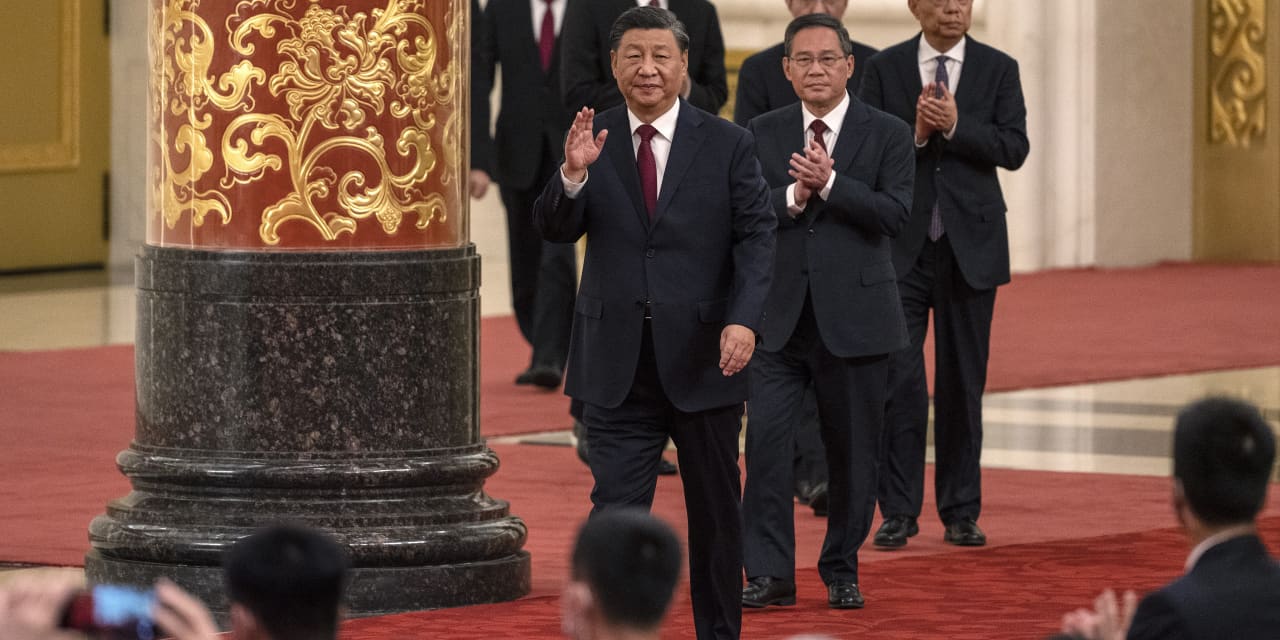

China’s top rated leader, Xi Jinping, secured a groundbreaking third leadership expression on Sunday and launched a new Politburo Standing Committee stacked with loyalists in a clean up sweep not found since the era of Communist Get together founder Mao Zedong.

Economic markets ended up rattled on anticipations that Xi’s plan agenda of bolstering countrywide security and the party’s political security would change the world’s second-most significant economy toward a more state-led design. That could make preserving political ties and the party’s ideology a bigger priority than acquiring economic development and coverage reform, economists said.

The selloff in Chinese property in part reflects expectations Xi will proceed with the country’s zero-COVID plan, which has resulted in sweeping lockdowns in an work to have the virus, explained Fawad Razaqzada, market analyst at Metropolis Index and Fx.com.

“Investors are also worried that since of Xi’s loyalists staying concentrated at the best of the determination-producing human body, there is the likely for extra coverage issues that could lead to serious damage to the upcoming path of expansion. Xi will have a lot additional say in how foreseeable future guidelines will form,” Razaqzada wrote.

Chinese stock markets tumbled on Monday with Hong Kong’s Hold Seng

HSI,

ending extra than 6% decrease to a new 13-yr very low. Shares in mainland China also plunged on Monday, though not by as substantially. The Shanghai Composite

SHCOMP,

completed 2% decrease, and the benchmark CSI 300

000300,

declined 2.9%.

In the U.S., the New York-listed shares of China-centered companies plummeted with the major five major Chinese providers by industry capitalization wiping a whole of $55 billion as of Monday afternoon, in accordance to Dow Jones Current market details. Tech giants Alibaba Team Holding Ltd.

BABA,

Tencent Holdings Ltd.

TCEHY,

and Meituan

MPNGY,

tumbled 12.5%, 14.2% and 16.7%, respectively.

