(Bloomberg) — Chip-linked shares in Japan, South Korea and Taiwan slumped as a go by the Biden administration to control China’s entry to US semiconductor engineering sparked a selloff that has wiped out additional than $240 billion from the sector’s current market price globally.

Taiwan Semiconductor Producing Co. plunged a lot more than 7%, the most since May 2021, while Samsung Electronics Co. dropped the most in a yr. Tokyo Electron Ltd. missing as a great deal as 5.8%. Marketplaces in South Korea, Japan and Taiwan had been shut Monday for holiday seasons, when the Philadelphia Inventory Exchange Semiconductor Index sank to its cheapest close because late 2020 subsequent a two-working day rout of in excess of 9%.

South Korea’s received slumped as a great deal as 1.6% compared to the dollar when the Taiwan dollar dropped .7%. Inventory benchmarks in the two nations had been the worst performers in Asia on Tuesday. The US introduced the export curbs Friday, and there have been strategies that related actions may possibly be deployed in other nations around the world to make certain global cooperation.

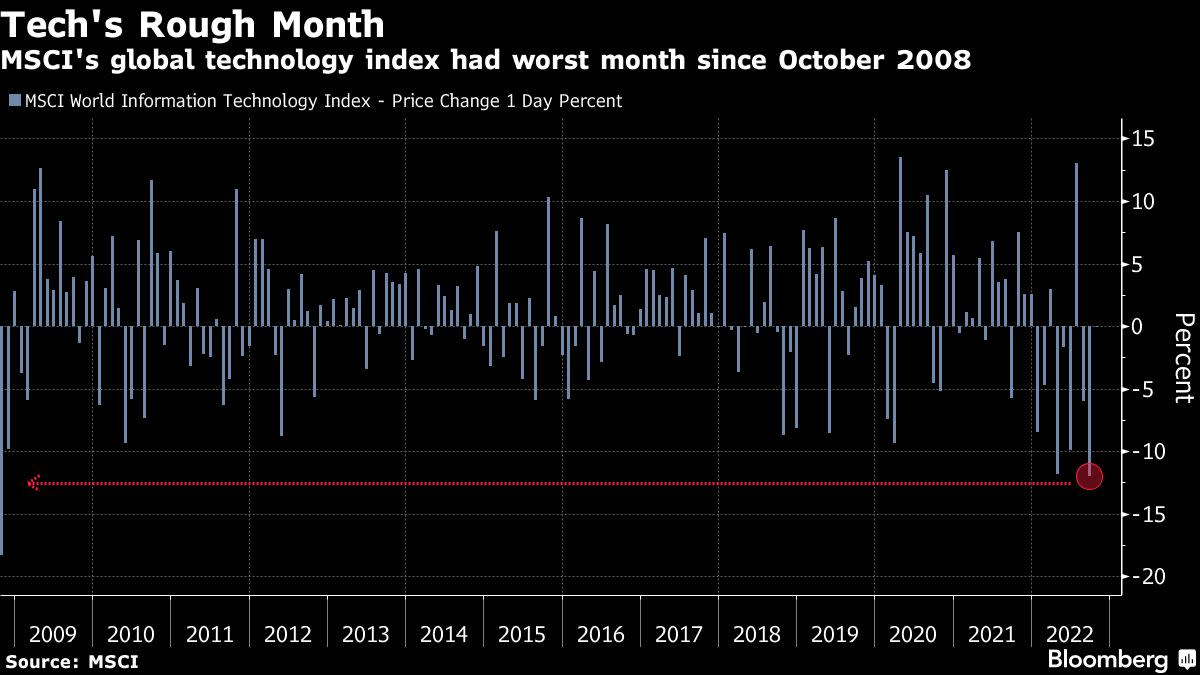

The most recent curbs are very likely to gasoline a knock-on affect throughout the sector’s supply chain and add to a rising record of challenges for technologies shares together with a hawkish Federal Reserve and tensions across the Taiwan Strait. The present-day rout has now wiped out additional than $240 billion from chip shares globally since Thursday’s shut, according to data compiled by Bloomberg.

“The latest U.S. go would prompt China to go quicker in fostering the domestic chip field,” explained Omdia analyst Akira Minamikawa. “Japanese firms should continue on trading with Chinese companies with products not restricted since the enterprise is organization. But they need to be all set for a potential — it’s possible in a 10 years or two — when they reduce all the Chinese consumers as a end result of the existing pressure dialing up speed of the Chinese attempts.”

The ban is envisioned to have much-achieving implications. For companies with plants in China — which includes non-US ones — the guidelines will build added hurdles and require authorities signoff. South Korea’s SK Hynix is one particular of the world’s premier makers of memory chips and has amenities in China — section of a source network that sends parts about the entire world. Its shares slid 3.5% on Tuesday before paring losses.

Chinese point out media and officers have responded to Biden’s shift in latest days, warning of financial penalties and stirring speculation about potential retaliation.

“With the newest measure, it would grow to be difficult for China to manufacture and acquire semiconductors simply because most semiconductor equipment are dominated by US and its allies,” this kind of as Japan and Netherlands,” Chae Minsook, an analyst at Korea Financial investment & Securities, wrote in a report. “It is unachievable to maintain the chip field with out adopting highly developed equipments.”

The actions find to stop China’s travel to create its personal chip business and advance its military capabilities. They contain restrictions on the export of some varieties of chips utilised in artificial intelligence and supercomputing and tighten regulations on the sale of semiconductor manufacturing products to any Chinese business.

The US is trying to find to ensure that Chinese corporations really don’t transfer technologies to the country’s army and that chipmakers in China do not create the functionality to make state-of-the-art semiconductors them selves.

The curbs are a “big setback to China” and “bad news” for international semiconductors, Nomura Holdings Inc. analyst David Wong wrote in a notice Monday. China’s localization initiatives might also be “at hazard as it may not be equipped to use sophisticated foundries in Taiwan and Korea,” he wrote.

(Updates through)

Extra tales like this are accessible on bloomberg.com

©2022 Bloomberg L.P.