Los Certificates of the Federation Treasury (Cetes) at 91 days exceeded 11% for the first time since October 2001when the papers with a maturity of three months they paid a rate of 11.09%and achieved a yield of 11.05 percent.

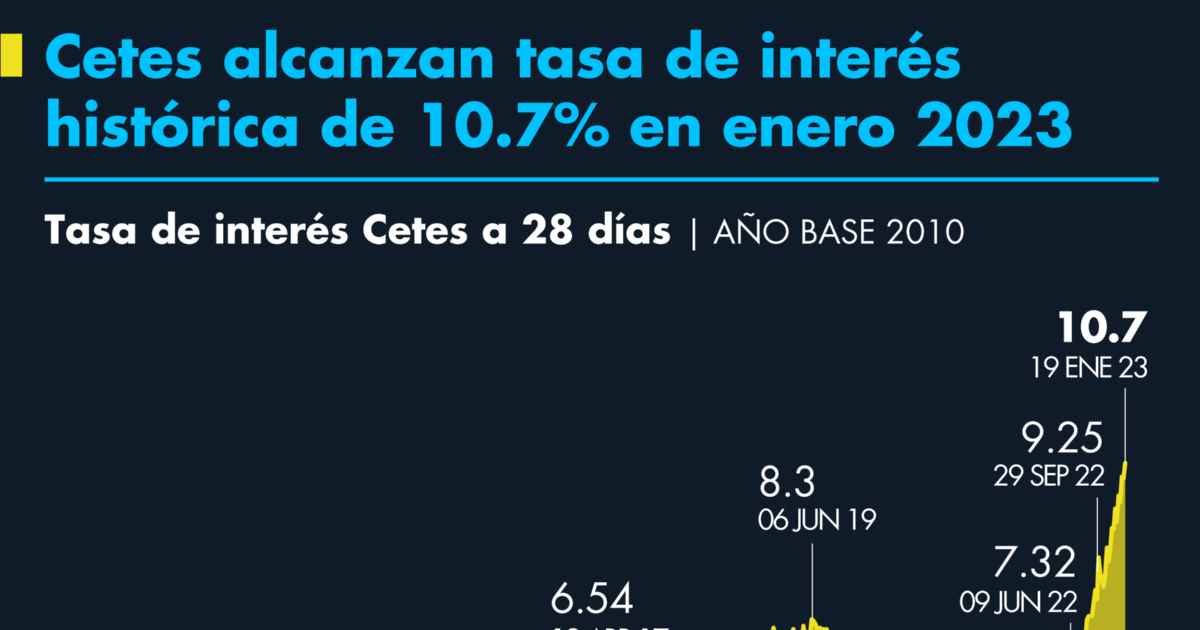

Papers with a maturity of 182 days were the ones that rose the most, at 19 basis points, at a rate of 11.18 percent. The 28-day cetes increased their yield by 10 base points to 10.8%, while the one-year cetes advanced by 4 base points and paid a rate of 11.1 percent.

The increase in the rates of short-term government papers occurred on the same day that the data from inflation in Mexico for the first half of January, 7.94% for annual headline inflation, which were above what was expected by analysts.

“Although inflation surprised today to rise, it is presumed that the highest level or inflationary ceiling was already reached last year, in this sense, the rate of rate hikes could begin to decrease, this would cause the level of rates offered by cetes is no longer substantially different from the current ones,” said Alain Jaimes, senior analyst at Signum Research.

Jaimes estimates that the reference rate of the Bank of Mexico (Banxico) is positioned at a level between 11% and 11.25%, “with this, the level of the cetes should not be located at a level very far from said estimate,” he added.

In total, 67,250 million pesos were placed between the different terms auctioned by the Bank of Mexico, with a demand 2.26 times greater than the amount offered. Of the total, 85.5% of the income was obtained from the sale of Cetes and the remaining 14.5% corresponds to long-term paper.

Long-term bonds continue to fall

All the long-term papers lowered their yields, being the 20-year bonds (20A) the ones that lowered their rate the most with a reduction of 37 base points to remain at 8.71%, its lowest level since August of last year.

The Signum Research expert commented, “increasingly there are fewer incentives to acquire long-term debt”, however, in a diversified portfolio it is recommended to have this type of instrument not only because they are above expected inflation, but also because your level of risk is substantially lower than that of variable income.

With the auction this Tuesday, the 28-day cetes have an advantage of 209 base points to the bonds with a 20-year (20A) maturity, while the same 28-day term pays more than twice as much as 30-year Udibonos.

Janneth Quiroz, deputy director of Economic Analysis at Monex Casa de Bolsa, estimates that the yield on cetes will continue to be above the premium on long-term bonds until next year, when Banxico makes the first interest rate cuts and cancels inversion of the yield curve.

Quiroz added that it is very difficult for long-term rates to exceed the performance of cetes, since a scenario of economic slowdown is still expected in the coming months.

victor.barragan@eleconomista.mx

hartford car insurance shop car insurance best car insurance quotes best online car insurance get auto insurance quotes auto insurance quotes most affordable car insurance car insurance providers car insurance best deals best insurance quotes get car insurance online best comprehensive car insurance best cheap auto insurance auto policy switching car insurance car insurance quotes auto insurance best affordable car insurance online auto insurance quotes az auto insurance commercial auto insurance instant car insurance buy car insurance online best auto insurance companies best car insurance policy best auto insurance vehicle insurance quotes aaa insurance quote auto and home insurance quotes car insurance search best and cheapest car insurance best price car insurance best vehicle insurance aaa car insurance quote find cheap car insurance new car insurance quote auto insurance companies get car insurance quotes best cheap car insurance car insurance policy online new car insurance policy get car insurance car insurance company best cheap insurance car insurance online quote car insurance finder comprehensive insurance quote car insurance quotes near me get insurance