As CES 2023 attracts to a close, considerably of the attention in the chip world was lauded on businesses like Highly developed Micro Gadgets Inc. and Nvidia Corp. but a reduced profile chip maker appears superior positioned coming out of the conference.

Morgan Stanley analyst Joseph Moore claimed there is nevertheless a lot of caution about general chip desire in particular with softness in China, but autos seem to be a person of the robust themes of CES 2023, he mentioned.

“The places that have been weak remain considerably weaker – notably memory, semi cap, and commonly Laptop and cloud builds – even though the marketplaces that have been potent (such as automotive and industrial) keep on being sturdy but with guide times clearly starting off to normalize, which possible details to for a longer period term income pressures especially in a weaker economic system,” Moore mentioned.

“Still, the for a longer period expression themes keep on being optimistic, specifically for autos (which is increasingly the concentration of CES),all around themes these kinds of as EVs, ADAS and autonomous.”

These was the case when Nvidia Corp.

NVDA,

said on Tuesday it was partnering with Hon Hai Technological know-how Group

2317,

, or Foxconn, ideal known for getting the producer of Apple Inc.’s

AAPL,

Iphone, to make electric motor vehicles that use Nvidia’s Travel Orin chips and sensors, and bringing its GeForce Now streaming video clip video game services to autos designed by Hyundai Motor Group

005380,

BYD

1211,

and Swedish EV maker Polestar.

“We normally believe that Nvidia quantities are probably Ok from right here, though there was some warning on market as a result of in China for gaming, and a obvious consciousness that while the company’s place in just cloud is pretty good, that force in cloud budgets sales opportunities to considerably reduce visibility,” Moore reported. “But we would say that frequently we believe that they are earlier the worst of the pressures in their business enterprise, in distinction to most of the semiconductor group wherever there are nevertheless possible numbers cuts in advance.”

Meanwhile, Advanced Micro Units Inc.

