(Bloomberg) — Credit Suisse Team AG is battling to restore confidence in its battered model, with buyers so much demonstrating minimal optimism that last month’s method revamp will succeed just after several years of scandals and mismanagement.

Most Examine from Bloomberg

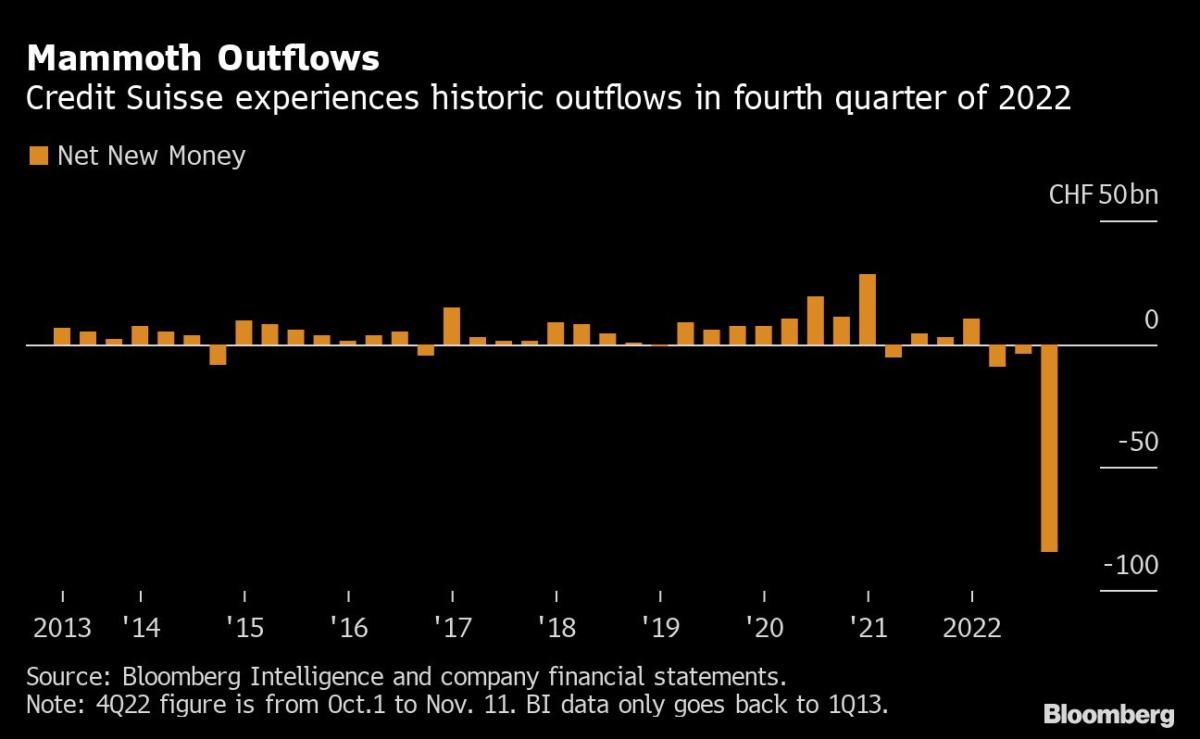

The pursuing charts display 3 fronts significant for the Zurich-based mostly bank’s turnaround — and on all, the bank continues to deal with problems. The share rate hit an all-time low Tuesday, the charge of default insurance is spiking again, and the wealthy purchasers the loan provider relies on carry on to pull out their money.

Go through A lot more: Credit history Suisse Noticed $88 Billion Outflows as Self-assurance Slumped

With one more decline looming for the final quarter of the calendar year and a $4 billion capital elevate under way that dilutes the holdings of current shareholders, Credit rating Suisse is counting on the persistence of traders and staff as the gains of restructuring acquire time to arrive. Chief Govt Officer Ulrich Koerner has established 2024 as the yr the bank will “definitely” be rewarding again.

Credit score Suisse shares opened higher Wednesday immediately after hitting a small of 2.90 Swiss francs ($3.0417) on Tuesday, with the shares on monitor for their longest losing streak due to the fact October 2007. The inventory has fallen 18% considering that the financial institution announced huge outflows from prosperity-administration clients previous 7 days. The downward craze usually means Credit rating Suisse is no for a longer period Switzerland’s 2nd-most significant financial institution by current market capitalization, slipping driving wealth supervisor Julius Baer Group Ltd.

The latest fall is nevertheless also staying affected by the ongoing cash increase by way of rights problem. The initially working day of investing for the new shares is predicted to be Dec. 9, possibly assuaging some of the downward tension on the shares.

Downgrades of Credit history Suisse financial debt by scores companies have been weighing on customers’ consolation concentrations in undertaking business enterprise with the financial institution. They have also elevated the charge of borrowing, and the price buyers shell out for insurance policy from default. Credit score default swaps for the bank’s senior debt had now risen to the maximum since the financial crisis in early October amid persistent rumors more than the bank’s stability, and strike a different document on Tuesday.

Read through Much more: Credit score Suisse Minimize to Just one Stage Higher than Junk Standing by S&P

The lender issued a US bond yielding more than 9% in early November, as nicely as a euro bond paying out a coupon of just underneath 8%. The price was the next-maximum ever for a new senior financial commitment-grade financial institution deal in euros.

Browse A lot more: Credit history Suisse Forced to Shell out Junk-Stage Yields for Cash Infusion

The phrases could proceed to worsen if Credit rating Suisse gets an additional credit score downgrade as two corporations — Moody’s and Fitch — have negative outlooks on the lender, with equally now placing it two notches over junk. A downgrade could be activated if it just cannot stem the shopper outflows, Moody’s mentioned in a rating decision previously this thirty day period.

Credit score Suisse is on a campaign to rebuild have faith in in the wake of the outflows. Executives reported last 7 days that the withdrawals from wealth management have stabilized but not reversed considering the fact that October.

Nonetheless, hundreds of wealthy prospects in Asia have sought to place their cash with rival Swiss loan company UBS Team AG in the region amid the turmoil, and the financial institution is arranging to re-allocate staff members to deal with these growing accounts, persons familiar with the make a difference previously told Bloomberg. Morgan Stanley is also amid financial institutions benefiting from the historic outflows at Credit history Suisse.

–With support from Jan-Patrick Barnert and Allegra Catelli.

(Updates with shares)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.