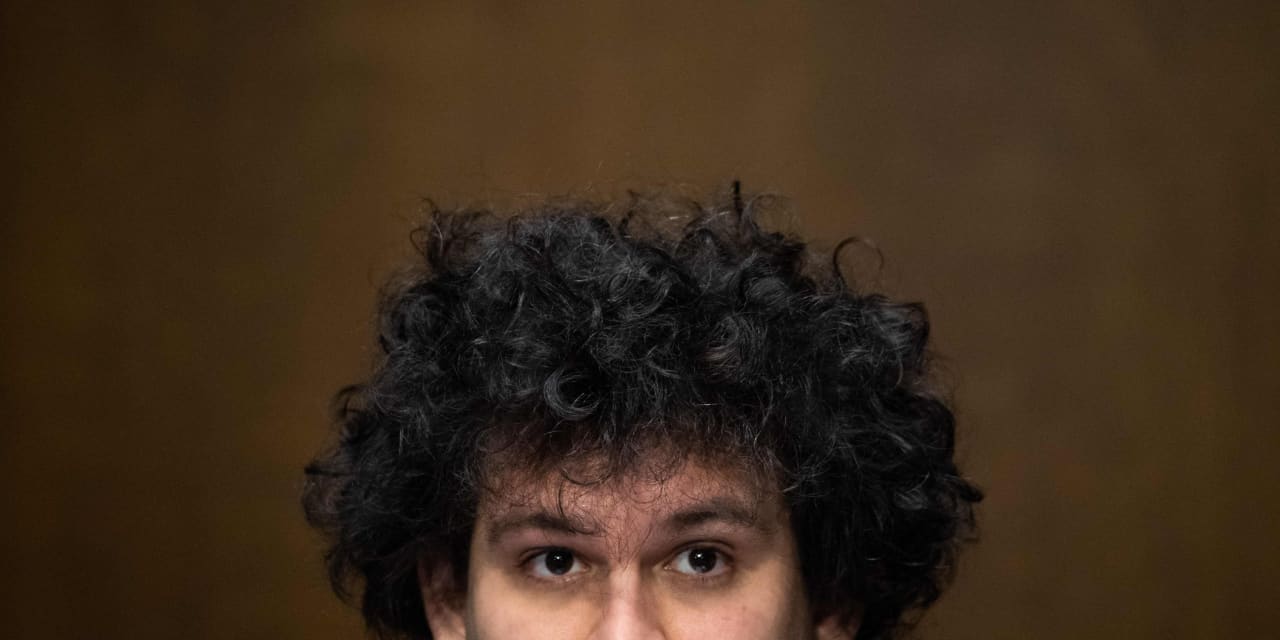

On Thursday, John Ray, III, the new CEO of FTX, dropped a prolonged-awaited declaration in U.S. personal bankruptcy court, giving a sober evaluation of the collapse of Sam Bankman-Fried’s crypto empire. The bankruptcy-court filing adopted a whirlwind of occasions, such as the publication of explosive texts Bankman-Fried despatched to a Vox reporter before this 7 days.

Ray established the tone for what he has found considering that FTX submitted for bankruptcy safety final 7 days, citing his 40 years of expertise in the lawful and restructuring small business, together with a part as main restructuring officer and CEO of Enron, a single of the most significant corporate collapses at any time.

“Never in my occupation have I seen this kind of a entire failure of company controls and these a finish absence of reputable monetary info as transpired right here,” Ray wrote. “This condition is unparalleled.”

Below are 10 revelations that Ray manufactured in federal bankruptcy court docket on Thursday about Bankman-Fried and the FTX debacle he developed.

1. Most of FTX’s digital assets have not been secured

As of Thursday, Ray made very clear that even though he now controls the a variety of FTX trading and exchange platforms and Bankman-Fried’s crypto hedge fund Alameda Exploration, he’d “located and secured only a fraction of the digital assets” he hoped to get well. In actuality, Ray reported only some $740 million of cryptocurrency experienced been secured in new cold wallets. Ray cited at least $372 million of unauthorized transfers that had taken place on the working day FTX and Alameda submitted for individual bankruptcy past 7 days, and the “dilutive ‘minting’ of about $300 million in FTT tokens by an unauthorized source” in the days immediately after the filing. FTT tokens were being created by FTX to aid investing on its exchange and created up a massive chunk of Alameda’s property.

