The Biden administration’s new inventory buyback tax will have little influence on the over-all stock market. It could possibly even basically help it. I’m referring to the new 1% excise tax on share repurchases that went into impact on Jan. 1.

This tax has set off alarm bells in some corners of Wall Avenue, on the theory that buybacks had been just one of the major props supporting the previous decade’s bull current market — and anything at all weakening that prop could direct to much lessen rates.

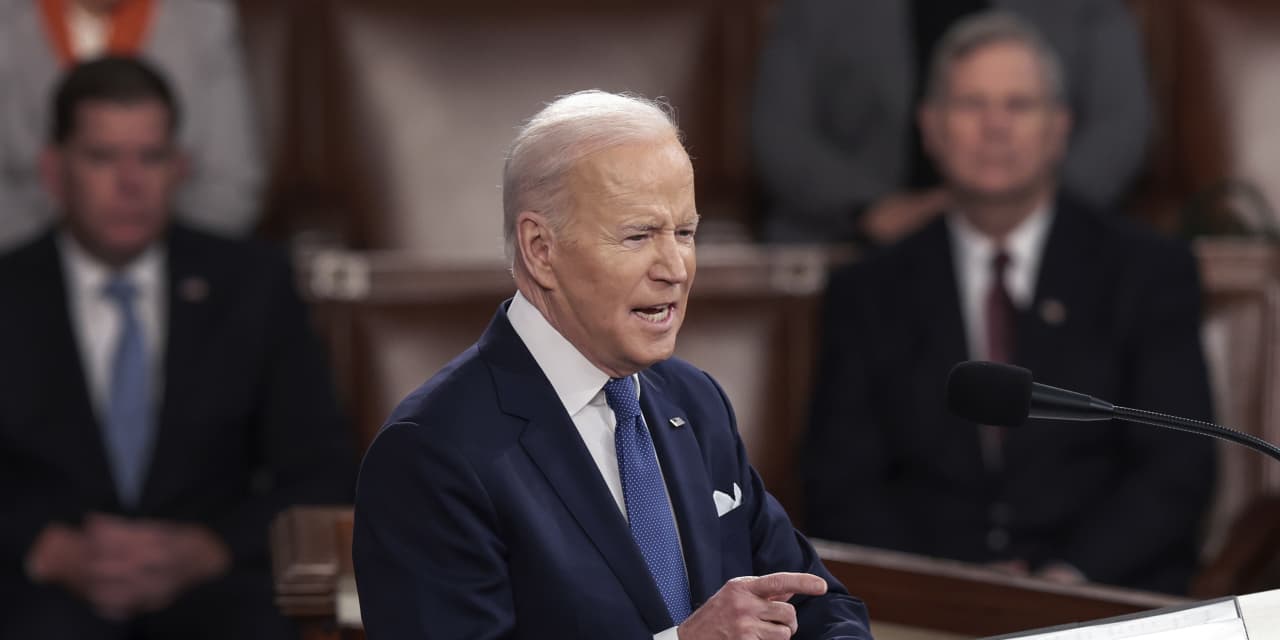

Even additional alarms went off just after President Joe Biden telegraphed his intent to quadruple federal taxes on buybacks, to 4%.

Browse: Biden’s Point out of the Union: Listed here are vital proposals from his speech

Although this proposal is regarded as useless on arrival on Capitol Hill, the focus on possibly raising this tax from 1% minimizes the chance that it will be eliminated anytime quickly.

Tax applies to web repurchases

But stock-market place bulls shouldn’t fear. Just one rationale is that the new excise tax — no matter whether 1% or 4% — is applied to net buybacks — repurchases in extra of how numerous shares the corporation may have issued.

As has been greatly reported for several years, the shares that a lot of companies are acquiring back generally are hardly plenty of to compensate for the new shares they problem as portion of their payment of business executives. As a final result, internet repurchases — on which the new tax will be levied — are an purchase of magnitude smaller sized than gross repurchases.

The chart below presents the historic context. It plots the S&P 500’s

SPX,

divisor, which is the number utilised to divide the put together marketplace cap of all ingredient companies to come up with the index level alone. When more shares are issued than repurchased, the divisor rises the reverse triggers the divisor to tumble.

See from the chart that, although there have been some 12 months-to-12 months fluctuations in the divisor, the divisor’s end-of-2022 level was virtually unchanged from the place it was at the top of the web bubble.

There is considerably irony in the excise tax’s software to web repurchases. A lot of the political rhetoric that led to the development of the tax was dependent on the criticism that businesses ended up repurchasing their shares basically to lower the share dilution that would normally come about when executives are specified shares as component of their compensation offers. But it’s specifically when share repurchases equal share issuance which is the tax would not apply.

The buyback tax could encourage better dividends

The motive why the new tax on share repurchases may basically help the inventory current market traces to the affect it could have on companies’ dividend coverage. Up until eventually now, the tax code delivered an incentive for firms to repurchase shares fairly than pay out dividends when they wanted to return hard cash to shareholders. By at minimum partially eliminating that incentive, corporations heading ahead might convert to dividends more than they did earlier. The Tax Coverage Centre estimates that the new 1% buyback tax will lead to “a about 1.5 per cent maximize in corporate dividend payouts.”

