© Reuters. European Central Bank bets on a “global regulation” of cryptocurrencies

Madrid, Apr 21 (.).- The vice president of the European Central Bank (ECB), Luis de Guindos, has opted for a “global regulation” of financial markets and especially in the case of cryptocurrencies, since it is the only way to avoid situations of “comparative advantage” of some areas of the world over others.

This was indicated by De Guindos this Friday, one day after the European Parliament approved two agreements to regulate all crypto assets for the first time in the European Union, from their authorization and supervision to transparency requirements, as well as to trace transfers with cryptocurrencies in order to fight money laundering.

“It is not worth a specific jurisdiction, be it the euro zone or the US, to take measures, because immediately the flows can be diverted”, said the vice-president of the ECB, who has considered a “global regulation” would avoid situations of comparative advantage.

De Guindos also referred this Friday to the digital euro, after delivering the conference “Economic prospects for the euro zone in an environment of uncertainty”, at an event organized by the La Caixa Foundation.

As he has said, “if there is something different from a cryptocurrency or a cryptoactive, it is the digital euro”, which will allow “any of us to have an account on the ECB’s balance sheet”, an entity that will never go bankrupt.

“The digital euro is an extension of cash” and it is not intended to “replace current accounts”, but it must be done “with care” because “it has implications from the point of view of financial stability and at the moment we are seeing How is that channeled?

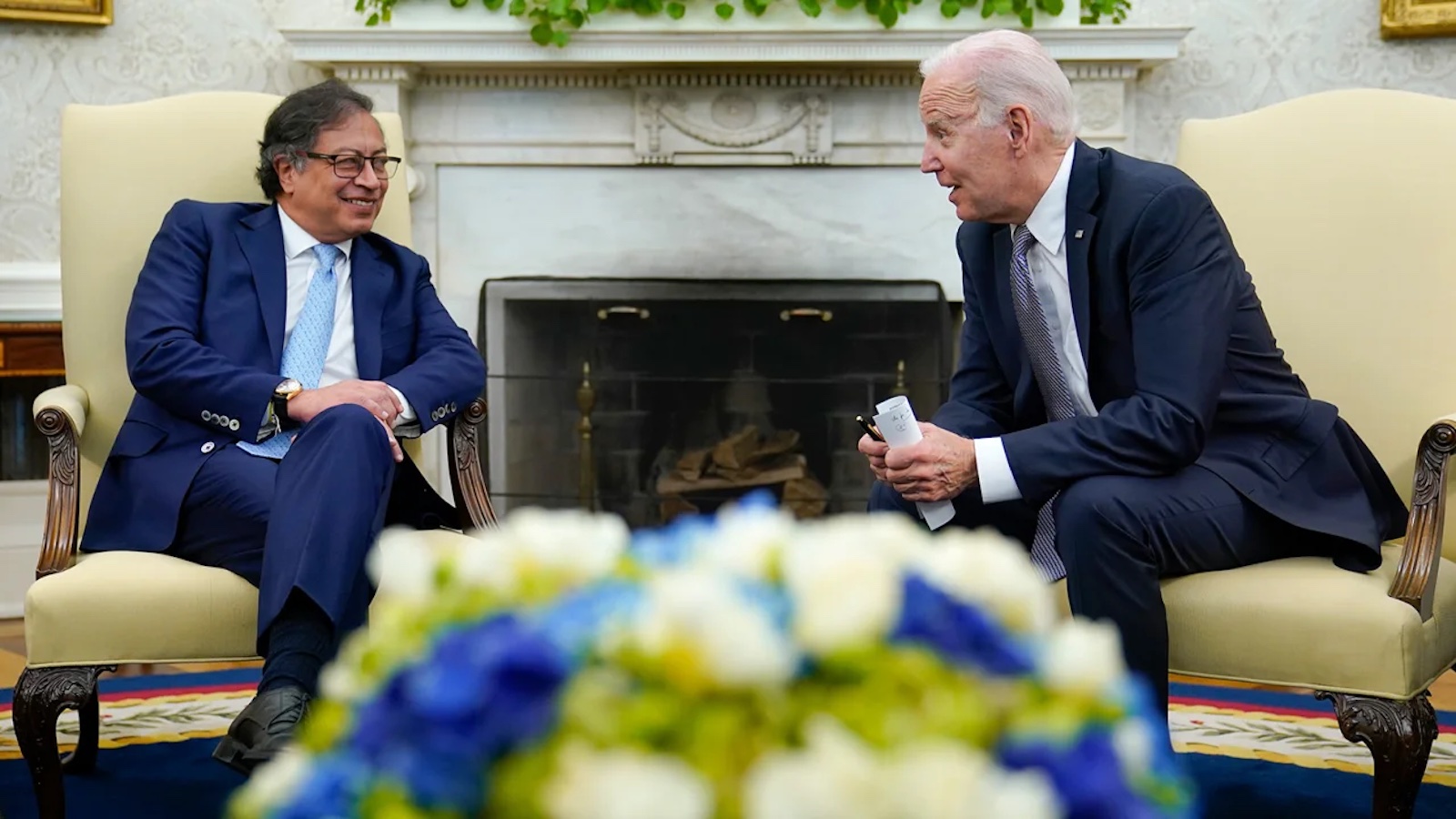

(Photo)