(Bloomberg) — Wall Street’s waning conviction in Coinbase Global Inc. has carried out little to deter Cathie Wood. In its place, she’s been scooping up shares of the struggling cryptocurrency trade in the wake of the collapse of Sam Bankman-Fried’s FTX.

Most Read through from Bloomberg

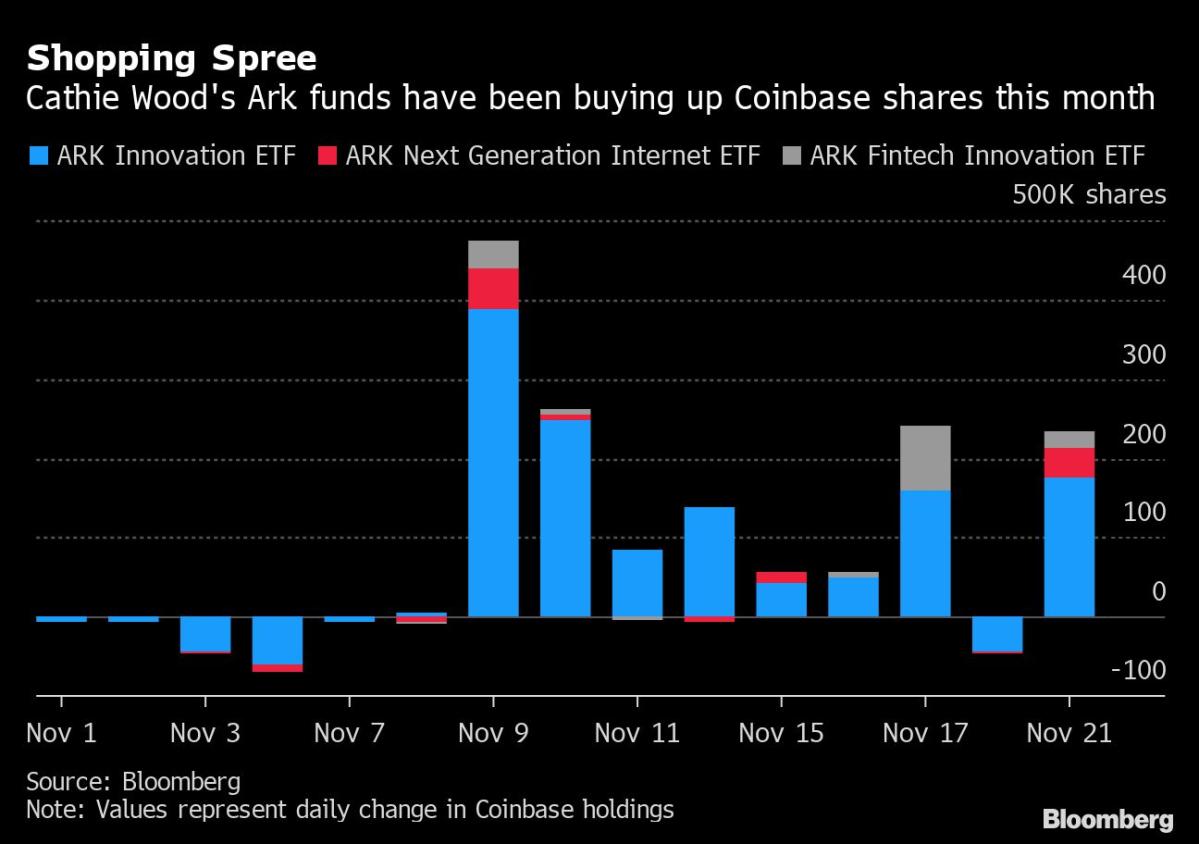

Wood’s Ark Investment Administration money have acquired additional than 1.3 million shares of Coinbase since the start off of November, worthy of about $56 million dependent on Monday’s buying and selling price tag, according to information compiled by Bloomberg. The shopping spree, which started off just as FTX’s demise started, has boosted Ark’s total holdings by about 19% to about 8.4 million shares. That equates to around 4.7% of Coinbase’s overall excellent shares.

Coinbase originally rebounded in the times next Ark’s initial buy on Nov. 8, due in significant element to softer-than-predicted US inflation details which sent possibility-property surging globally. That rally, on the other hand, was quick-lived for the crypto exchange, with its stock rate falling for four consecutive days, including an 8.9% fall on Monday to shut at a new history lower.

The vast majority of Ark’s Coinbase holdings are from its flagship ARK Innovation ETF which has virtually 6 million shares for a weighting of about 3.6%, the fund’s 13th premier placement. Although the ARK Subsequent Generation World wide web ETF and ARK Fintech Innovation ETF every single only hold just in excess of 1 million shares, Coinbase’s weighting in the two cash is far better at 5.4% and 6.3% respectively, in accordance to knowledge on Ark’s site.

Ark’s renewed interest in Coinbase stands in stark contrast to the sentiment emanating from Wall Road for the improved aspect of the last 6 months. Analysts from corporations like Lender of The usa and Daiwa Securities have downgraded the stock this thirty day period, leaving it with just 14 acquire-equal analyst tips, its least expensive quantity considering that August 2021.

Browse additional: FTX Collapse Is Shaking Wall Street’s Conviction in Coinbase

Wood has also been introducing to stakes in other crypto-related property in modern months. Her ARK Future Generation Online ETF procured far more than 315,000 shares of the Grayscale Bitcoin Rely on very last week as its discounted relative to the worth of its underlying cryptocurrency continues to widen. That obtaining was followed afterwards in the week by a order of about 140,000 shares of crypto financial institution Silvergate Money Corp.

The amplified purchasing arrives as cryptocurrecy-uncovered shares have plunged this 12 months amid a deep selloff by tokens like Bitcoin and Ether. Coinbase and Silvergate Cash have equally get rid of additional than 80% of their benefit this yr. Those losses are even deeper than all those suffered by the world’s two largest cryptocurrenices — their price ranges have declined by a lot more than 65% in 2022 with the plunge accelerating this thirty day period in the wake of the FTX collapse.

The Coinshares Block Index, which tracks 45 world wide shares with varying publicity to the cryptocurrency sector, fell 2.5% Monday.

(Updates with closing rates)

Most Browse from Bloomberg Businessweek

©2022 Bloomberg L.P.