See: Xi’s electrical power go punishes Chinese shares, pushing them down as much as 26% in a single working day

The broader U.S. sector shook off fears, with the Dow Jones Industrial Normal

DJIA,

growing in excess of 400 details, or 1.3%, even though the S&P 500

SPX,

superior 1.2%.

In the meantime, the offshore Chinese yuan

CNHUSD,

fell 1.3% to 7.3253 for each dollar on Monday, an all-time reduced on record primarily based on facts back again to 2010, according to Dow Jones Marketplace Details.

Markets Are living: A historically poor day for China’s yuan

The hefty advertising in China-linked property was notably jarring given the rosier-than-expected 3rd quarter GDP knowledge. China’s financial state expanded by 3.9% in the 3 months ended Sept. 30 from a calendar year before, the govt said Monday in a release that was abruptly postponed as Communist Party leaders gathered final week for the congress.

The third-quarter performance exceeded industry consensus of 3.4% and picked up from a .4% expansion in the earlier quarter, when advancement was weighed down by a severe two-month lockdown in Shanghai. On the other hand, the data brings the average development for the initial 9 months of 2022 at 3.%, perfectly below the total-12 months target of 5.5% the govt established in March.

See: China’s Improved Financial Advancement Is Overshadowed by Xi’s Electric power Grab

Buyers have been battered by China’s economic slowdown, thanks in huge part to a stubborn pressure of COVID-19 that has rippled by means of the country this year which forced hundreds of hundreds of thousands of folks into lockdowns. Lots of had hoped Chinese leaders could spell out a pivot absent from demanding COVID-19 limitations following the social gathering congress.

Nonetheless, Julian Evans-Pritchard, senior China economist of Capital Economics, thinks the outlook remains gloomy as the variety of cities with outbreaks and lockdowns has risen to levels last seen throughout the peak of the Omicron wave earlier this 12 months.

“There is no prospect of China lifting its zero-COVID policy in the close to future, and we really do not anticipate any significant rest prior to 2024,” Evans-Pritchard stated in a Monday notice. “Recurring virus disruptions will for that reason proceed to weigh on in-particular person action and even more large-scale lockdowns just cannot be dominated out.”

See: Markets on enjoy as China’s Celebration congress kicks off this weekend. What traders will need to know.

The “zero-COVID” technique also worsened the weak spot in the country’s credit card debt-laden assets sector. Traders feared the housing-industry meltdown could switch into a house loan collapse and hoped Xi and his new standing committee could produce much more policy help to ignite a profits turnaround.

“There are also couple signs of an imminent turnaround in the home sector,” stated Evans-Pritchard. “We imagine official GDP will grow just 3.5% future year, with genuine growth possible to be even weaker.”

In addition, the downturn in the real-estate market place could more suppress commodity demand and bitter investors’ sentiment.

“Given that China is the major commodity buyer in the earth by virtue of its inhabitants and development, its economic wellness has a fantastic bearing on the course of commodity costs — notably metals and minerals,” said Boris Ivanov, founder of Emiral Sources Ltd.

“President Xi’s Congress speech on Sunday (Oct. 16) signaled that this coverage (zero-COVID) will continue being unchanged. This will be unhappy news for traders and producers of metals & minerals like iron ore to crude oil who would like fewer draconian guidelines sapping commodity demand.”

Costs of foundation metals were being increased on Monday, as far better-than-predicted economic info from China raised hopes of more powerful desire. The most-traded November copper agreement on the Shanghai Futures Exchange rose 1.3% to 63,910 yuan ($8,809.70) for every metric ton, whilst aluminum gained .1% to 18,640 yuan for each metric ton. On New York Mercantile Trade, copper futures for December

HGZ22,

were down 4 cents, or 1.3%, to $3.4305 for every pound.

China’s top rated leader, Xi Jinping, secured a groundbreaking third leadership expression on Sunday and launched a new Politburo Standing Committee stacked with loyalists in a clean up sweep not found since the era of Communist Get together founder Mao Zedong.

Economic markets ended up rattled on anticipations that Xi’s plan agenda of bolstering countrywide security and the party’s political security would change the world’s second-most significant economy toward a more state-led design. That could make preserving political ties and the party’s ideology a bigger priority than acquiring economic development and coverage reform, economists said.

The selloff in Chinese property in part reflects expectations Xi will proceed with the country’s zero-COVID plan, which has resulted in sweeping lockdowns in an work to have the virus, explained Fawad Razaqzada, market analyst at Metropolis Index and Fx.com.

“Investors are also worried that since of Xi’s loyalists staying concentrated at the best of the determination-producing human body, there is the likely for extra coverage issues that could lead to serious damage to the upcoming path of expansion. Xi will have a lot additional say in how foreseeable future guidelines will form,” Razaqzada wrote.

