Elon Musk took out the carrot.

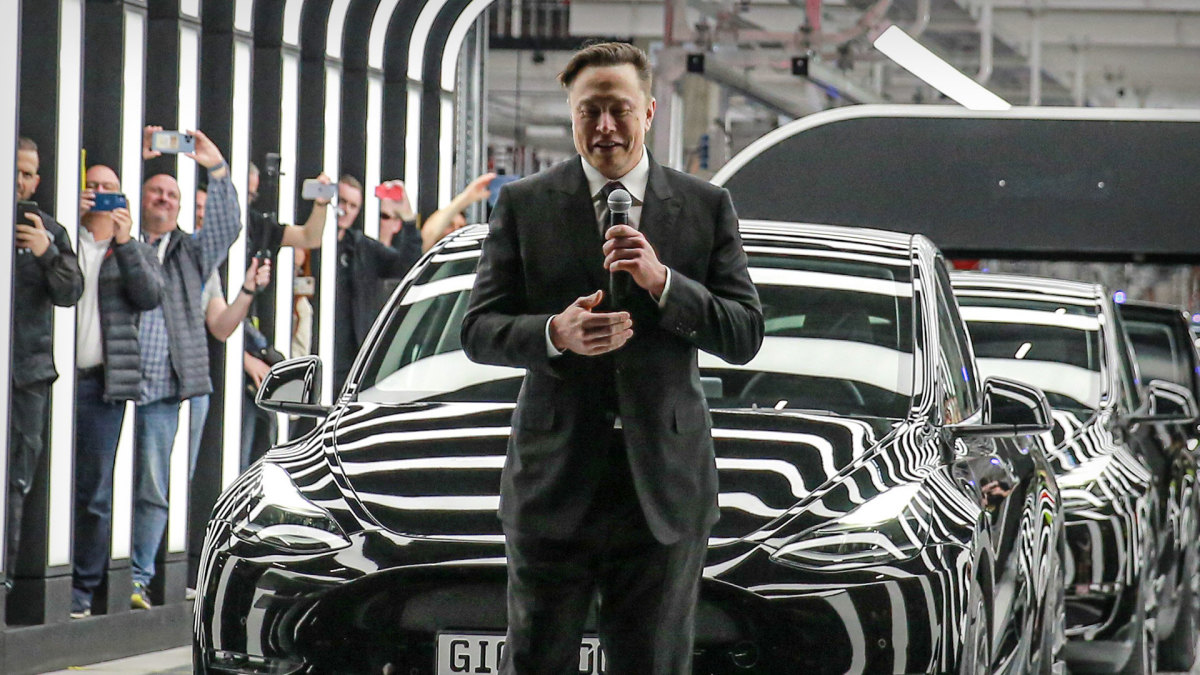

The CEO of Tesla (TSLA) tried on Oct 19 to reassure the electrical automobile maker’s shareholders immediately after a absolutely disastrous very first 50 % of Oct for Tesla shares.

Tesla shares have lost 16.3% given that September 30, which interprets into a decrease in market value of approximately $135 billion.

The decline is likely to continue on, presented the group’s combined final results in the 3rd quarter and careful forecast for the whole of 2022.

“As we seem forward, our options exhibit that we are on observe for the 50% once-a-year progress in manufacturing this year. While we are monitoring offer chain risks, which are over and above our command,” Chief Financial Officer Zach Kirkhorn told analysts during the earnings’ connect with. “On the shipping and delivery aspect, we do hope to be just underneath 50% expansion owing to an increase in the cars and trucks in transit at the close of the year .”

He extra: “This signifies that yet again, you should really count on a gap between manufacturing and deliveries in Q4. And people cars in transit will be delivered shortly to their prospects upon arrival to their desired destination and Q1 [of 2023].”

Tesla really should as a result deliver almost 1.4 million motor vehicles in 2022 and provide above 1.4 million units. It would be a report in both cases, but the organization had hoped to supply 1.5 million vehicles in 2022.

‘Meaningful Buyback’

Tesla posted a third-quarter web profit of $3.3 billion on profits of $21.45 billion, the company claimed on October 19. Inspite of a 56% maximize, revenues arrived down below the $21.96 billion anticipated by analysts.

Confronted with this avalanche of not quite reassuring information, Musk pulled out the bazooka. Without a doubt, the whimsical CEO indicated that Tesla experienced discussed a huge share buyback method, intended to remunerate the shareholders by boosting the share price tag.

This share buyback method would be between $5 billion and $10 billion, the tech tycoon advised analysts all through the earnings’ phone.

“We debated the buyback notion thoroughly at board degree,” Musk explained. “The board frequently thinks that it helps make feeling to do a buyback. We want to do the job by means of the correct procedure to do a buyback. But it is certainly attainable for us to do a buyback on the buy of $5 [billion] to $10 billion even in the draw back scenario of following 12 months. Even if next 12 months is a very hard yr, we even now have the means to do a $5 [billion] to $10 billion buyback.”

He additional that it “is definitely pending board evaluation and acceptance.”

The tech tycoon, on the other hand, appears optimistic that this will be carried out.

“So it’s probable that we will do some significant buyback,” he concluded.

The announcement also will come a number of months just after Tesla carried out a inventory split. In current days, traders have been speculating about a buyback on Twitter where Musk is quite existing.

“Tesla is having PE ratio compression that can be solved only by buyback and/or by 2x earnings maximize,” a Twitter consumer prompt on October 3.

“Pointed out,” Musk responded.