(Bloomberg) — Federal Reserve Chair Jerome Powell says the central lender has far more get the job done to do in increasing curiosity costs and vanquishing inflation. Investors on Wall Avenue appear to see the outlook for 2023 in a different way.

Most Study from Bloomberg

In a 45-minute press convention immediately after the Fed hiked rates by 50 basis factors to the best degree given that 2007, Powell sought to dispel any idea that the central bank would again away from its battle to bring down inflation even with ebbing cost pressures and mounting fears of work losses and a economic downturn.

“We nonetheless have some ways to go,” he stated on Wednesday just after the Fed unveiled forecasts of additional price will increase following 12 months. “We will stay the course right up until the job is done.”

After buckling on what was to begin with found as rough-appreciate information from the Fed, bond selling prices reversed study course as buyers guess that the central bank would execute a U-change subsequent yr and inevitably stop up chopping fascination prices as the economic climate falters.

“The industry is not shopping for the Fed’s increasingly hawkish posture that they are likely to raise costs to a better-than-envisioned stage and maintain them there,” mentioned Lindsey Piegza, chief economist at Stifel Nicolaus & Co. “The current market plainly thinks inflation is heading to be on a considerably far more fascinating path than the Fed is anticipating.”

Powell affirmed the Fed’s perseverance to lessen inflation to its 2% target — it is presently working three instances that — and created very clear that the central financial institution is not considering chopping charges upcoming year, no issue what buyers might imagine.

The Fed will not cut down rates till it is “really self-assured that inflation is coming down in a sustained way,” he claimed. And “that will be some time.”

What Bloomberg Economics States…

“The most striking portion of the up-to-date SEP is how unified the committee is on the have to have to increase charges additional aggressively – considerably bigger than the 4.8% terminal amount marketplaces experienced priced in ahead of the meeting. It’s also crystal clear that officers understand the amount of money of expected tightening will press the economic climate into recession.”

— Anna Wong, David Wilcox and Eliza Winger (economists)

— To go through much more click right here

Though welcoming the latest signs that price improves could have peaked, Powell zeroed in on what he named the “extremely tight” career sector and the stress that greater wages would place on companies’ labor prices and finally inflation.

”It’s all about the labor marketplace,” former New York Fed President and Bloomberg columnist William Dudley explained to Bloomberg Tv. “They have to sluggish the financial system down sufficiently to deliver sufficient slack in the labor market place so wage developments come down to be steady with 2% inflation.”

That message might not go about well with some Democratic Social gathering lawmakers who have now complained about the impression that the Fed’s repeated rate will increase will have on the jobs industry and the economic system.

Wage raises are currently jogging about 5% for every year, or about 2 proportion details speedier than Powell reckons is dependable with the acquiring inflation back down to 2%.

In projections launched soon after the summary of their two-working day meeting, Fed policy makers do see inflation falling in 2023, to 3.1% by the end of the yr, according to their median forecast. But that will appear at the value of bigger unemployment – it boosts to 4.6% in the median outlook from 3.7% in November – as financial advancement limps along at a .5% pace.

“I desire there were being a completely painless way to restore selling price steadiness,” Powell claimed. “There is not.”

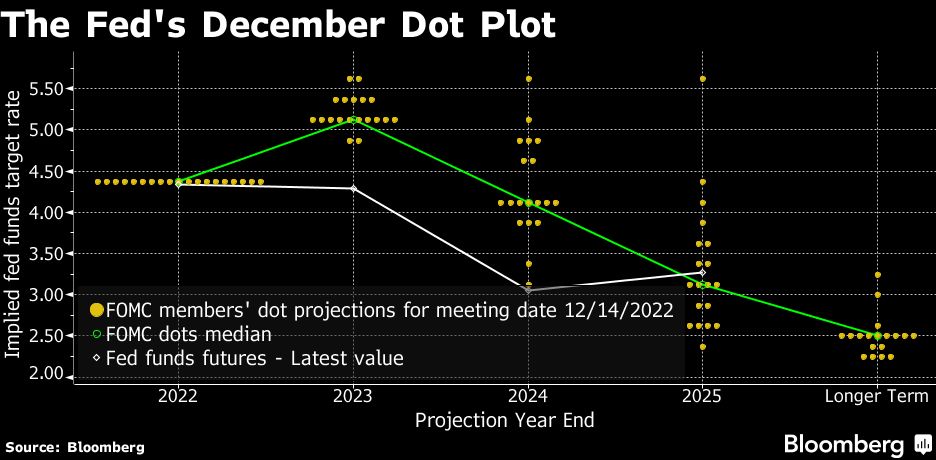

To support neat down inflation, policymakers see themselves elevating premiums an additional 75 basis factors up coming yr – higher than the amount that traders are betting on. Powell pointed out that 17 of 19 Fed officials wrote down a peak amount of 5% or a lot more up coming 12 months. Immediately after Wednesday’s improve, the Fed’s focus on variety for the benchmark federal cash fee is 4.25% to 4.5%.

Whilst Powell shied absent from stating a recession was in the cards, two policymakers penciled in a downturn in gross domestic products next year, according to the projections released by the Fed.

”It does look like there is a continued thrust towards a harder landing inside the Fed’s forecasts, even if they’re not noting that the baseline is you get a recession,” Matthew Luzzetti, chief US economist for Deutsche Financial institution Securities. “The rise in unemployment fee that they forecast, you have never seen come about without having a economic downturn.”

Powell at just one position in the push convention did let that the Fed may possibly be nearing the end of a credit-tightening marketing campaign that has seen the central bank increase charges from close to zero at the start off of the year. “Our plan is having into a really very good put,” he explained.

But he straight away extra that policymakers have a extended strategies to go to restore value security to the economic system.

The Fed “still has an unwavering emphasis on receiving inflation back again to focus on,” Wrightson ICAP LLC main economist Lou Crandall stated.

–With guidance from Jonnelle Marte, Matthew Boesler, Steve Matthews and Craig Torres.

Most Examine from Bloomberg Businessweek

©2022 Bloomberg L.P.