Textual content dimension

CVS inventory yields 3.2% and has a one-yr return of minus 26%.

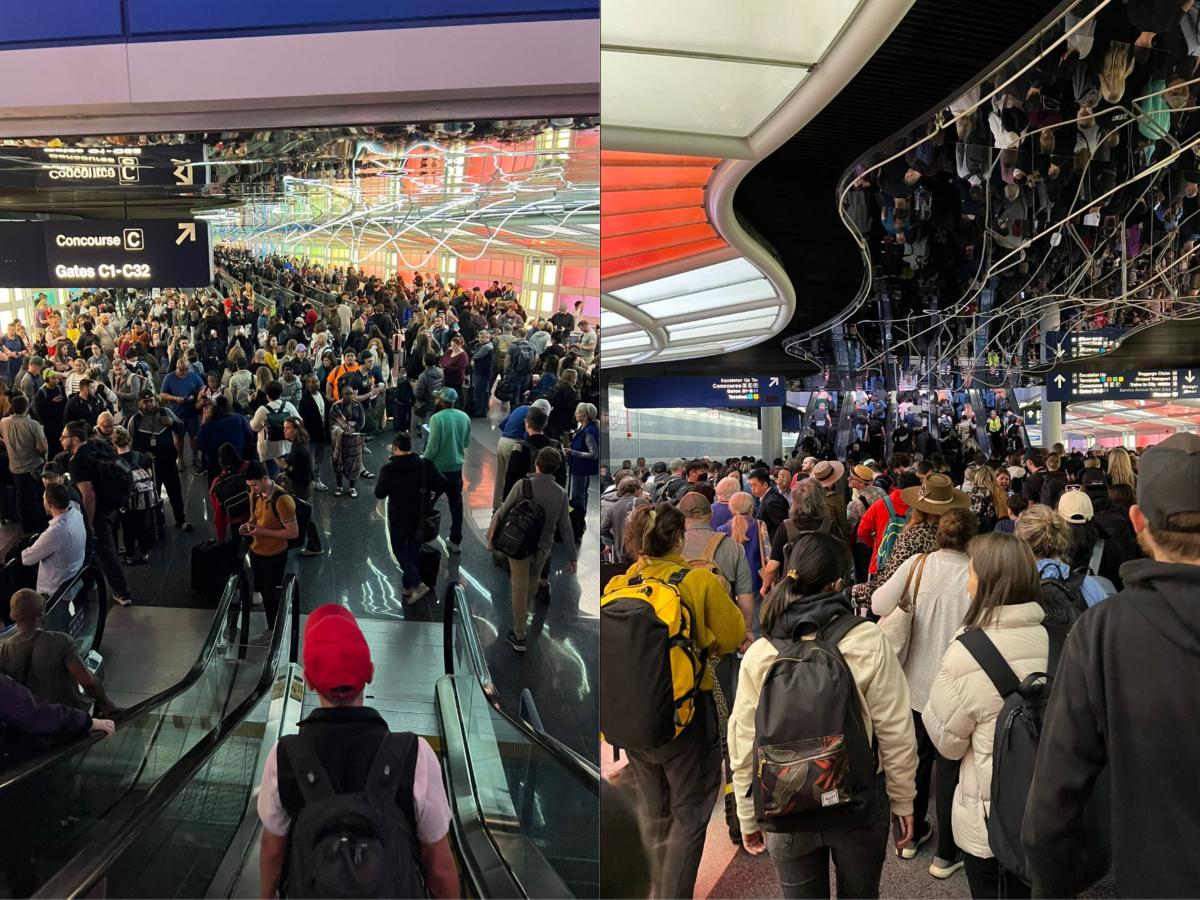

Mario Tama/Getty Images

As the economy worsens, Treasuries aren’t automatically the only refuge for buyers.

“During Uncertainty, Concentrate on Sustainable Dividend Growers” study the headline of a

UBS

equity analysis be aware on Friday.

The report cites a challenging investing backdrop that consists of “continued inflation worries, violent moves in the produce curve, and the current market forecasting foreseeable future Fed rate cuts.”

The report’s authors compiled a checklist of 30 shares, with three-yr dividend development prices at the very least in the mid-one digits, based on the projections of UBS analysts. All have Obtain ratings from that organization.

Other criteria for the inventory monitor provided owning a dividend produce above the 1.7% average for the S&P 500 and sustainable payout ratios. The payout ratio steps the proportion of earnings that get paid out in dividends.

The report observes that “S&P 500 dividend progress has been considerably less volatile than [earnings per share] and buyback advancement and as a result must be extra resilient.”

It also maintains that “dividend stocks can provide a margin of security through uncertain moments.”

Barron’s resolved to slim the list and focus on utilities, whose dividends seem to be resilient heading into an economic downturn, and a number of other industries.

That includes

Eaton

Corp.

(ticker: ETN), which will make a selection of items these types of as electrical factors, brakes, and cylinders. The stock, which yields 2%, has a a person-year return of 11% by March 30, such as dividends, as opposed with minus 10% for the S&P 500. UBS tasks Eaton will develop its dividend by 8.6% a year from 2022 by means of 2025.

A further corporation on the record is house-enhancement retailer

Residence Depot

(High definition), which yields 2.9% and has a just one-yr return of minus 5%. Its projected annual dividend expansion is 10%.

Prescription drug distributor

Cardinal Wellness

(CAH), which UBS expects to mature its dividend at a 7.2% once-a-year clip, is yielding 2.6%. The stock has a 1-year return of 35%.

The compound annual dividend growth projection for

CVS Health and fitness

Corp.

(CVS) is 9.7% via 2025. The inventory, which yields 3.2%, has a a person-yr return of minus 26%. Other than a nationwide drug-shop chain, the company’s belongings include Aetna, a substantial managed-care operator. It is in the approach of attaining

Oak Street Wellness

(OSH), which operates primary treatment centers.

Turning to utilities, which give some defensiveness to a portfolio, Houston-primarily based

CenterPoint Vitality

(CNP) has a 1-calendar year return of minus 2%. It yields 2.6%. UBS jobs that its a few-year yearly dividend development through 2025 will be 8%. The company has been investing in its transmission and distribution grid—expenses that are predicted to aid raise earnings as the company’s assets grow.

Shares of an additional utility,

Exelon

(EXC), have a one-year return of minus 9% and produce 3.5%. The company’s holdings incorporate numerous utilities such as Baltimore Gas and Electric and Potomac Electrical Electrical power. UBS places its 3-year once-a-year dividend growth at 7.5%.

A further utility to think about is

American Electric Electricity

(AEP), yielding 3.7%. The inventory has returned minus 6% above the previous calendar year. UBS projects that its dividend will expand at a 7% annual clip through 2025. Primarily based in Columbus, Ohio, the business generates, transmits and distributes electrical energy throughout a geographically various corporation. The states in which it has controlled functions incorporate Arkansas, Indiana, Kentucky, Louisiana, Michigan Oklahoma, Texas, and Virginia.

Compose to Lawrence C. Strauss at lawrence.strauss@barrons.com