To say that Vladimir Putin threw a wrench into the world-wide power current market this year is an understatement. Because Russia’s invasion of Ukraine in February, Putin’s beloved resource to erode assist for the state has been electrical power. Russian strength businesses have restricted flows of purely natural gasoline to Europe, just one of Russia’s most significant strength buyers, sending selling prices increasing and international locations scrambling to establish replacements in advance of winter season sets in.

In the meantime, Russian oil and fuel revenues have soared, as countries worldwide have been eager to pay a premium for increased volumes of Russian oil and fuel. Putin has been threatening Europe with this kind of energy blackmail for years, but 2022 was when it became explicit.

There is a weakness in this method, even though: Russia’s economy has stayed afloat mainly because the strength market place is so globalized. Here’s how Putin’s aggression through 2022 could spectacularly backfire.

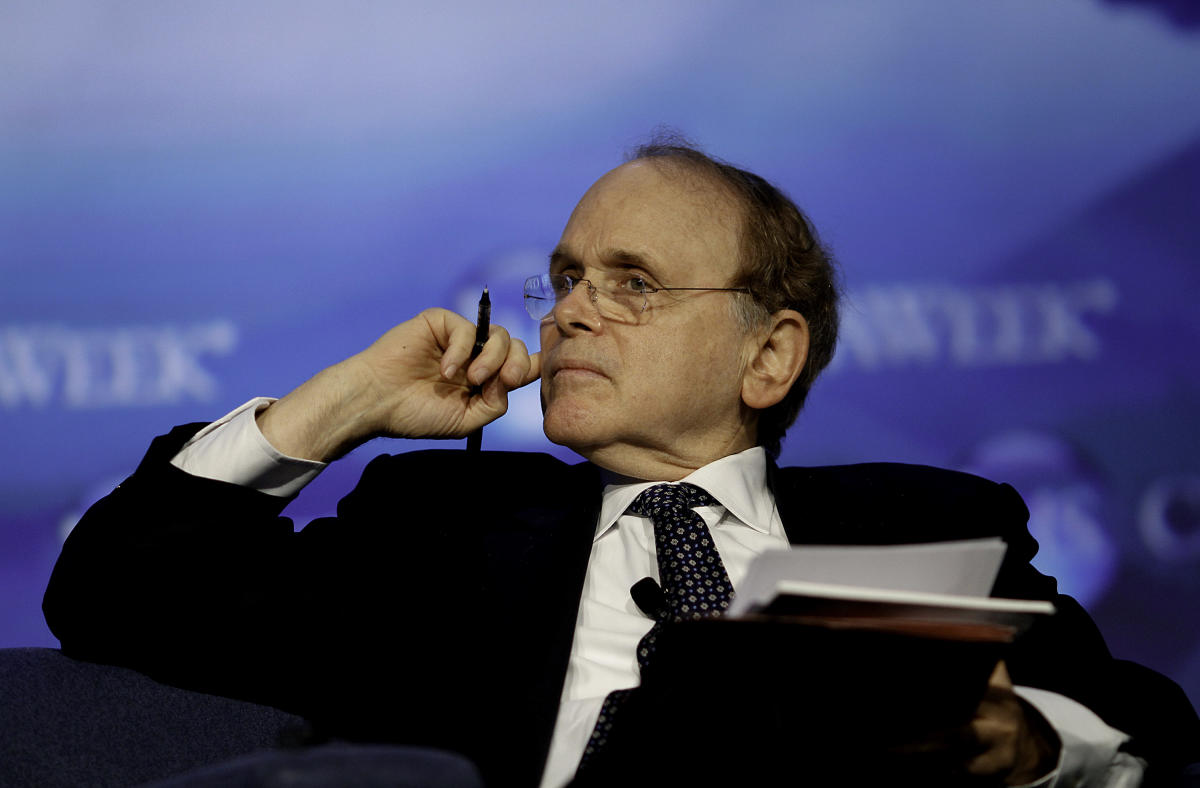

Since the fall of the Soviet Union in the 1990s and international locations which includes Russia and China stepping into the world-wide overall economy, strength has become a global commodity, and oil most of all, Daniel Yergin, an vitality historian and vice chairman of S&P International, wrote in a Wall Road Journal op-ed revealed Monday. Significant suppliers like Russia could count on international locations from any where in the environment to obtain their oil, offering a secure supply of income that has propped up the country’s financial state for many years.

