The Federal Reserve need to declare an rapid cease fire in its war from inflation and maintain its benchmark desire fee continual rather of increasing the federal money by a 50 % percentage place to a assortment of 4.25% to 4.50%, as expected at its assembly that ends Wednesday.

With the relatively benign report on the consumer selling price index in November produced on Tuesday, the Fed has now has “compelling evidence” that it has accomplished its instant target of looking at a significant slowing in inflation.

The CPI was better than envisioned in November, with headline inflation climbing just .1% (1.2% annualized) and core inflation up .2% (2.4% annualized).

Go through: Inflation is slowing, but the struggle is far from more than

The U.S. inventory industry

SPX,

DJIA,

COMP,

on Tuesday at first greeted the CPI report as affirmation that the Fed could get started to enable up, but by midday the realization strike that the Fed is going to continue to keep mountaineering fees.

Market Snapshot: Dow clings to get in remaining hour of trade as Wall Avenue gauges cooler inflation report, subsequent Fed amount decision

Much better than the media says

The CPI report was in fact improved than it’s staying portrayed by the media, which proceed to aim irrationally on yr-more than-12 months improvements in inflation alternatively than hunting at what has took place given that the Fed began raising fascination prices 9 months ago. For instance, what are we to make of. this incoherent headline in the New York Moments: “U.S. Inflation Cools as Client Charges Rise 7.1 Percent”?

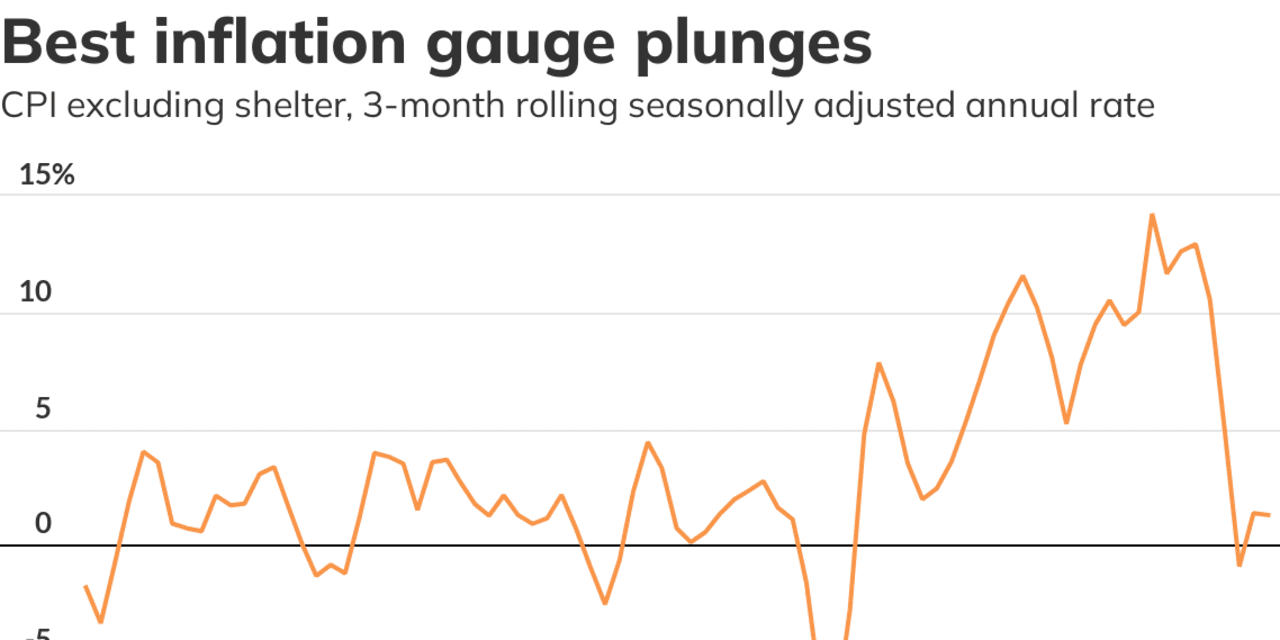

If we do not want to miss the turning details, we have to shorten our horizon to one thing much less than a 12 months, but not so short that it’s all noise and no signal. A few months is about ideal.

In March 2022, when the Fed initial raised fees, inflation was accelerating. From January to March, the CPI experienced risen at an 11.3% once-a-year fee. That was an alarming inflation level which named for action by the Fed.

But then the Fed lifted desire costs at 6 straight meetings, going from in the vicinity of zero to in the vicinity of 4% and now inflation is decelerating. From September to November, inflation rose at a 3.7% once-a-year amount.

That is important progress in the most applicable evaluate of inflation.

Browse: Why November’s CPI facts are noticed as a ‘game-changer’ for financial marketplaces

The mistaken point of view

The progress is substantially a lot less apparent when the figures are documented on a calendar year-in excess of-calendar year basis, as most media retailers do. From November 2021 to November 2022, inflation rose 7.1% — but that determine is meaningless to our understanding of what the Fed has accomplished due to the fact that time body also involves 5 months of higher inflation from ahead of the Fed acted.

