaluate of the change in between a company’s fixed and variable fees. It can transform negative in the wake of peak inflation when some of a company’s expenses keep on being large but is not capable to offset them by increasing selling prices since need has faltered.

Even though earnings held up surprisingly effectively through the pandemic and driven a range of bear current market rallies, a slide in working leverage could show to be the final hazard that provides shares to their eventual lows, in accordance to a team of Morgan Stanley strategists led by Mike Wilson.

“Thinking about the parts of inflation that are very likely to stay extra resilient into future calendar year (shelter, wages, certain expert services) and the places that are probably to decelerate (products) does not paint a constructive picture for S&P 500 margins, in our perspective,” Wilson, one of Wall Street’s major equity bears, wrote in a current notice to purchasers.

Running leverage, which his crew measured by subtracting product sales growth from earnings for each share progress, is not likely to stay beneficial in the coming quarters, in accordance to his team. And though he’s a single of the many sell-aspect analysts voicing considerations of a margin contraction, consensus estimates are continue to beneficial for future 12 months.

Fairness analysts anticipate earnings to improve 5.56% for the 1st quarter of 2023 versus a 5.48% bounce in revenue as margins grow. The sample presently holds for the full calendar year 2023 as very well: earnings are anticipated to rise more than profits as working leverage remains optimistic.

Credit score Suisse AG’s Jonathan Golub stands with Wilson’s look at. Whilst outlining his modern S&P 500 price concentrate on downgrade, he wrote that “declining CPI put together with sticky wages should direct to a margin contraction.”

Wilson’s group has been arguing for months that the supreme lower for stocks will not be determined by the Fed, but by the growth trajectory of earnings. He sees the S&P 500 bottom in a 3,000- to 3,400-position range developing later in 2022 or early up coming calendar year.

Read through Extra: Morgan Stanley’s Wilson States Shares Can Get a Elevate Into Earnings

Even though shares have shed extra than 22% 12 months to date, a amount of sell-aspect analysts say terrible earnings news has by now been priced in, and earnings could actually surprise and increase. World wide 12-month forward earnings have been revised down every single month in the last quarter. To Jim Paulsen of The Leuthold Team — an ardent stock bull — the simple fact that income margins broke historical patterns and held up whilst inflation has soared suggests they might not be owing to come down soon after all.

But to Liz Ann Sonders, chief financial investment strategist at Charles Schwab, income margins may acquire a strike as companies reduce their ability to elevate rates sufficiently enough to offset superior mounted prices.

“Inflation specifically early in the cycle tends to indicate pricing ability for corporations,” Sonders mentioned. “Demand is strong and paying out is powerful. Which is excellent news for earnings. If then you lose the desire side and you shed the inflation which helps enhance prices, which is when you can operate into problems.”

Most Examine from Bloomberg Businessweek

©2022 Bloomberg L.P.