AMD,

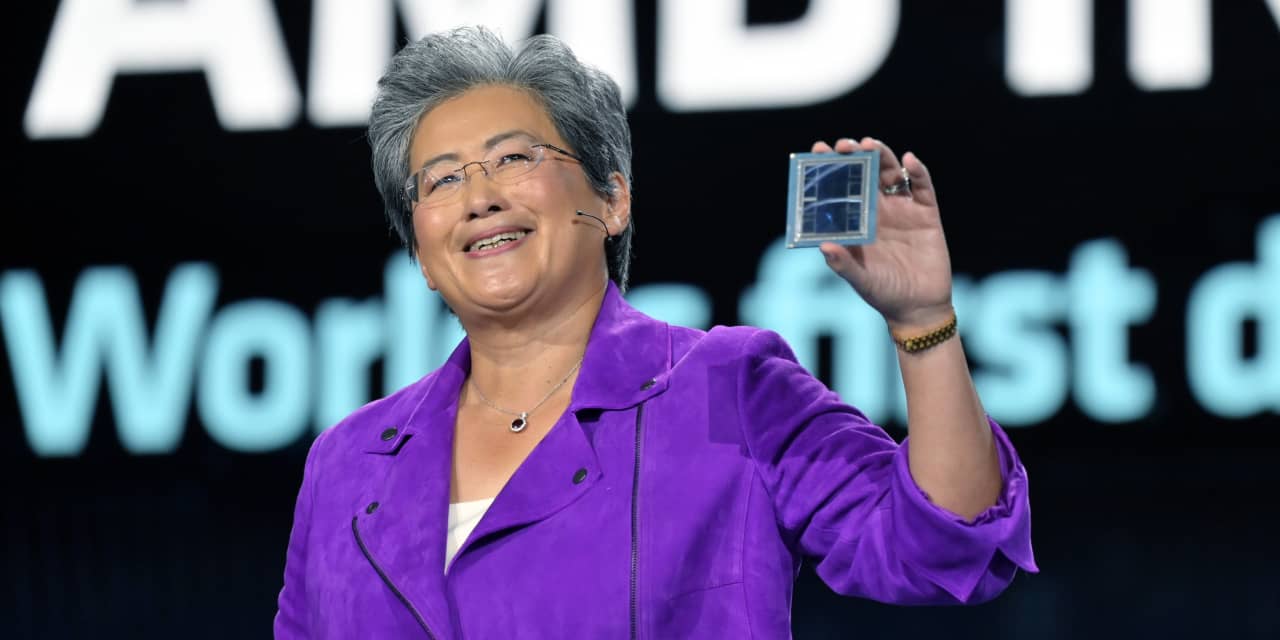

utilized the CES keynote to introduce the Instinct MI300 chip as “world’s first knowledge-heart integrated CPU + GPU.” The combined central processing unit and graphics processing device meant for AI inference, the months-extensive method where facts facilities expend hundreds of thousands of bucks a year on electric power to practice and build artificial intelligence. AMD Chief Government and Chair Lisa Su mentioned the MI300 can decrease the time it usually takes for an inference modeling approach from months to months.

But a single chip maker that does not get a good deal of awareness appeared to arise from CES most effective positioned for the 12 months: ON Semiconductor Corp.

ON,

which focuses on electric powered autos and highly developed driver assistance systems as key expansion drivers, leveraging its legacy position in automobile chips.

“Most notably, the company’s push into [Silicon Carbide] continues to be on monitor, and assume to even now exit the yr at a run-price the place the the vast majority of crystal driving the enterprise is internally sourced,” Moore mentioned. “The organization remains self-assured that demand in the EV place will considerably outpace source for a lengthy time and have so shifted their concentration about to execution on the manufacturing facet.”

Citi Analysis analyst Christopher Danley lauded ON as currently being the most bullish chip maker of CES 2023.

“ON continues to be on keep track of to triple Silicon Carbide profits YoY from about $300 million in 2022 to $1. billion in 2023,” Danley claimed. “The company stated it is marketed out via 2023.”

But ON aside, Danley explained absolutely everyone at CES is “nervous” about “cracks” in info-centre desire, “and they should really be.”

“There was a tone of nervousness on the details center outlook with several execs and investors careful and conversing about ‘uncertainty’ in details center outlooks from the two hyperscalers and organization consumers,” Danley mentioned. “We carry on to imagine data center correction will take place offered a multitude of datapoints and primary indicators.”

Again in early December, Danley stated his checks “indicate purchase costs from the knowledge heart close market are fading with downside from the business close market (approximately 40% of the info center end market place) and Facebook,” which is owned by dad or mum enterprise Meta Platforms Inc.

META,

“We continue on to assume a correction in the information middle end current market in 1H23,” Danley mentioned.

That said, Danley claimed his prime decide was and go on to feel a correction there is unavoidable. We continue to be careful on semis right until all conclude marketplaces and corporations right and our major decide remains chip maker Analog Products Inc.

ADI,

Back to autos: Ambarella Inc.

AMBA,

on Thursday, Ambarella mentioned it was partnering with Continental AG

CON,

to produce components and application for assisted driving employing AI with the top intention of an autonomous driving technique. The corporations hope to have devices in production in 2026.

Moore claimed Ambarella’s tech “continues to impress,” and mentioned the Continental partnership will offer program profits which is shared but with the greater portion likely to Continental.

At CES 2023, “the corporations are showing a full L2+ ADAS implementation for a 10-digital camera method working on a solitary chip, which for every AMBA was only employing 8% of the compute value of the chip.”

As CES 2023 attracts to a close, considerably of the attention in the chip world was lauded on businesses like Highly developed Micro Gadgets Inc. and Nvidia Corp. but a reduced profile chip maker appears superior positioned coming out of the conference.

Morgan Stanley analyst Joseph Moore claimed there is nevertheless a lot of caution about general chip desire in particular with softness in China, but autos seem to be a person of the robust themes of CES 2023, he mentioned.

“The places that have been weak remain considerably weaker – notably memory, semi cap, and commonly Laptop and cloud builds – even though the marketplaces that have been potent (such as automotive and industrial) keep on being sturdy but with guide times clearly starting off to normalize, which possible details to for a longer period term income pressures especially in a weaker economic system,” Moore mentioned.