2. No one is familiar with who the major shopper lenders are of FTX.

FTX.com and FTX.US experienced buyers close to the planet who employed its cryptocurrency exchanges and platforms. But Ray said he was not able to produce a checklist of FTX’s prime 50 creditors that integrated clients.

3. Alameda Investigate loaned $4.1 billion out to entities, including Bankman-Fried and his closest partners.

There have been stories that FTX lent out billions of dollars in customer funds to Bankman-Fried’s hedge fund, Alameda Investigation. But on Thursday, Ray revealed that Alameda had built $4.1 billion of relevant-get together loans that remained superb at the close of September. This included a $1 billion personal loan Alameda created to Bankman-Fried himself, a $543 million mortgage built to FTX cofounder Nishad Singh, and $55 million borrowed by FTX co-CEO Ryan Salame.

4. FTX corporate money had been utilised to invest in individual homes

Bankman-Fried lived in a luxury vacation resort in the Bahamas, the place FTX was also centered. There, personal bankruptcy filings say, company funds of FTX “were employed to order households and other own objects for personnel and advisors.” Ray explained in his submitting that there is no documentation for the transactions and loans linked with these genuine estate buys, which were being recorded in the own name of workers and advisors.

5. Customized emojis to approve disbursements

To display the deficiency of disbursement and appropriate company controls at FTX, Ray pointed out that FTX employees “submitted payment requests by an on-line ‘chat’ system the place a disparate group of supervisors accredited disbursements by responding with personalized emojis.”

6. Alameda Investigation was a single of the world’s largest hedge resources

In accordance to the bankruptcy filing, Alameda’s balance sheet showed $13.46 billion in overall belongings as of the end of September. Which is approximately equal to the belongings managed by well known billionaire hedge fund traders like Bill Ackman, Paul Tudor Jones and Jeffrey Talpins.

7. Audit viewpoints from the metaverse

Bankman-Fried secured audit thoughts for the intercontinental FTX buying and selling system section of his enterprise from Prager Metis, a agency that Ray had under no circumstances read of ahead of. Ray said he went to the firm’s web site to discover much more about it and found that Prager Metis explained by itself as the“first-at any time CPA agency to officially open up its Metaverse headquarters in the metaverse system Decentraland.”

8. Alameda experienced a magic formula exemption on FTX.com

Ray’s filing on Thursday indicated that Bankman-Fried’s Alameda hedge fund may well have experienced a investing edge on the FTX.com trading platform. According to the filing, Alameda experienced a “secret exemption” from “certain features of FTX.com’s automobile-liquidation protocol.”

9. Shopper liabilities are not reflected in FTX economical statements

Ray expects that the FTX.US exchange and investing system, which serviced American consumers, will have “significant liabilities arising from crypto belongings deposited by clients by way of the FTX US platform.” He believes the FTX trade that was utilized by FTX consumers outdoors the U.S. could also have substantial customer liabilities. But none of these liabilities are reflected in the money statements that were prepared although Bankman-Fried ran FTX, Ray reported.

10. Ray has no self-assurance in any FTX harmony sheet

Time and again in the filing, Ray features the very same disclaimer soon after detailing FTX-associated fiscal statements. He notes that lots of of the harmony sheets at FTX and Alameda are unaudited, and that for the reason that they were being created even though Bankman-Fried ran and managed the company, “I do not have assurance in it.”

On Thursday, John Ray, III, the new CEO of FTX, dropped a prolonged-awaited declaration in U.S. personal bankruptcy court, giving a sober evaluation of the collapse of Sam Bankman-Fried’s crypto empire. The bankruptcy-court filing adopted a whirlwind of occasions, such as the publication of explosive texts Bankman-Fried despatched to a Vox reporter before this 7 days.

Ray established the tone for what he has found considering that FTX submitted for bankruptcy safety final 7 days, citing his 40 years of expertise in the lawful and restructuring small business, together with a part as main restructuring officer and CEO of Enron, a single of the most significant corporate collapses at any time.

“Never in my occupation have I seen this kind of a entire failure of company controls and these a finish absence of reputable monetary info as transpired right here,” Ray wrote. “This condition is unparalleled.”

