(Bloomberg) — A new snapshot of the international economy’s weakening progress and persistent inflation will arrive in the coming 7 days, just as surveys reveal headwinds for companies from the US to Europe and Japan.

Most Read from Bloomberg

The OECD’s forecasts on Tuesday will demonstrate how officers at the Paris-primarily based business perceive a reduction of momentum gripping nations all around the world amid a number of shocks ranging from the energy disaster induced by Russia’s invasion of Ukraine, to surging consumer costs and persisting offer squeezes.

The OECD’s preceding projections, produced in September, presently proposed a worsening development outlook for 2023. With economists now increasingly anticipating a economic downturn to strike the US in 2023 — and with substantially of Europe potentially presently contracting — the see is now probably to be bleaker.

Surveys of getting managers due the following working day may well include one more layer of gloom, exhibiting deterioration in business all through various advanced economies. All measures in the euro zone and United kingdom are expected to present weakening, whilst economists predict factory exercise in the US will be on the brink of contraction.

The prospect of slowing or slumping economies is sharpening the predicament for world wide central bankers as they combat the worst bout of inflation in a era. Even with signals of cost pressures beginning to simplicity in the US, there’s no space for complacency.

“One of the most important worries economies about the planet are struggling with is inflation, and to deliver inflation down at a time when progress is also slowing,” Gita Gopinath, 1st deputy taking care of director at the International Financial Fund, mentioned at the Bloomberg New Financial state Forum in Singapore on Thursday. “We possibly are getting into an era in which for central financial institutions, they seriously have a trade-off to offer with.”

How this sort of criteria have currently begun weighing on policy makers in the US and Europe might be uncovered in minutes of the most current choices of the Federal Reserve and the European Central Financial institution, thanks for launch on Wednesday and Thursday, respectively.

What Bloomberg Economics Says:

“Data showing resilient demand from customers, really do not bolster the circumstance for a smooth landing. Somewhat, they counsel the US economic climate is overheated and the Fed has to go harder at cooling the need element of inflation. Real, adverse provide shocks are receding, bringing inflation down in their wake, but the demand from customers component of cost pressures remains intact.”

— Anna Wong, Andrew Husby and Eliza Winger, economists. For complete analysis, click on below

In other places, numerous central lender selections will most likely feature amount hikes from New Zealand to South Korea, and from Sweden to South Africa. Turkish plan makers may buck the pattern with another reduce in borrowing expenses.

Click right here for what took place past week, and beneath is our wrap of what else is coming up in the world-wide economic system.

US Financial system

Minutes from the Fed’s policy assembly earlier this thirty day period will spotlight the shortened Thanksgiving 7 days. Traders will scan for further more perception on when policymakers choose it’ll be correct to slow the speed of rate hikes.

The closing November reading of inflation anticipations from the College of Michigan will also be critical for Fed watchers. A preliminary study confirmed rate views climbed from final thirty day period.

Various measures of the economy’s production sector will occur out as well, like manufacturing facility exercise in the Richmond Fed’s region, strong items orders for October, and S&P Global’s composite PMI for November, which also tracks solutions.

Asia

The central banking institutions of New Zealand and South Korea are widely expected to increase fees once more at conferences on Wednesday and Thursday, respectively. That will be the ninth straight hike for the Reserve Financial institution of New Zealand as inflation continues to surprise on the upside.

Price growth in Korea also continues to be elevated, however weak spot in the won will very likely be less of a variable in the decision this time about.

Write-up-assembly remarks by the RBNZ’s Adrian Orr and the Financial institution of Korea’s Rhee Chang-yong will be parsed for any indicators of modify in the plan route, as will feedback before in the week from Reserve Lender of Australia Governor Philip Lowe.

Friday’s Tokyo CPI numbers for November will possibly both display that the national price tag pattern is established to continue accelerating, or that Japan’s inflation has peaked.

Europe, Center East, Africa

Sweden’s Riksbank will just take center phase at the ultimate determination less than the helm of Governor Stefan Ingves. A rate hike as huge as 75 foundation details is most likely on Thursday.