“Still, the for a longer period expression themes keep on being optimistic, specifically for autos (which is increasingly the concentration of CES),all around themes these kinds of as EVs, ADAS and autonomous.”

These was the case when Nvidia Corp.

NVDA,

said on Tuesday it was partnering with Hon Hai Technological know-how Group

2317,

, or Foxconn, ideal known for getting the producer of Apple Inc.’s

AAPL,

Iphone, to make electric motor vehicles that use Nvidia’s Travel Orin chips and sensors, and bringing its GeForce Now streaming video clip video game services to autos designed by Hyundai Motor Group

005380,

BYD

1211,

and Swedish EV maker Polestar.

“We normally believe that Nvidia quantities are probably Ok from right here, though there was some warning on market as a result of in China for gaming, and a obvious consciousness that while the company’s place in just cloud is pretty good, that force in cloud budgets sales opportunities to considerably reduce visibility,” Moore reported. “But we would say that frequently we believe that they are earlier the worst of the pressures in their business enterprise, in distinction to most of the semiconductor group wherever there are nevertheless possible numbers cuts in advance.”

Meanwhile, Advanced Micro Units Inc.

AMD,

utilized the CES keynote to introduce the Instinct MI300 chip as “world’s first knowledge-heart integrated CPU + GPU.” The combined central processing unit and graphics processing device meant for AI inference, the months-extensive method where facts facilities expend hundreds of thousands of bucks a year on electric power to practice and build artificial intelligence. AMD Chief Government and Chair Lisa Su mentioned the MI300 can decrease the time it usually takes for an inference modeling approach from months to months.

But a single chip maker that does not get a good deal of awareness appeared to arise from CES most effective positioned for the 12 months: ON Semiconductor Corp.

ON,

which focuses on electric powered autos and highly developed driver assistance systems as key expansion drivers, leveraging its legacy position in automobile chips.

“Most notably, the company’s push into [Silicon Carbide] continues to be on monitor, and assume to even now exit the yr at a run-price the place the the vast majority of crystal driving the enterprise is internally sourced,” Moore mentioned. “The organization remains self-assured that demand in the EV place will considerably outpace source for a lengthy time and have so shifted their concentration about to execution on the manufacturing facet.”

Citi Analysis analyst Christopher Danley lauded ON as currently being the most bullish chip maker of CES 2023.

“ON continues to be on keep track of to triple Silicon Carbide profits YoY from about $300 million in 2022 to $1. billion in 2023,” Danley claimed. “The company stated it is marketed out via 2023.”

But ON aside, Danley explained absolutely everyone at CES is “nervous” about “cracks” in info-centre desire, “and they should really be.”

“There was a tone of nervousness on the details center outlook with several execs and investors careful and conversing about ‘uncertainty’ in details center outlooks from the two hyperscalers and organization consumers,” Danley mentioned. “We carry on to imagine data center correction will take place offered a multitude of datapoints and primary indicators.”

Again in early December, Danley stated his checks “indicate purchase costs from the knowledge heart close market are fading with downside from the business close market (approximately 40% of the info center end market place) and Facebook,” which is owned by dad or mum enterprise Meta Platforms Inc.

META,

“We continue on to assume a correction in the information middle end current market in 1H23,” Danley mentioned.

That said, Danley claimed his prime decide was and go on to feel a correction there is unavoidable. We continue to be careful on semis right until all conclude marketplaces and corporations right and our major decide remains chip maker Analog Products Inc.

ADI,

Back to autos: Ambarella Inc.

AMBA,

on Thursday, Ambarella mentioned it was partnering with Continental AG

CON,

to produce components and application for assisted driving employing AI with the top intention of an autonomous driving technique. The corporations hope to have devices in production in 2026.

Moore claimed Ambarella’s tech “continues to impress,” and mentioned the Continental partnership will offer program profits which is shared but with the greater portion likely to Continental.

At CES 2023, “the corporations are showing a full L2+ ADAS implementation for a 10-digital camera method working on a solitary chip, which for every AMBA was only employing 8% of the compute value of the chip.”