If Tuesday was any indication of how the market will behave this year, then buckle up, it looks like it will be a wild one. The Dow Jones Industrial Average

DJIA,

had a 537-point trading range, even though the blue chip index lost only 11 points by the close.

It’s still early enough in the year to look at 2023 predictions, so this time we’ll go with one from an analyst who called the market correctly at the end of 2021. “The S&P 500 will have its worst year since 2008,” said Michael Batnick, managing partner at Ritholtz Wealth Management. “I predict this year it will fall more than 15%. The combination of high multiples, high inflation, supply chain issues, and the Fed raising interest rates will prove to be too much for investors to handle.” The S&P 500

SPX,

dropped 19% last year.

Of course, not all his predictions came true — for instance, he said the Fed would end up cutting rates by the end of the year — but still that’s a better track record than many. So what does he expect for 2023?

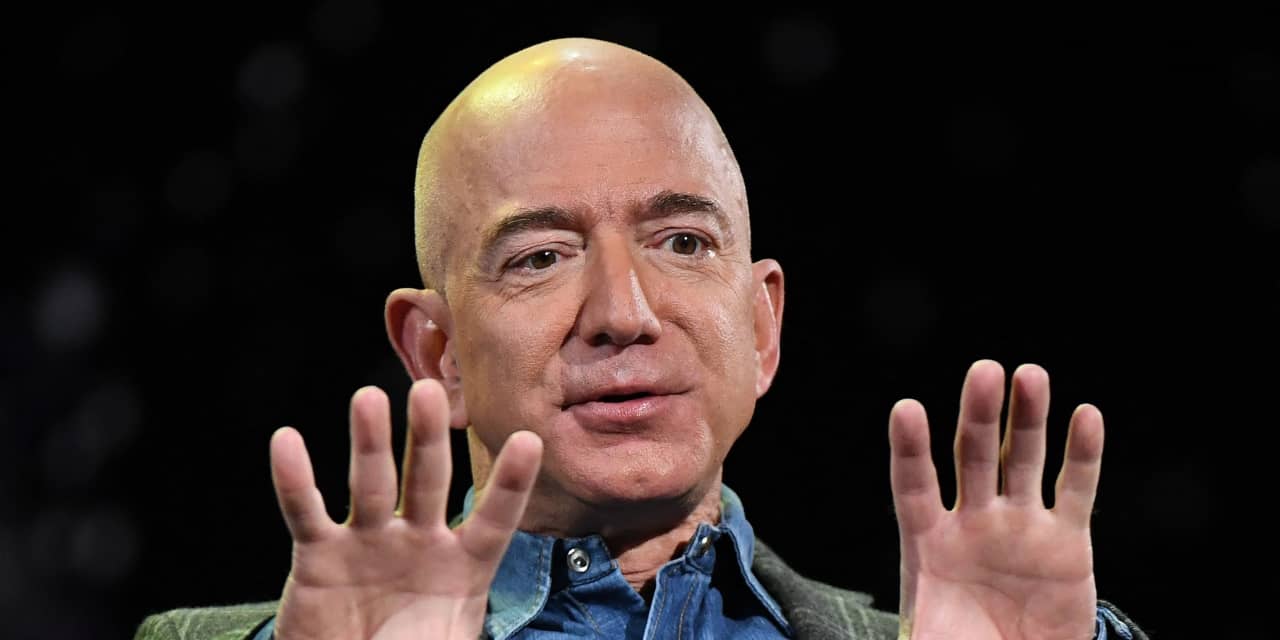

Jeff Bezos, in the style of Bob Iger at Walt Disney, will come back to lead Amazon.com

AMZN,

after the stock’s 50% drop last year, he reckons. “Jeff Bezos spent 27 years at Amazon and has been gone for less than two. In 2023 he pulls a Bob Iger and returns to steady the ship,” says Batnick.

That’s not crazy talk, given Amazon’s share-price struggles, though of course Andy Jassy had the unfortunate timing to start as CEO just five months before the first vaccines arrived, releasing consumers from their homes. “Is Amazon in a lousy business or do they do a lousy job running it,” asked Laura Martin, an analyst at Needham, in a late December note forecasting just 2% operating margins for the fiscal year.

Relatedly, Microsoft

MSFT,

was just downgraded by UBS, in part on worries that its Azure cloud business that competes with Amazon’s AWS is slowing due to maturation and not just macroeconomic headwinds.

Batnick more broadly expects the tech sector to continue its layoffs — which he wrote ahead of Salesforce.com

CRM,

announcing a 10% reduction in jobs — and value to continue to outperform growth.

A few of his other forecasts: bonds will hold their own as a diversifying asset; bitcoin

BTCUSD,

will double; gold

GC00,

will make a new all-time high; and stocks will gain double digits. “With peak inflation hopefully behind us, a consumer that is still in good shape, and an investor class that is negative across the board, it wouldn’t take much in the way of an upside surprise for stocks to take off,” he says.

