(Bloomberg) — The magnificent plunge of Carvana Co.’s stock price tag is bringing discomfort to lots of buyers, but one elite group on Wall Street is sensation it acutely — hedge money.

Most Study from Bloomberg

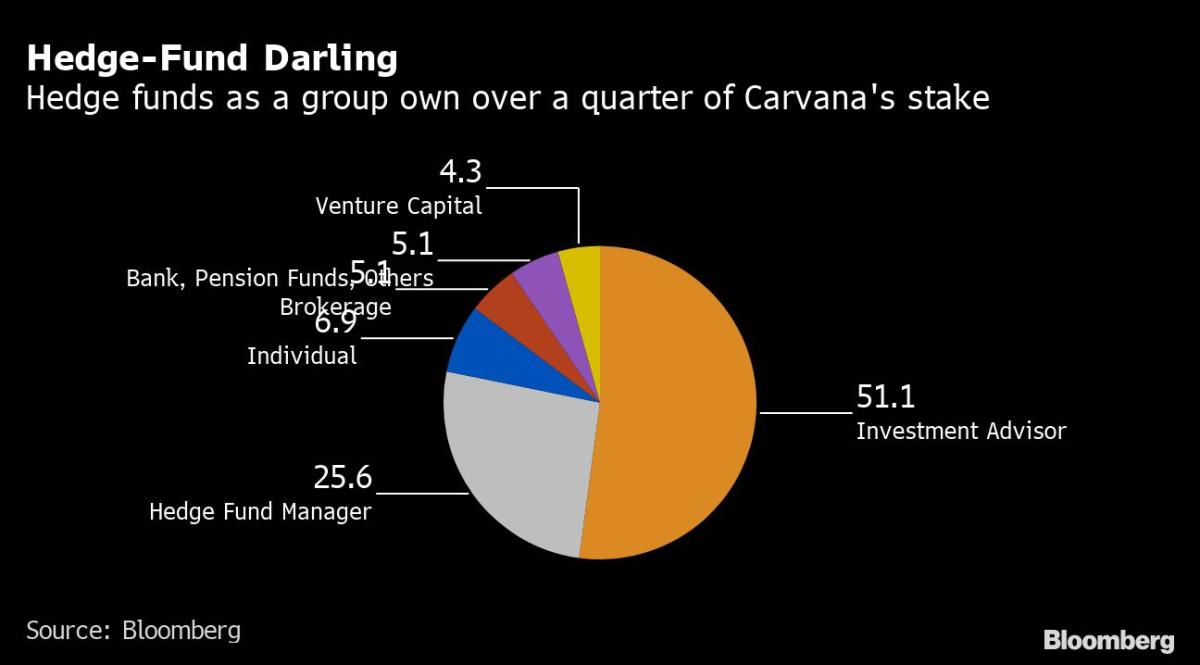

The online utilised-automobile seller, which has noticed its shares drop 97% in the past 12 months, was considered a hedge-fund darling, and for good motive. Collectively, these actively managed funds however possess far more than a quarter of the company’s shares, in accordance to Bloomberg information.

Carvana’s tumbling fortunes symbolize just a person amid lots of development investments that have gone awry for hedge resources this 12 months, providing investors a exceptional glimpse into how the carefully held companies have fared throughout the powerful marketplace selloff. Nevertheless, the sheer magnitude of Carvana’s rout stands out, threatening to place a sizable dent in their portfolio valuations.

“The business was burning cash stream at an alarming amount even prior to made use of car charges began declining,” reported Ivana Delevska, chief expense officer at SPEAR Make investments. “Now with their fundamental market place deteriorating, Carvana is struggling with liquidity challenges and will requires important equilibrium sheet restructuring.”

Some have presently opted to cut their losses and exit. Before this calendar year, Tiger World wide Management and D1 Money Partners bailed on the corporation. Considering the fact that D1’s disclosed exit in Might the inventory has sunk about 80%.

Carvana shares shut down 1.9% at $7.97 in New York on Friday. Its all-time closing high touched in August final year was $370.10.

About 15 months back, Carvana’s downfall was tricky to forecast. The business, whose technologies allows people today to purchase their employed vehicles from the comfort and ease of their couch, was a pandemic winner. Investors flush with money rushed into stocks and thoughts that manufactured it easier to conduct business enterprise with no ever stepping outdoors the home.

But the tables turned this yr, with liquidity having tighter, inflation soaring and the Federal Reserve aggressively boosting fascination premiums, the shares of unprofitable businesses have taken the greatest hits. Buyers are now searching for security and worth in the facial area of a looming economic downturn and have been rapid to shun growth shares. For Carvana, the realities of its business enterprise have also altered greatly.

In the course of the pandemic charges of made use of autos rose to stratospheric heights as new-auto production stalled because of to source concerns. This year, charges commenced ratcheting down rapidly as shortages eased, putting tension on Carvana’s margins. At the identical time, demand from customers has cooled with people receiving squeezed by high inflation and climbing fees.

Earlier this thirty day period Carvana claimed third-quarter outcomes that fell short of analysts’ anticipations. Chief Executive Officer Ernie Garcia explained that “cars are really high priced, and they’re very sensitive to fascination charges.”

Wall Avenue analysts, who have also started out to sound the alarm, are seeing tiny hope for a fast turnaround.

JPMorgan analyst Rajat Gupta mentioned there’s no motive to buy neutral-rated Caravana shares now. “Even when the industry bottoms out, we really do not see a V-shaped recovery in the field, particularly given tough source dynamics in the medium time period for just one to five-year aged cars and trucks and negative fairness chance, along with Carvana’s expanding credit card debt burden,” he wrote in a observe dated Nov. 22.

Spruce Residence Expenditure Administration LLC, FPR Associates LLC, 683 Cash Management LLC, Place72 Asset Administration LP and KPS World-wide Asset Administration United kingdom Ltd are the hedge funds with the major positions in the organization as of Sept. 30, according to info compiled by Bloomberg.

(Updates inventory transfer in sixth paragraph.)

Most Read through from Bloomberg Businessweek

©2022 Bloomberg L.P.