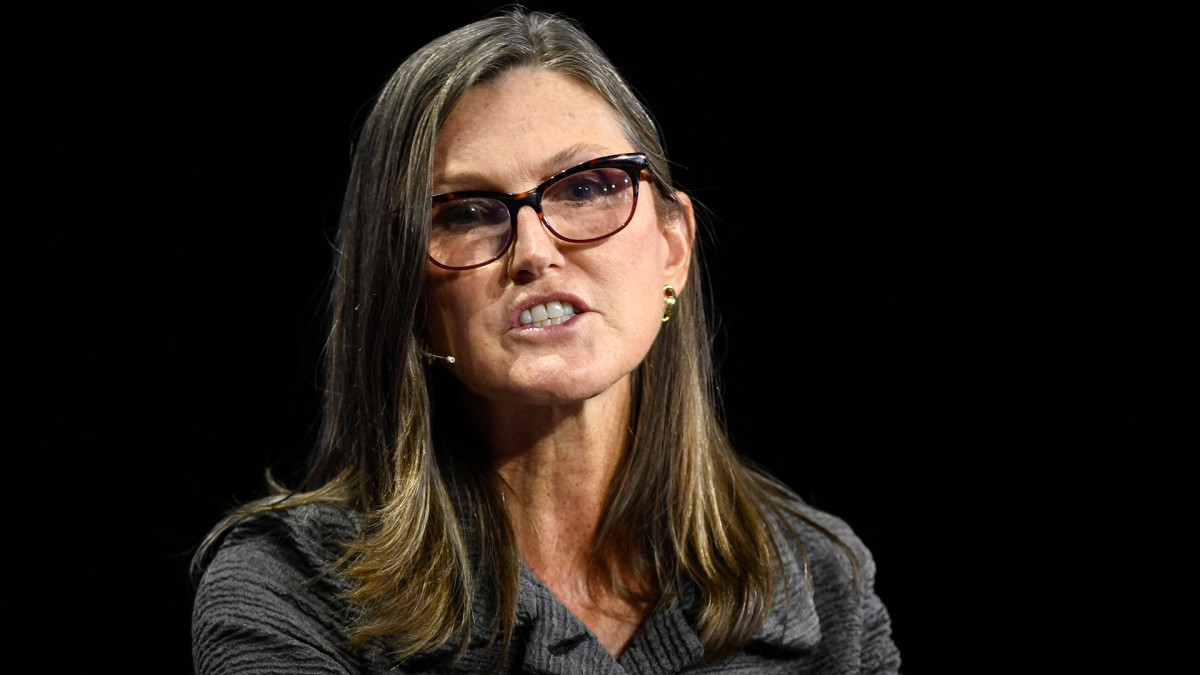

Famed investor Cathie Wood, main government of Ark Expenditure Management, unloaded a single of her favored shares Jan. 23, possibly trying to choose benefit of its new rebound.

Ark funds dumped 175,491 shares of Actual Sciences (EXAS) – Get Free of charge Report, a healthcare diagnostics organization famed for its at-home colon most cancers take a look at. That kitty was valued at $11.9 million as of the Jan. 23 near.

The stock has shed 11% in excess of the previous year, but it has jumped 119% considering the fact that Oct. 14 buoyed by strong earnings and the all round market’s rally. Precise Sciences is the most significant holding in Wood’s flagship Ark Innovation ETF (ARKK) – Get Free of charge Report.

Also Jan. 23, Wood ongoing her recent purchasing spree of electric vehicle titan Tesla (TSLA) – Get Totally free Report. Ark Innovation bought 13,243 shares, valued at $1.9 million as of that day’s shut. Ark has absorbed 819,906 Tesla shares in January alone, valued at $117.3 million just lately.

Tesla is the No. 3 holding for Ark Innovation, right after Zoom Video clip Communications at No. 2.

Wood’s Returns Tumble

Meanwhile, Wood’s efficiency has not particularly overwhelmed the investment earth over the past calendar year, as her youthful know-how stocks have slumped. Ark Innovation ETF has slid 47% during that period of time and 76% from its February 2021 peak.

To be positive, the fund has rebounded 20% so much this yr, becoming a member of the know-how inventory surge.

Wooden has defended her approach by noting that she has a five-year expense horizon. But the 5-calendar year annualized return of Ark Innovation was unfavorable .48% through Jan. 23, as opposed with the S&P 500’s good return of 9.11%.

The fund’s general performance also does not arrive near to Wood’s target for annualized returns of 15% more than five-yr intervals.

Ark Innovation’s subpar returns may possibly ultimately be starting off to thrust investors away. The $7.4 billion fund registered a net financial commitment outflow of $242 million in the previous month, in accordance to ETF research agency VettaFi. But it continue to notched a $1.57 billion influx over the earlier calendar year.

What Draws Buyers to Wood

You might surprise why so many traders have trapped with Wooden. The truth that she experienced a single impressive 12 months absolutely assists. Ark Innovation skyrocketed 153% in 2020.

Also, Wood has come to be something of a rock star in the expense planet, showing usually in the media. She explains economic ideas in approaches that amateur traders can fully grasp.

Wood does have her detractors. Morningstar analyst Robby Greengold issued a scathing critique of Ark Innovation final calendar year.

“ARKK exhibits several symptoms of enhancing its threat administration or ability to productively navigate the difficult territory it explores,” he wrote.

Wood, of course, begged to differ. “I do know there are companies like that just one [Morningstar] that do not realize what we’re executing,” she explained in an interview with Magnifi Media by Tifin.