But the Ukraine war and the West’s developing aversion to Russian power imports may perhaps spell the end of the intercontinental oil market’s heyday, replaced by a considerably extra splintered and regionalized edition exactly where borders are defined by politics, Yergin argued.

“Europe’s ban on Russian oil, put together with the U.S.-generated ‘cap’ on Russian oil charges, marks the finish of the world oil sector. In its position is a partitioned sector whose borders are formed by not only economics and logistics but also geopolitical system,” he wrote.

Yergin argued that Russia could retaliate towards the EU’s new vitality steps by reducing back again on oil generation and raising charges, complicating issues more for nations supporting Ukraine. But the fragmented and unpredictable character of the present oil market suggests the approach may well backfire spectacularly on Putin.

“Moscow will counterattack, hoping to result in disruption, worry, and a crack in assistance for Ukraine. But Russia will have a harder time than anticipated specified existing marketplace ailments,” Yergin wrote.

Undoing Putin’s playbook

In the face of a solid present of unity from Europe and the U.S., Russia has sought to leverage its standing as an essential international electricity supplier to chip absent at support for Ukraine. But Western allies have so significantly managed to hold business.

Starting this month, the European Union, Russia’s greatest historical vitality shopper, commenced phasing out Russian oil imports whilst Team of 7 nations accepted an oil selling price cap for Russian imports. For Putin, the West’s increasing independence from Russian power and a much more fragmented international oil industry total could finish up a important hit to the power revenues Russia has developed reliant on, and it could all be his have accomplishing.

The oil value cap, which Yergin identified as “ingenious,” has been established at $60 for each barrel, made to continue to keep Russian oil on the marketplace though restricting the country’s revenues from crude oil and oil goods including gasoline and diesel, which in the to start with six months of the war had led to €102 billion euros ($108.6 billion) in profits for Russia.

Putin has responded by contacting the price tag cap “stupid,” and the Kremlin has threatened to cut Russian oil production by 5% to 7% early up coming calendar year, boosting international charges and further starving the West of vitality. Previously this month, officers even signaled the region would not market oil to countries that have agreed to the rate cap.

With international locations in the West no more time reputable buyers, Russia appears to have leaned into the concept of a more regionalized oil marketplace. In an interview with Saudi news channel Asharq previous 7 days, Russian finance minister Anton Siluanov said the country is actively “looking for new oil customers” in the wake of the Western oil price cap, and Russian oil companies are “rerouting their supplies from the West to the East, South, other international locations.”

But turning to a more compact oil sector could be a hit to Russia’s revenues if it decides to lower output, a thing analysts have warned Putin could do in a bid to increase oil rates and damage the West.

“The Kremlin could minimize exports to spite the cap to test to increase worldwide oil price ranges,” scientists from Bruegel, a Brussels-dependent imagine tank, wrote in a modern report. “Even if chopping exports hurts Russia, the Kremlin could determine to do so as a signal of its willingness to suffer financial ache.”

Profits backfire

But if Russia does come to a decision to minimize oil creation or exports, it could do additional damage to Putin than superior, Yergin argued, by raising rates adequate to transform absent recent Russian oil prospective buyers which include China and India.

“Sharp oil cuts and the attendant price tag increases would be felt not only by European nations around the world but also by those people vital to Russia, specifically India and China, which together obtained about 70% of the country’s full seaborne crude-oil exports in December,” he wrote.

At the exact time, the West may well not experience the sting of significant oil rates as much as Putin hopes. Even drawing on strategic oil reserves all over again may “not be important,” Yergin explained, as the developing likelihood of a worldwide economic downturn in 2023 threatens to force oil demand down.

Yergin said oil selling prices are unstable heading into 2023 in an interview with CNBC final week, but extra that a “real recession” could bring costs down. In Oct, the Globe Bank also warned a recession could have an adverse effect on demand, cautioning that the “prospect of a international economic downturn could direct to a lot weaker oil usage.”

“A generation cut could perfectly finish up introducing to the Kremlin’s extended line of miscalculations,” Yergin wrote.

This tale was at first highlighted on Fortune.com

Far more from Fortune:

Persons who skipped their COVID vaccine are at better hazard of site visitors incidents

Elon Musk claims obtaining booed by Dave Chapelle admirers ‘was a first for me in true life’ suggesting he is conscious of setting up backlash

Gen Z and younger millennials have uncovered a new way to afford luxurious handbags and watches—living with mom and dad

Meghan Markle’s genuine sin that the British public cannot forgive–and People simply cannot fully grasp