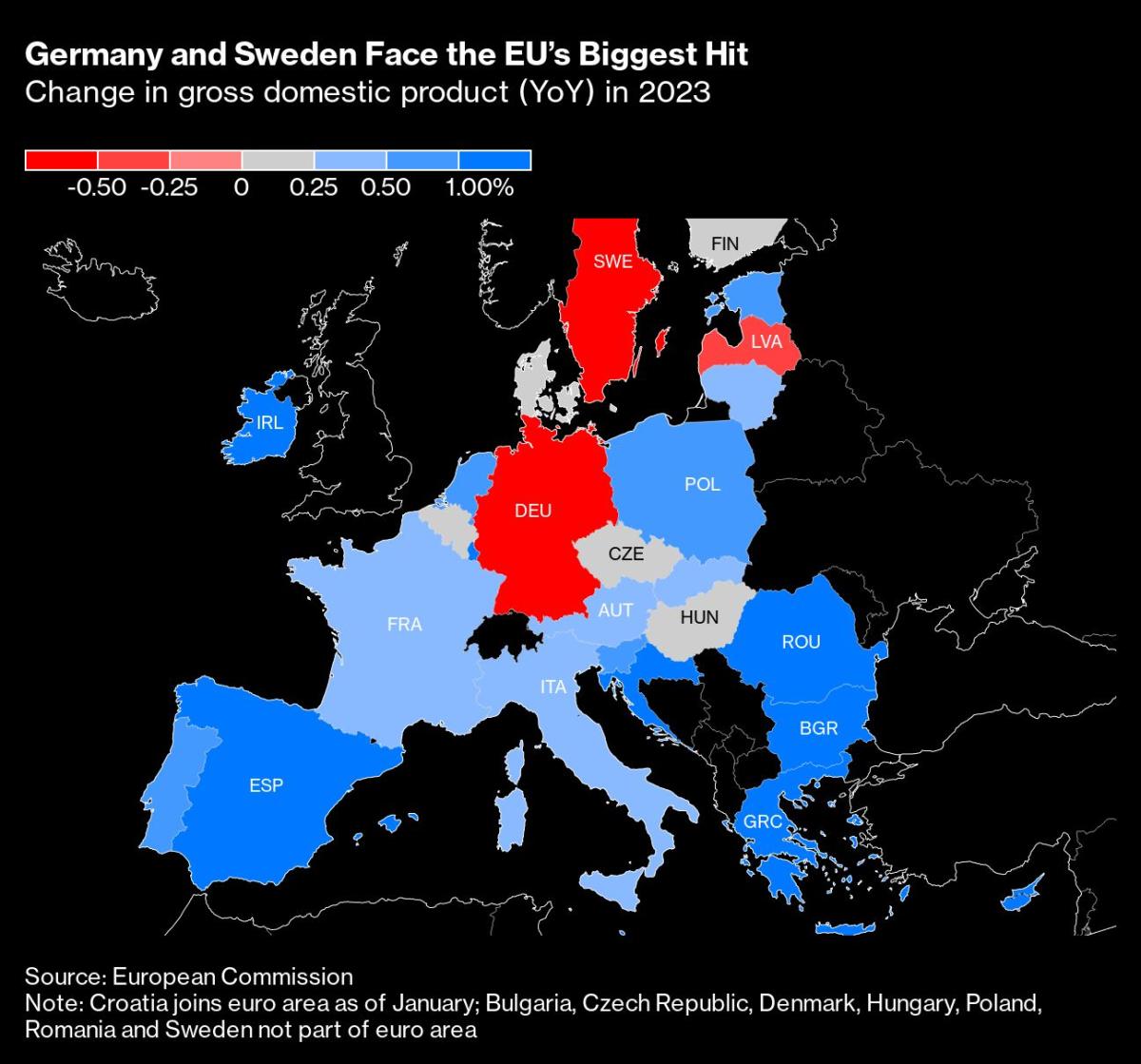

While smaller sized than the 100 foundation-position transfer past time, it continue to showcases aggression against inflation in the confront of a significantly deteriorating financial state and housing industry. The European Fee predicts Sweden’s gross domestic product or service will shrink upcoming calendar year by .6%, matching Germany for the worst general performance in the European Union.

In the euro region, where inflation is currently functioning at the best in the record of the solitary currency, minutes of the ECB’s Oct. 27 meeting will toss mild on the variables that drove officials to raise by 75 basis factors, even with the economic system potentially already in economic downturn.

Numerous speeches are scheduled by ECB coverage makers, which includes Vice President Luis de Guindos. Details highlights contain euro-place consumer confidence on Tuesday, buying manager surveys owing the future working day, and German Ifo enterprise sentiment.

On the lookout south, analysts are divided about the measurement of the Lender of Israel’s future price hike on Monday after inflation jumped much more than expected in October. Some forecast officers will sluggish monetary tightening.

Nigeria is anticipated to improve borrowing costs for a fourth straight meeting on Tuesday to consist of inflation, now at a 17-calendar year superior. The upcoming working day in Kenya, the monetary coverage committee is forecast to hike for a next consecutive meeting.

On Thursday, South African fee setters are most likely to increase the benchmark by 75 basis factors however again. Governor Lesetja Kganyago stated in an job interview final month that the bank will only contemplate charge cuts when there is a sustained retreat in inflation. Cost progress is predicted to have slowed to 7.4% in October, facts on Wednesday is forecast to display.

In Turkey, the central lender is predicted to deliver yet another rate slice on Thursday and lower its benchmark into one digits, as demanded by President Recep Tayyip Erdogan — even as inflation spirals out of command and the area currency stays under pressure.

Slowing inflation may perhaps see financial coverage officers in Angola slash borrowing expenditures on Friday for a next meeting, building it a further outlier at a time of world wide monetary tightening.

Latin The usa

In Mexico, tight money disorders, inflation and large borrowing expense have individuals on the back foot, very likely damping September’s retail revenue outcomes. The final print of 3rd-quarter GDP must reaffirm the astonishing strength found in final month’s flash reading through, whilst highlighting some of the headwinds slowing the economy towards year-close.

Mexico watchers are keen to pore about the minutes of Banxico’s Nov. 10 assembly, exactly where coverage makers hiked the essential price to a history 10%, retained a hawkish bias, and signaled far more boosts to arrive. Primarily based on early estimates for mid-month inflation, Banxico’s stern posture appears to be like about right: analysts count on that consumer rates have once again drifted higher though the core looking at, a focal position for the central bank, pushed to a refreshing 22-yr superior.

Curiosity costs and inflation that are higher by Peru’s specifications, coupled with never-ending political turmoil, very likely slowed third-quarter advancement significantly from the 3.3% calendar year-on-year tempo posted in April-June.

In Brazil, the mid-month consumer price tag report might underscore a tough truth of the matter: having inflation down nearly 600 basis details since April to roughly 6.2% was the simple portion. Economists surveyed by the central bank really do not see inflation back again to goal right until 2025, and only underneath the duress of unforgiving monetary coverage.

–With support from Robert Jameson, Reade Pickert, Paul Richardson, Malcolm Scott and Molly Smith.

Most Go through from Bloomberg Businessweek

©2022 Bloomberg L.P.