Because charge hikes choose some time to have an influence on selling prices and on the financial state, they didn’t actually start off to chunk until eventually July. In the 5 months due to the fact then, inflation has slowed to a 2.5% annualized level, noticeable to any individual who’s hunting. The unprecedented rise in fascination rates is doing work to neat off price tag will increase.

The development is even higher when you just take into account that nearly all of the inflation we’ve endured not long ago is coming from increased rents, which are now growing at a 10% yearly level in a lagged reaction to final year’s extraordinary 20%+ improve in residence rates and limited rental marketplaces.

Rents still increasing as dwelling rates drop

Dwelling prices have now begun to slide in most areas of the U.S. Rents for new tenants have also started to fall, but rents compensated by continuing tenants have lagged guiding and could choose yet another 12 months or lengthier to capture up, in accordance to exploration by economists at Goldman Sachs. That’s since rents on present leases are likely to reset on an yearly basis.

“ Rents are applied to compute the expenses not only of renters but of house owners as well. It is as if we measured champagne charges by searching at how considerably beer expenditures. ”

With more than 900,000 multifamily housing models now beneath building, the supply constraints will before long start off to simplicity, lessening stress on rents, when those people units strike the market place, most likely in the upcoming calendar year or so.

Rents have an outsized affect on the CPI, since rents are used to compute the prices not only of renters but of householders as very well. It is as if we measured champagne selling prices by on the lookout at how much beer expenses. Indeed, there is some correlation most of the time, but not always.

Employing rents to measure homeowners’ fees may possibly be an acceptable methodology in usual times, but not now. Primarily based on the increase in rents, the CPI showed that shelter charges for home owners rose at a 8% yearly level in November. No a person believes which is legitimate. Most home owners have a fixed-price house loan, so principal and interest payments haven’t long gone up.

The appropriate point of view

The greatest thing to do in this predicament is to understand that we need to exclude shelter fees (which accounts for a third of the CPI) if we want to see wherever underlying inflation is heading.

“Substantial disagreement about the right way to evaluate shelter inflation argues for seeking at inflation actions that place much less fat on shelter inflation, not far more, when the determination is of greater consequence,” wrote Goldman Sachs economists Ronnie Walker and David Mericle in a notice printed in October.

The CPI excluding shelter fell .2% in November and has risen at just a 1.3% annual fee in excess of the past three months.

Even Fed Chair Jerome Powell has acknowledged that a sudden drop in household costs will not exhibit up in the headline CPI for months, but he’s not performing like he pretty believes it. If he did, he’d urge his colleagues at the Fed to pause now and allow the total affect of 375 basis points of tightening get the job done on the overall economy.

Additional: Fed seen slowing down to quarter-level hike in February soon after soft buyer price tag inflation reading

We know, nevertheless, that the Fed won’t pause. The Fed shed way too much reliability last calendar year when it skipped the rapid improve in inflation as the financial state emerged from its pandemic lockdown, and now the Fed is scrambling to restore the public’s belief as an inflation fighter.

Regretably, that can make a recession practically inevitable, because the Fed is likely to do what it normally does: Increase prices as well far and thrust the economy into a position-killing economic downturn.

Rex Nutting is a columnist for MarketWatch who has been writing about the Fed and the economy for additional than 25 decades.

Rex Nutting on inflation

What NASA knows about tender landings that the Federal Reserve doesn’t

Everyone is on the lookout at the CPI by the improper lens. Inflation fell to the Fed’s concentrate on in the past three months, in accordance to the ideal evaluate.

Bigger paychecks are excellent news for America’s functioning households. Why does it freak out the Fed?

The Federal Reserve need to declare an rapid cease fire in its war from inflation and maintain its benchmark desire fee continual rather of increasing the federal money by a 50 % percentage place to a assortment of 4.25% to 4.50%, as expected at its assembly that ends Wednesday.

With the relatively benign report on the consumer selling price index in November produced on Tuesday, the Fed has now has “compelling evidence” that it has accomplished its instant target of looking at a significant slowing in inflation.

The CPI was better than envisioned in November, with headline inflation climbing just .1% (1.2% annualized) and core inflation up .2% (2.4% annualized).

Go through: Inflation is slowing, but the struggle is far from more than

The U.S. inventory industry

SPX,

DJIA,

COMP,

on Tuesday at first greeted the CPI report as affirmation that the Fed could get started to enable up, but by midday the realization strike that the Fed is going to continue to keep mountaineering fees.

Market Snapshot: Dow clings to get in remaining hour of trade as Wall Avenue gauges cooler inflation report, subsequent Fed amount decision

Much better than the media says

The CPI report was in fact improved than it’s staying portrayed by the media, which proceed to aim irrationally on yr-more than-12 months improvements in inflation alternatively than hunting at what has took place given that the Fed began raising fascination prices 9 months ago. For instance, what are we to make of. this incoherent headline in the New York Moments: “U.S. Inflation Cools as Client Charges Rise 7.1 Percent”?