Chinese stock markets tumbled on Monday with Hong Kong’s Hold Seng

HSI,

ending extra than 6% decrease to a new 13-yr very low. Shares in mainland China also plunged on Monday, though not by as substantially. The Shanghai Composite

SHCOMP,

completed 2% decrease, and the benchmark CSI 300

000300,

declined 2.9%.

In the U.S., the New York-listed shares of China-centered companies plummeted with the major five major Chinese providers by industry capitalization wiping a whole of $55 billion as of Monday afternoon, in accordance to Dow Jones Current market details. Tech giants Alibaba Team Holding Ltd.

BABA,

Tencent Holdings Ltd.

TCEHY,

and Meituan

MPNGY,

tumbled 12.5%, 14.2% and 16.7%, respectively.

See: Xi’s electrical power go punishes Chinese shares, pushing them down as much as 26% in a single working day

The broader U.S. sector shook off fears, with the Dow Jones Industrial Normal

DJIA,

growing in excess of 400 details, or 1.3%, even though the S&P 500

SPX,

superior 1.2%.

In the meantime, the offshore Chinese yuan

CNHUSD,

fell 1.3% to 7.3253 for each dollar on Monday, an all-time reduced on record primarily based on facts back again to 2010, according to Dow Jones Marketplace Details.

Markets Are living: A historically poor day for China’s yuan

The hefty advertising in China-linked property was notably jarring given the rosier-than-expected 3rd quarter GDP knowledge. China’s financial state expanded by 3.9% in the 3 months ended Sept. 30 from a calendar year before, the govt said Monday in a release that was abruptly postponed as Communist Party leaders gathered final week for the congress.

The third-quarter performance exceeded industry consensus of 3.4% and picked up from a .4% expansion in the earlier quarter, when advancement was weighed down by a severe two-month lockdown in Shanghai. On the other hand, the data brings the average development for the initial 9 months of 2022 at 3.%, perfectly below the total-12 months target of 5.5% the govt established in March.

See: China’s Improved Financial Advancement Is Overshadowed by Xi’s Electric power Grab

Buyers have been battered by China’s economic slowdown, thanks in huge part to a stubborn pressure of COVID-19 that has rippled by means of the country this year which forced hundreds of hundreds of thousands of folks into lockdowns. Lots of had hoped Chinese leaders could spell out a pivot absent from demanding COVID-19 limitations following the social gathering congress.

Nonetheless, Julian Evans-Pritchard, senior China economist of Capital Economics, thinks the outlook remains gloomy as the variety of cities with outbreaks and lockdowns has risen to levels last seen throughout the peak of the Omicron wave earlier this 12 months.

“There is no prospect of China lifting its zero-COVID policy in the close to future, and we really do not anticipate any significant rest prior to 2024,” Evans-Pritchard stated in a Monday notice. “Recurring virus disruptions will for that reason proceed to weigh on in-particular person action and even more large-scale lockdowns just cannot be dominated out.”

See: Markets on enjoy as China’s Celebration congress kicks off this weekend. What traders will need to know.

The “zero-COVID” technique also worsened the weak spot in the country’s credit card debt-laden assets sector. Traders feared the housing-industry meltdown could switch into a house loan collapse and hoped Xi and his new standing committee could produce much more policy help to ignite a profits turnaround.

“There are also couple signs of an imminent turnaround in the home sector,” stated Evans-Pritchard. “We imagine official GDP will grow just 3.5% future year, with genuine growth possible to be even weaker.”

In addition, the downturn in the real-estate market place could more suppress commodity demand and bitter investors’ sentiment.

“Given that China is the major commodity buyer in the earth by virtue of its inhabitants and development, its economic wellness has a fantastic bearing on the course of commodity costs — notably metals and minerals,” said Boris Ivanov, founder of Emiral Sources Ltd.

“President Xi’s Congress speech on Sunday (Oct. 16) signaled that this coverage (zero-COVID) will continue being unchanged. This will be unhappy news for traders and producers of metals & minerals like iron ore to crude oil who would like fewer draconian guidelines sapping commodity demand.”

Costs of foundation metals were being increased on Monday, as far better-than-predicted economic info from China raised hopes of more powerful desire. The most-traded November copper agreement on the Shanghai Futures Exchange rose 1.3% to 63,910 yuan ($8,809.70) for every metric ton, whilst aluminum gained .1% to 18,640 yuan for each metric ton. On New York Mercantile Trade, copper futures for December

HGZ22,

were down 4 cents, or 1.3%, to $3.4305 for every pound.