This would be great news mainly because, dollar for greenback, a bigger dividend produce has far more bullish penalties than a better buyback yield. (The buyback yield is calculated by dividing for every-share buybacks by share price.) To display this, I when compared the predictive qualities of both produce. I analyzed quarterly facts back again to the early 1990s, which is when the full volume of buybacks in the current market began to be sizeable.

The accompanying table reports the r-squareds of regressions in which the various yields are made use of to predict the S&P 500’s return above the subsequent 1- or 5-yr periods. (The r-squared measures the diploma to which one particular knowledge collection explains or predicts one more.) Observe that the r-squareds are markedly increased for the dividend yield than for the buyback generate

| When predicting S&P 500’s return around subsequent 1 12 months | When predicting S&P 500’s return over subsequent 5 yrs | |

| Dividend generate | 4.2% | 54.9% |

| Buyback produce | 1.% | 10.2% |

The base line? Even though the new buyback tax is unlikely to have a huge effect on the inventory current market, the affect it does have may be more good than negative.

Mark Hulbert is a standard contributor to MarketWatch. His Hulbert Scores tracks investment decision newsletters that pay back a flat price to be audited. He can be attained at mark@hulbertratings.com

Far more: Biden targets inventory buybacks — do they assistance you as an investor?

Also browse: The bond sector is flashing a warning that U.S. stocks could be headed reduced

The Biden administration’s new inventory buyback tax will have little influence on the over-all stock market. It could possibly even basically help it. I’m referring to the new 1% excise tax on share repurchases that went into impact on Jan. 1.

This tax has set off alarm bells in some corners of Wall Avenue, on the theory that buybacks had been just one of the major props supporting the previous decade’s bull current market — and anything at all weakening that prop could direct to much lessen rates.

Even additional alarms went off just after President Joe Biden telegraphed his intent to quadruple federal taxes on buybacks, to 4%.

Browse: Biden’s Point out of the Union: Listed here are vital proposals from his speech

Although this proposal is regarded as useless on arrival on Capitol Hill, the focus on possibly raising this tax from 1% minimizes the chance that it will be eliminated anytime quickly.

Tax applies to web repurchases

But stock-market place bulls shouldn’t fear. Just one rationale is that the new excise tax — no matter whether 1% or 4% — is applied to net buybacks — repurchases in extra of how numerous shares the corporation may have issued.

As has been greatly reported for several years, the shares that a lot of companies are acquiring back generally are hardly plenty of to compensate for the new shares they problem as portion of their payment of business executives. As a final result, internet repurchases — on which the new tax will be levied — are an purchase of magnitude smaller sized than gross repurchases.

The chart below presents the historic context. It plots the S&P 500’s

SPX,

divisor, which is the number utilised to divide the put together marketplace cap of all ingredient companies to come up with the index level alone. When more shares are issued than repurchased, the divisor rises the reverse triggers the divisor to tumble.

See from the chart that, although there have been some 12 months-to-12 months fluctuations in the divisor, the divisor’s end-of-2022 level was virtually unchanged from the place it was at the top of the web bubble.

There is considerably irony in the excise tax’s software to web repurchases. A lot of the political rhetoric that led to the development of the tax was dependent on the criticism that businesses ended up repurchasing their shares basically to lower the share dilution that would normally come about when executives are specified shares as component of their compensation offers. But it’s specifically when share repurchases equal share issuance which is the tax would not apply.

The buyback tax could encourage better dividends

The motive why the new tax on share repurchases may basically help the inventory current market traces to the affect it could have on companies’ dividend coverage. Up until eventually now, the tax code delivered an incentive for firms to repurchase shares fairly than pay out dividends when they wanted to return hard cash to shareholders. By at minimum partially eliminating that incentive, corporations heading ahead might convert to dividends more than they did earlier. The Tax Coverage Centre estimates that the new 1% buyback tax will lead to “a about 1.5 per cent maximize in corporate dividend payouts.”

This would be great news mainly because, dollar for greenback, a bigger dividend produce has far more bullish penalties than a better buyback yield. (The buyback yield is calculated by dividing for every-share buybacks by share price.) To display this, I when compared the predictive qualities of both produce. I analyzed quarterly facts back again to the early 1990s, which is when the full volume of buybacks in the current market began to be sizeable.

The accompanying table reports the r-squareds of regressions in which the various yields are made use of to predict the S&P 500’s return above the subsequent 1- or 5-yr periods. (The r-squared measures the diploma to which one particular knowledge collection explains or predicts one more.) Observe that the r-squareds are markedly increased for the dividend yield than for the buyback generate

| When predicting S&P 500’s return around subsequent 1 12 months | When predicting S&P 500’s return over subsequent 5 yrs | |

| Dividend generate | 4.2% | 54.9% |

| Buyback produce | 1.% | 10.2% |

The base line? Even though the new buyback tax is unlikely to have a huge effect on the inventory current market, the affect it does have may be more good than negative.

Mark Hulbert is a standard contributor to MarketWatch. His Hulbert Scores tracks investment decision newsletters that pay back a flat price to be audited. He can be attained at mark@hulbertratings.com

Far more: Biden targets inventory buybacks — do they assistance you as an investor?

Also browse: The bond sector is flashing a warning that U.S. stocks could be headed reduced