If we do not want to miss the turning details, we have to shorten our horizon to one thing much less than a 12 months, but not so short that it’s all noise and no signal. A few months is about ideal.

In March 2022, when the Fed initial raised fees, inflation was accelerating. From January to March, the CPI experienced risen at an 11.3% once-a-year fee. That was an alarming inflation level which named for action by the Fed.

But then the Fed lifted desire costs at 6 straight meetings, going from in the vicinity of zero to in the vicinity of 4% and now inflation is decelerating. From September to November, inflation rose at a 3.7% once-a-year amount.

That is important progress in the most applicable evaluate of inflation.

Browse: Why November’s CPI facts are noticed as a ‘game-changer’ for financial marketplaces

The mistaken point of view

The progress is substantially a lot less apparent when the figures are documented on a calendar year-in excess of-calendar year basis, as most media retailers do. From November 2021 to November 2022, inflation rose 7.1% — but that determine is meaningless to our understanding of what the Fed has accomplished due to the fact that time body also involves 5 months of higher inflation from ahead of the Fed acted.

Because charge hikes choose some time to have an influence on selling prices and on the financial state, they didn’t actually start off to chunk until eventually July. In the 5 months due to the fact then, inflation has slowed to a 2.5% annualized level, noticeable to any individual who’s hunting. The unprecedented rise in fascination rates is doing work to neat off price tag will increase.

The development is even higher when you just take into account that nearly all of the inflation we’ve endured not long ago is coming from increased rents, which are now growing at a 10% yearly level in a lagged reaction to final year’s extraordinary 20%+ improve in residence rates and limited rental marketplaces.

Rents still increasing as dwelling rates drop

Dwelling prices have now begun to slide in most areas of the U.S. Rents for new tenants have also started to fall, but rents compensated by continuing tenants have lagged guiding and could choose yet another 12 months or lengthier to capture up, in accordance to exploration by economists at Goldman Sachs. That’s since rents on present leases are likely to reset on an yearly basis.

“ Rents are applied to compute the expenses not only of renters but of house owners as well. It is as if we measured champagne charges by searching at how considerably beer expenditures. ”

With more than 900,000 multifamily housing models now beneath building, the supply constraints will before long start off to simplicity, lessening stress on rents, when those people units strike the market place, most likely in the upcoming calendar year or so.

Rents have an outsized affect on the CPI, since rents are used to compute the prices not only of renters but of householders as very well. It is as if we measured champagne selling prices by on the lookout at how much beer expenses. Indeed, there is some correlation most of the time, but not always.

Employing rents to measure homeowners’ fees may possibly be an acceptable methodology in usual times, but not now. Primarily based on the increase in rents, the CPI showed that shelter charges for home owners rose at a 8% yearly level in November. No a person believes which is legitimate. Most home owners have a fixed-price house loan, so principal and interest payments haven’t long gone up.

The appropriate point of view

The greatest thing to do in this predicament is to understand that we need to exclude shelter fees (which accounts for a third of the CPI) if we want to see wherever underlying inflation is heading.

“Substantial disagreement about the right way to evaluate shelter inflation argues for seeking at inflation actions that place much less fat on shelter inflation, not far more, when the determination is of greater consequence,” wrote Goldman Sachs economists Ronnie Walker and David Mericle in a notice printed in October.

The CPI excluding shelter fell .2% in November and has risen at just a 1.3% annual fee in excess of the past three months.

Even Fed Chair Jerome Powell has acknowledged that a sudden drop in household costs will not exhibit up in the headline CPI for months, but he’s not performing like he pretty believes it. If he did, he’d urge his colleagues at the Fed to pause now and allow the total affect of 375 basis points of tightening get the job done on the overall economy.

Additional: Fed seen slowing down to quarter-level hike in February soon after soft buyer price tag inflation reading

We know, nevertheless, that the Fed won’t pause. The Fed shed way too much reliability last calendar year when it skipped the rapid improve in inflation as the financial state emerged from its pandemic lockdown, and now the Fed is scrambling to restore the public’s belief as an inflation fighter.

Regretably, that can make a recession practically inevitable, because the Fed is likely to do what it normally does: Increase prices as well far and thrust the economy into a position-killing economic downturn.

Rex Nutting is a columnist for MarketWatch who has been writing about the Fed and the economy for additional than 25 decades.

Rex Nutting on inflation

What NASA knows about tender landings that the Federal Reserve doesn’t

Everyone is on the lookout at the CPI by the improper lens. Inflation fell to the Fed’s concentrate on in the past three months, in accordance to the ideal evaluate.

Bigger paychecks are excellent news for America’s functioning households. Why does it freak out the Fed?