(Bloomberg) — Warren Buffett’s Berkshire Hathaway Inc. took a stake of about $5 billion in Taiwan Semiconductor Producing Co., a indication the famous investor thinks the world’s foremost chipmaker has bottomed out soon after a selloff of much more than $250 billion. Shares surged.

Most Read through from Bloomberg

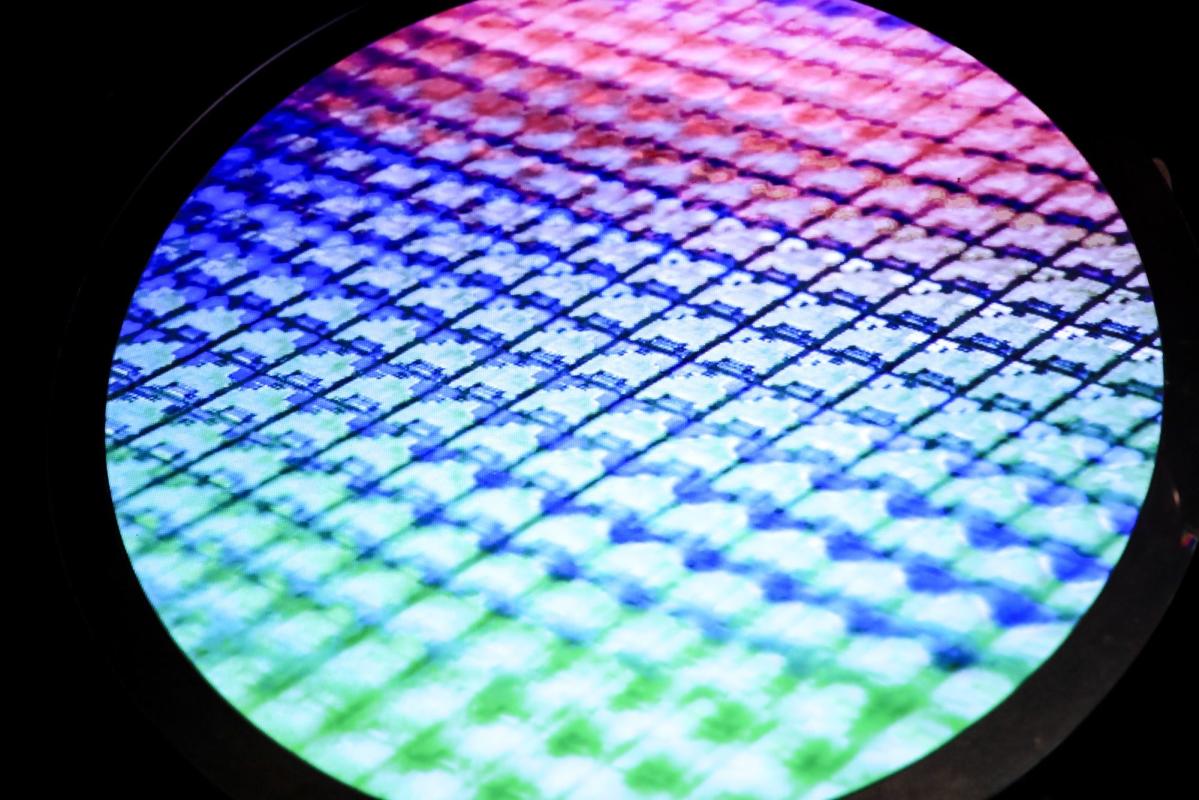

The Omaha-dependent conglomerate obtained about 60 million American depository receipts in TSMC in the a few months finished September, it said in a submitting. The Taiwanese corporation creates semiconductors for clients like Nvidia Corp. and Qualcomm Inc. and is the distinctive provider of Apple Inc.’s personalized Silicon chips. Apple continues to be the most valuable solitary keeping in Berkshire’s portfolio.

Assuming Buffett bought TSMC’s ADRs at the common price for the third quarter, the stake would have expense him $5.1 billion. They at this time trade at $72.80. TSMC’s shares rose as substantially as 9.4% in Taiwan soon after the disclosure, the most significant intraday enhance in much more than two many years.

The 92-calendar year-outdated Buffett very long shied absent from the tech marketplace, producing the situation that he did not want to spend in organizations that he did not absolutely fully grasp. That stance improved in recent several years, however, and he has committed an escalating proportion of his company’s investments to the tech sector.

Chipmaking is just one segment that promises sustained advancement around the coming a long time as it is essential to the growth of nascent industries like self-driving and electric powered automobiles, artificial intelligence and linked household programs. Growth of cloud solutions like Amazon.com Inc.’s AWS also claims to bring in a lot more orders for silicon that goes into wide information centers.

What Bloomberg Intelligence Claims

Technology’s deep-red bond returns this calendar year may mask the strong funds flows and fortified stability sheets that underlie the sector. These traits could guide to outperformance in 2023 as buyers weigh the prospective for a economic downturn. Tight spreads and limited score draw back underpin the sector’s energy.

— Robert Schiffman, BI analyst

Click in this article for the total analysis

TSMC, which has taken above from Intel Corp. as the agency advancing the chopping edge of chipmaking, has also emerged as a strategically crucial player at a time when the US and China have clashed above management in the world wide technologies sector. Taiwan’s most important firm has the production prowess to make the world’s most innovative chips, instrumental to advancing every nation’s foreseeable future professional industries like EVs and AI but also feeding their armed forces and cyberdefense ambitions. The US has imposed elevated sanctions on substantial-stop chips developed for Chinese prospects precisely to forestall them creating their way into the arms of the Chinese armed service.

Biden’s Chip Curbs Beat Trump in Forcing Planet to Align on China

TSMC shares at property in Taiwan experienced dropped 28% this 12 months by way of Monday’s close, as need for chips has slowed with the economic downturn and investors fretting about oversupply. The firm stated in October it pulled back again on capital shelling out to about $36 billion this calendar year, which would still be a document superior, down from at minimum $40 billion prepared formerly.

–With support from Cindy Wang.

(Updates with investing in Taiwan in 3rd paragraph)

Most Browse from Bloomberg Businessweek

©2022 Bloomberg L.P.