Below are 10 revelations that Ray manufactured in federal bankruptcy court docket on Thursday about Bankman-Fried and the FTX debacle he developed.

1. Most of FTX’s digital assets have not been secured

As of Thursday, Ray made very clear that even though he now controls the a variety of FTX trading and exchange platforms and Bankman-Fried’s crypto hedge fund Alameda Exploration, he’d “located and secured only a fraction of the digital assets” he hoped to get well. In actuality, Ray reported only some $740 million of cryptocurrency experienced been secured in new cold wallets. Ray cited at least $372 million of unauthorized transfers that had taken place on the working day FTX and Alameda submitted for individual bankruptcy past 7 days, and the “dilutive ‘minting’ of about $300 million in FTT tokens by an unauthorized source” in the days immediately after the filing. FTT tokens were being created by FTX to aid investing on its exchange and created up a massive chunk of Alameda’s property.

2. No one is familiar with who the major shopper lenders are of FTX.

FTX.com and FTX.US experienced buyers close to the planet who employed its cryptocurrency exchanges and platforms. But Ray said he was not able to produce a checklist of FTX’s prime 50 creditors that integrated clients.

3. Alameda Investigate loaned $4.1 billion out to entities, including Bankman-Fried and his closest partners.

There have been stories that FTX lent out billions of dollars in customer funds to Bankman-Fried’s hedge fund, Alameda Investigation. But on Thursday, Ray revealed that Alameda had built $4.1 billion of relevant-get together loans that remained superb at the close of September. This included a $1 billion personal loan Alameda created to Bankman-Fried himself, a $543 million mortgage built to FTX cofounder Nishad Singh, and $55 million borrowed by FTX co-CEO Ryan Salame.

4. FTX corporate money had been utilised to invest in individual homes

Bankman-Fried lived in a luxury vacation resort in the Bahamas, the place FTX was also centered. There, personal bankruptcy filings say, company funds of FTX “were employed to order households and other own objects for personnel and advisors.” Ray explained in his submitting that there is no documentation for the transactions and loans linked with these genuine estate buys, which were being recorded in the own name of workers and advisors.

5. Customized emojis to approve disbursements

To display the deficiency of disbursement and appropriate company controls at FTX, Ray pointed out that FTX employees “submitted payment requests by an on-line ‘chat’ system the place a disparate group of supervisors accredited disbursements by responding with personalized emojis.”

6. Alameda Investigation was a single of the world’s largest hedge resources

In accordance to the bankruptcy filing, Alameda’s balance sheet showed $13.46 billion in overall belongings as of the end of September. Which is approximately equal to the belongings managed by well known billionaire hedge fund traders like Bill Ackman, Paul Tudor Jones and Jeffrey Talpins.

7. Audit viewpoints from the metaverse

Bankman-Fried secured audit thoughts for the intercontinental FTX buying and selling system section of his enterprise from Prager Metis, a agency that Ray had under no circumstances read of ahead of. Ray said he went to the firm’s web site to discover much more about it and found that Prager Metis explained by itself as the“first-at any time CPA agency to officially open up its Metaverse headquarters in the metaverse system Decentraland.”

8. Alameda experienced a magic formula exemption on FTX.com

Ray’s filing on Thursday indicated that Bankman-Fried’s Alameda hedge fund may well have experienced a investing edge on the FTX.com trading platform. According to the filing, Alameda experienced a “secret exemption” from “certain features of FTX.com’s automobile-liquidation protocol.”

9. Shopper liabilities are not reflected in FTX economical statements

Ray expects that the FTX.US exchange and investing system, which serviced American consumers, will have “significant liabilities arising from crypto belongings deposited by clients by way of the FTX US platform.” He believes the FTX trade that was utilized by FTX consumers outdoors the U.S. could also have substantial customer liabilities. But none of these liabilities are reflected in the money statements that were prepared although Bankman-Fried ran FTX, Ray reported.

10. Ray has no self-assurance in any FTX harmony sheet

Time and again in the filing, Ray features the very same disclaimer soon after detailing FTX-associated fiscal statements. He notes that lots of of the harmony sheets at FTX and Alameda are unaudited, and that for the reason that they were being created even though Bankman-Fried ran and managed the company, “I do not have assurance in it.”