Caveat emptor, though. “These are my best guesses as to what happens in the next year, and I look forward to rereading them in twelve months in disbelief that I could be so wrong on so many things,” writes Batnick.

Best of the web

The website Unusual Whales has published its 2022 Congressional stock trading report, which finds both Democrats and Republicans enjoyed market-beating returns last year.

The head of Saudi Arabia’s wealth fund has been subpoenaed in a lawsuit over an Elon Musk tweet.

Moody’s warns not of a recession but a ‘slowcession.’

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

MULN, |

Mullen Automotive |

|

AAPL, |

Apple |

|

NIO, |

Nio |

|

BBBY, |

Bed Bath & Beyond |

|

AMZN, |

Amazon.com |

|

BABA, |

Alibaba |

|

NVDA, |

Nvidia |

The chart

This chart from Fidelity Investments strategist Jurrien Timmer lays out the difference between market and central bank expectations on where rates are headed. “The risk here is that the Fed is correct, and markets are wrong in projecting the path of policy in 2023, and that financial conditions will remain tighter for longer,” he says. He says the recent rally from the mid-October low may not just be justified if rates stay higher for longer than what investors anticipate.

Random reads

An unhappy jolt in the new year: Goldman Sachs

GS,

is now charging its bankers for coffee.

The man believed to be the world’s tallest is 9 foot 6 inches in height.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

If Tuesday was any indication of how the market will behave this year, then buckle up, it looks like it will be a wild one. The Dow Jones Industrial Average

DJIA,

had a 537-point trading range, even though the blue chip index lost only 11 points by the close.

It’s still early enough in the year to look at 2023 predictions, so this time we’ll go with one from an analyst who called the market correctly at the end of 2021. “The S&P 500 will have its worst year since 2008,” said Michael Batnick, managing partner at Ritholtz Wealth Management. “I predict this year it will fall more than 15%. The combination of high multiples, high inflation, supply chain issues, and the Fed raising interest rates will prove to be too much for investors to handle.” The S&P 500

SPX,

dropped 19% last year.

Of course, not all his predictions came true — for instance, he said the Fed would end up cutting rates by the end of the year — but still that’s a better track record than many. So what does he expect for 2023?

Jeff Bezos, in the style of Bob Iger at Walt Disney, will come back to lead Amazon.com

AMZN,

after the stock’s 50% drop last year, he reckons. “Jeff Bezos spent 27 years at Amazon and has been gone for less than two. In 2023 he pulls a Bob Iger and returns to steady the ship,” says Batnick.

That’s not crazy talk, given Amazon’s share-price struggles, though of course Andy Jassy had the unfortunate timing to start as CEO just five months before the first vaccines arrived, releasing consumers from their homes. “Is Amazon in a lousy business or do they do a lousy job running it,” asked Laura Martin, an analyst at Needham, in a late December note forecasting just 2% operating margins for the fiscal year.

Relatedly, Microsoft

MSFT,

was just downgraded by UBS, in part on worries that its Azure cloud business that competes with Amazon’s AWS is slowing due to maturation and not just macroeconomic headwinds.

Batnick more broadly expects the tech sector to continue its layoffs — which he wrote ahead of Salesforce.com

CRM,

announcing a 10% reduction in jobs — and value to continue to outperform growth.

A few of his other forecasts: bonds will hold their own as a diversifying asset; bitcoin

BTCUSD,

will double; gold

GC00,

will make a new all-time high; and stocks will gain double digits. “With peak inflation hopefully behind us, a consumer that is still in good shape, and an investor class that is negative across the board, it wouldn’t take much in the way of an upside surprise for stocks to take off,” he says.

Caveat emptor, though. “These are my best guesses as to what happens in the next year, and I look forward to rereading them in twelve months in disbelief that I could be so wrong on so many things,” writes Batnick.

Best of the web

The website Unusual Whales has published its 2022 Congressional stock trading report, which finds both Democrats and Republicans enjoyed market-beating returns last year.

The head of Saudi Arabia’s wealth fund has been subpoenaed in a lawsuit over an Elon Musk tweet.

Moody’s warns not of a recession but a ‘slowcession.’

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

MULN, |

Mullen Automotive |

|

AAPL, |

Apple |

|

NIO, |

Nio |

|

BBBY, |

Bed Bath & Beyond |

|

AMZN, |

Amazon.com |

|

BABA, |

Alibaba |

|

NVDA, |

Nvidia |

The chart

This chart from Fidelity Investments strategist Jurrien Timmer lays out the difference between market and central bank expectations on where rates are headed. “The risk here is that the Fed is correct, and markets are wrong in projecting the path of policy in 2023, and that financial conditions will remain tighter for longer,” he says. He says the recent rally from the mid-October low may not just be justified if rates stay higher for longer than what investors anticipate.

Random reads

An unhappy jolt in the new year: Goldman Sachs

GS,

is now charging its bankers for coffee.

The man believed to be the world’s tallest is 9 foot 6 inches in height.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.