(Bloomberg) — World wide stocks were being on the backfoot on Friday, steadying right after modern sharp gains as traders awaited the every month US work report for clues on the Federal Reserve’s future policy measures.

Most Study from Bloomberg

Europe’s Stoxx 600 index edged reduced following two days of gains that have set it on keep track of for a 7-7 days rising streak. Futures contracts on the S&P 500 and Nasdaq 100 also slipped, though equally underlying indexes are established for a 2nd week of gains.

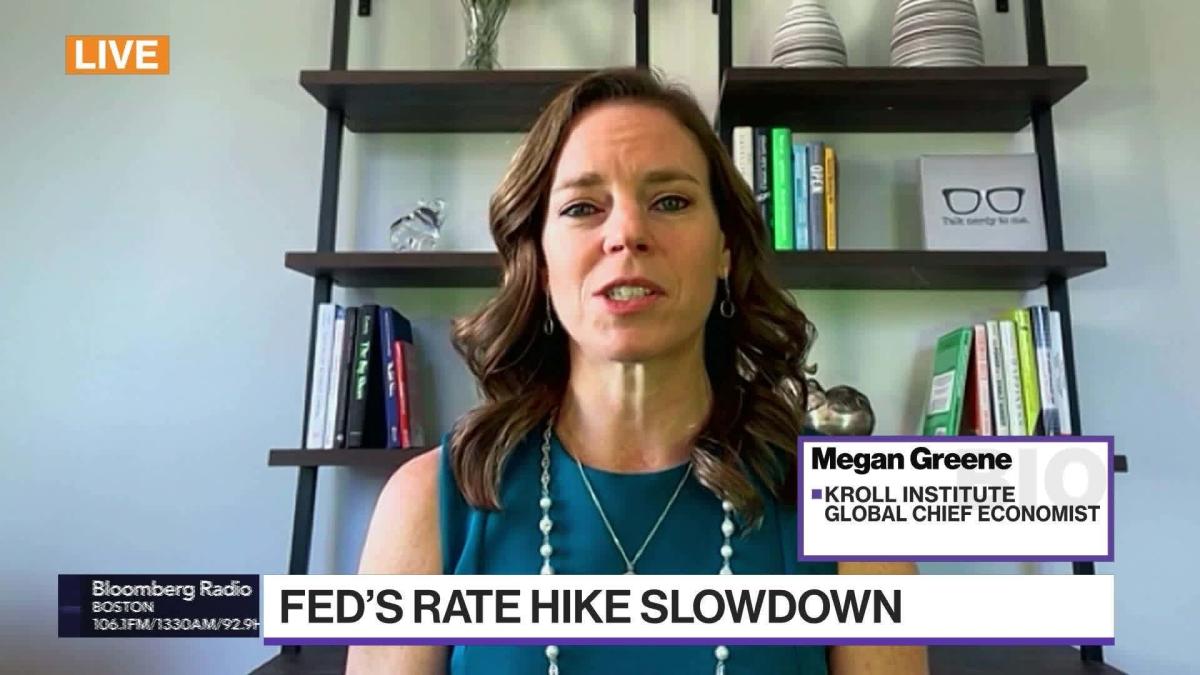

Stocks received a raise this 7 days from a softening in China’s stringent Covid zero stance and signals from Fed Chair Jerome Powell of a downshift in the pace of charge hikes. Bets on where the US central bank’s price will peak have now dropped under 4.9%, in accordance to swap marketplaces. The current benchmark sits in a array concerning 3.75% and 4%.

Nevertheless, many economists reckon Friday’s employment report may possibly fall brief of the turning stage Fed officers are in search of in their struggle to conquer again inflation. The median projection in a Bloomberg study phone calls for payrolls to increase 200,000 in November, cooling only a bit from the prior month.

Some others stage to symptoms that steep price hikes will tip additional economies into economic downturn.

“Consensus is that recession is coming but equities simply cannot base just before it starts off, inflation won’t slide speedily so central banking institutions just can’t blink, China reopening will be a messy approach, and Europe remains challenging,” Barclays Plc strategist Emmanuel Cau wrote in a take note.

Recession considerations have develop into more pronounced immediately after data on Thursday showed November manufacturing unit action sliding in a assortment of nations, with American producing contracting for the to start with time considering the fact that Could 2020.

There are also indicators of pressure on company earnings, with software maker Salesforce Inc. the most current to alert of slowing revenue, though providers, ranging from Amazon.com to Ford Motor Co., have introduced tens of 1000’s of career cuts. Chipmakers together with Nvidia Corp., fell additional than .5% in US premarket trading.

Lender of America Corp. strategists highlighted the labor industry cooldown as one particular motive to like bonds to equities. They be a part of a refrain of bears together with JPMorgan Chase & Co. and Goldman Sachs Group Inc. who warn of fairness declines early future yr amid the specter of an economic economic downturn.

“We’re promoting danger rallies from in this article,” the BofA strategists stated, warning unemployment would change inflation as the primary fret in 2023.

The ebbing amount mountaineering bets have pushed the dollar decrease, fueling a rebound in reduce-yielding G-10 currencies these kinds of as the yen and euro. The dollar slipped for the fourth straight day from a basket of currencies, although ten-calendar year Treasury yields held just off 2-1/2-thirty day period lows.

Previously, a gauge of Asian shares dropped for the to start with time in four times, led by Japan, exactly where the yen’s five-working day rally enhanced downward pressure on shares.

Investors are observing for the once-a-year early-December convention of the Chinese Communist Party’s prime final decision-making entire body, which is predicted to signal a pragmatic technique toward Covid controls, even though stressing the require to increase financial development.

Somewhere else, South Africa’s rand rebounded, paring some of Thursday’s 2.6% fall. The rand has bucked this week’s upswing in rising marketplace currencies because of political turmoil swirling all over President Cyril Ramaphosa.

Oil slipped but headed for its most important weekly gain in almost two months, benefiting from looser Chinese curbs, phone calls by the Biden administration to halt revenue from US strategic reserves and an OPEC producers’ group determination to cut crude supply by the most considering that 2020.

Crucial activities this 7 days:

Some of the key moves in marketplaces:

Stocks

-

The Stoxx Europe 600 fell .2% as of 9:40 a.m. London time

-

Futures on the S&P 500 were being tiny adjusted

-

Futures on the Nasdaq 100 fell .2%

-

Futures on the Dow Jones Industrial Regular fell .1%

-

The MSCI Asia Pacific Index fell .4%

-

The MSCI Rising Markets Index fell .3%

Currencies

-

The Bloomberg Greenback Place Index fell .2%

-

The euro was very little improved at $1.0524

-

The Japanese yen rose 1.1% to 133.80 for each greenback

-

The offshore yuan rose .3% to 7.0187 for every dollar

-

The British pound rose .2% to $1.2267

Cryptocurrencies

-

Bitcoin rose .3% to $16,978.9

-

Ether rose .2% to $1,279.27

Bonds

-

The produce on 10-calendar year Treasuries state-of-the-art two foundation details to 3.52%

-

Germany’s 10-calendar year yield declined three basis points to 1.78%

-

Britain’s 10-calendar year generate declined four foundation factors to 3.06%

Commodities

This tale was manufactured with the aid of Bloomberg Automation.

–With assistance from Rob Verdonck.

Most Study from Bloomberg Businessweek

©2022 Bloomberg L.P.