U.S. stock futures rose as traders returned from the festive split in a generally bullish temper.

How are inventory-index futures buying and selling

-

S&P 500 futures

ES00,

+.88%

innovative 41 details, or 1.1%, to 3902 -

Dow Jones Industrial Typical futures

YM00,

+.79%

attained 332 points, or 1%, to 33617 -

Nasdaq 100 futures

NQ00,

+1.05%

climbed 122 points, or 1.1%, to 11144

On Friday, the Dow Jones Industrial Normal

DJIA,

fell 74 factors, or .22%, to 33147, the S&P 500

SPX,

declined 10 points, or .25%, to 3840, and the Nasdaq Composite

COMP,

dropped 12 points, or .11%, to 10466. The Nasdaq Composite fell 33.1% in 2022, the major one 12 months proportion decline because 2008.

What is driving markets

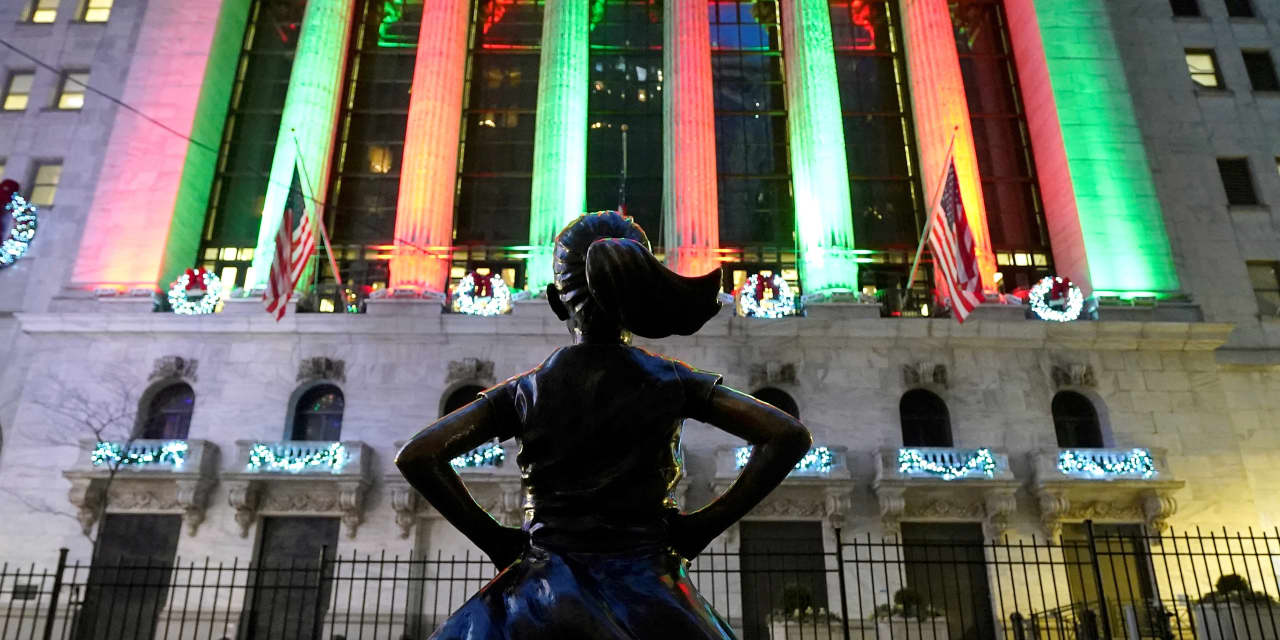

Immediately after Wall Street’s S&P 500 benchmark dropped approximately 20% in 2022, equity traders appeared decided on Tuesday to start out the new year of trading on a beneficial note.

Action in index futures was choppy, however, with the S&P 500 agreement wobbling in a 55 point variety in early-hrs action — volatility that illustrated the uncertainty still pervading the market.

“The calendar calendar year might have transformed, but the themes keep on being the same as the U.S. and U.K. markets reopen for 2023,” explained Richard Hunter, head of markets at Interactive Trader.

“Recessionary concerns will all over again best the agenda, underpinned by higher inflation and growing curiosity rates. This in flip could position to a troubled January as buyers search for beneficial indications that the tightening policies of the central banking companies might start to simplicity provided weakening economic data,” Hunter additional.

