The abrupt and speedy collapse of the FTX cryptocurrency exchange has brought about a shock in the crypto space.

The fall, in a couple times, of a enterprise valued at $32 billion in February, ended up casting suspicion on the overall youthful field of money providers, based mostly on the Blockchain know-how.

Self esteem in the industry is at an all-time lower. Retail investors have fled, although institutional buyers, joined to FTX and its sister business Alameda Analysis, are however pinpointing their losses from their exposure to Sam Bankman-Fried’s empire.

While there are lessons to be figured out from this catastrophe which threatens the entire sector, it is an understatement to say that it will take a long time to regain the lost self esteem.

‘A Great deal of Mistakes’

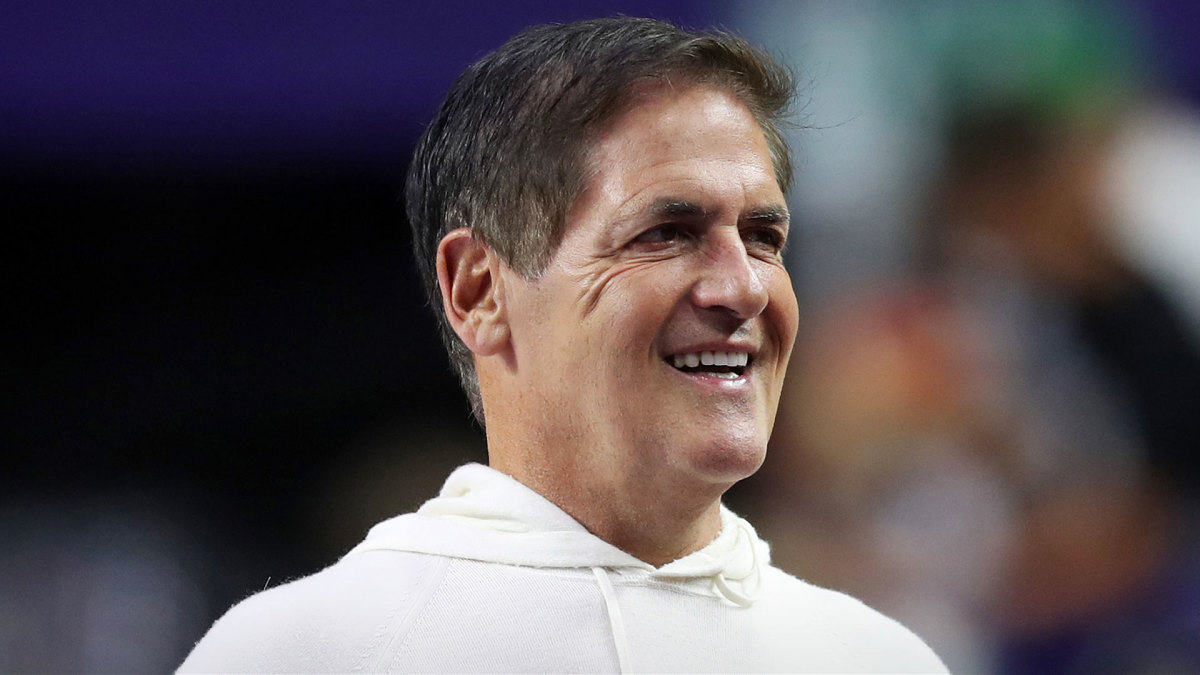

Billionaire Mark Cuban has not shed religion, although. He proceeds to think in the industry and assures that there is still a great deal of benefit in the sector, despite the slide of FTX. He thinks that crypto has its location and that you just have to search at the big picture.

“Separate the sign from the noise,” Cuban instructed TMZ. “There is been a whole lot of individuals producing a large amount of errors, but it doesn’t modify the underlying price.”

Cuban reported that, as lengthy as people have practical solutions in the crypto entire world, he won’t foresee the forex going in the tank.

The Dallas Mavericks operator is now the matter of a class motion lawsuit related to the individual bankruptcy of crypto lender Voyager Electronic, which he had promoted in a partnership signed in October 2021. This partnership in between Voyager Digital and the Dallas Mavericks had a person mission: to boost cryptocurrencies by building coins additional obtainable as a result of academic and electronic plans.

“Cuban and Ehrlich, as will be stated, went to excellent lengths to use their encounter as investors to dupe tens of millions of Us citizens into investing — in numerous conditions, their lifetime financial savings — into the deceptive Voyager platform and obtaining Voyager receive method accounts (“EPAs”), which are unregistered securities,” the class motion lawsuits stated, also referring to Stephen Ehrlich, who was CEO of Voyager.

“As a final result, over 3.5 million Us citizens have now all but lost around $5 billion in cryptocurrency property.”

Voyager submitted for individual bankruptcy as collateral injury of a credit crunch caused by the unexpected collapse of sister cryptocurrencies Luna and UST on May possibly 9.Hundreds of thousands of prospects have shed their savings. Belongings of Voyager Digital experienced been acquired by FTX, as component of the mortgage lender’s liquidation approach.

“A standard issue. Why have I invested in crypto?” Cuban wrote on Twitter on November 13. “Due to the fact I consider good contracts will have a important effect in building useful programs. I have stated from working day 1, the worth of a token is derived from the applications that run on its platform and the utility they create.”

Clever Agreement

A intelligent contract is a piece of laptop code that decides the phrases of a transaction (loans, investing, and many others.) and does not rely on any third party.

“What has not been produced is an application that is ubiquitous. 1 that is certainly essential by anyone and they are inclined to go by the discovering curve to use. Possibly it in no way comes. I hope and think it will,” Cuban ongoing.

The billionaire then when compared the crypto field to the streaming field, implying that poor suggestions are probable to perish although good kinds will prevail.

“The greatest analogy I can use is the early times of streaming. The shit folks experienced to do to pay attention to a 16k stream of new music was insane. An net subscription for your dial up modem. Down load the supplier shopper. Down load a tcp/ip shopper. Obtain the streaming customer,” he argued. “Click on on a batch file on a internet site. Make absolutely sure it all worked jointly. All while being laughed at for just not turning on your radio or tv.”

He concluded on a take note of optimism.

“But for in workplace or out of market it was truly worth it. It started as area of interest in 1995. Now notice that Sensible Contracts are about 5 yrs old.”

Cuban is involved in several crypto assignments, which includes the incredibly choose Bored Ape Yacht Club, which represents a selection of around 10,000 on the web photographs of monkeys putting funny poses. Bored Apes are the most highly-priced non-fungible tokens (NFTs).

He is what many named in the crypto space an Ethereum maximalist, which usually means that he strongly believes in the opportunity of the next premier crypto ecosystem soon after Bitcoin. Ethereum is regarded as the web of the crypto sector which aims to disrupt classic fiscal providers.