Without a doubt, the Worldwide Financial Fund greeted the new yr with a warning that a third of the world-wide economic climate will endure economic downturn in 2023, a downturn that will most likely trim corporate income.

In addition, a burst of refreshing energy in the greenback

DXY,

on Tuesday – a typical reaction to world wide financial slowdown anxieties – was very likely to even further crimp earnings of U.S. multinationals.

Even now, Julian Emanuel , strategist at Evercore ISI, reckoned that these types of worries really do not essentially signify stocks can not rally.

“Forecasting an earnings economic downturn in 2023 to accompany the economic recession that now seems unavoidable, alongside with a 2023 yr end S&P 500 price tag focus on of 4,150, would appear unattainable,” he said in a be aware to clientele.

“Yet not only is there a prolonged record of earnings down/shares up yrs (1970, 1982 and 1985 stand out, but there is also the inclination for strong stock/bond return decades to comply with traditionally forceful tightening cycles (1982, 1985) specifically in decades (1995) subsequent ‘havoc being wreaked’ on a 60/40 portfolio these types of as 2022’s declines.” Emanuel additional.

Resource: Evercore ISI

U.S. economic updates established for release on Tuesday involve the December S&P U.S. producing PMI at 9:45 a.m. and the November examining of development expending at 10 a.m., equally instances Japanese.

U.S. stock futures rose as traders returned from the festive split in a generally bullish temper.

How are inventory-index futures buying and selling

-

S&P 500 futures

ES00,

+.88%

innovative 41 details, or 1.1%, to 3902 -

Dow Jones Industrial Typical futures

YM00,

+.79%

attained 332 points, or 1%, to 33617 -

Nasdaq 100 futures

NQ00,

+1.05%

climbed 122 points, or 1.1%, to 11144

On Friday, the Dow Jones Industrial Normal

DJIA,

fell 74 factors, or .22%, to 33147, the S&P 500

SPX,

declined 10 points, or .25%, to 3840, and the Nasdaq Composite

COMP,

dropped 12 points, or .11%, to 10466. The Nasdaq Composite fell 33.1% in 2022, the major one 12 months proportion decline because 2008.

What is driving markets

Immediately after Wall Street’s S&P 500 benchmark dropped approximately 20% in 2022, equity traders appeared decided on Tuesday to start out the new year of trading on a beneficial note.

Action in index futures was choppy, however, with the S&P 500 agreement wobbling in a 55 point variety in early-hrs action — volatility that illustrated the uncertainty still pervading the market.

“The calendar calendar year might have transformed, but the themes keep on being the same as the U.S. and U.K. markets reopen for 2023,” explained Richard Hunter, head of markets at Interactive Trader.

“Recessionary concerns will all over again best the agenda, underpinned by higher inflation and growing curiosity rates. This in flip could position to a troubled January as buyers search for beneficial indications that the tightening policies of the central banking companies might start to simplicity provided weakening economic data,” Hunter additional.

Without a doubt, the Worldwide Financial Fund greeted the new yr with a warning that a third of the world-wide economic climate will endure economic downturn in 2023, a downturn that will most likely trim corporate income.

In addition, a burst of refreshing energy in the greenback

DXY,

on Tuesday – a typical reaction to world wide financial slowdown anxieties – was very likely to even further crimp earnings of U.S. multinationals.

Even now, Julian Emanuel , strategist at Evercore ISI, reckoned that these types of worries really do not essentially signify stocks can not rally.

“Forecasting an earnings economic downturn in 2023 to accompany the economic recession that now seems unavoidable, alongside with a 2023 yr end S&P 500 price tag focus on of 4,150, would appear unattainable,” he said in a be aware to clientele.

“Yet not only is there a prolonged record of earnings down/shares up yrs (1970, 1982 and 1985 stand out, but there is also the inclination for strong stock/bond return decades to comply with traditionally forceful tightening cycles (1982, 1985) specifically in decades (1995) subsequent ‘havoc being wreaked’ on a 60/40 portfolio these types of as 2022’s declines.” Emanuel additional.

Resource: Evercore ISI

U.S. economic updates established for release on Tuesday involve the December S&P U.S. producing PMI at 9:45 a.m. and the November examining of development expending at 10 a.m., equally instances Japanese.