(Bloomberg) — Cathie Wooden defended her firm’s choice to bail on Nvidia Corp. before the chipmaker’s shares surged 160%, declaring the laptop or computer-chip industry’s growth-bust cycle poses risks.

Most Read through from Bloomberg

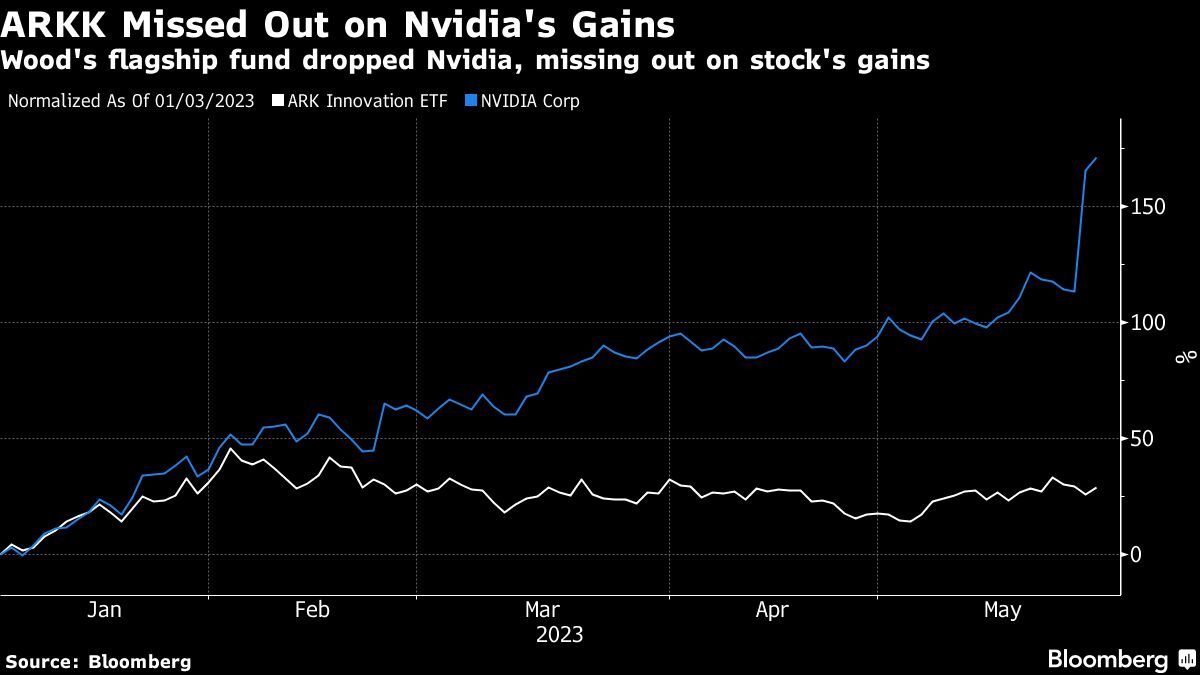

Wood’s flagship ARK Innovation ETF (ticker ARKK) cut its holding in Nvidia in January and missed out on most of the rally that added much more than half a trillion bucks in industry benefit. Nvidia jumped 24% Thursday by yourself soon after forecasting $11 billion in product sales this quarter, 53% a lot more than analysts envisioned.

“As considerably as Nvidia goes, there are a handful of good reasons we take some pause,” Wood explained in an job interview on Bloomberg Television. She mentioned when she hears, “shortages, shortages, shortages about GPUs or anything, I begin to assume about the cyclicality of a team.”

Nvidia also faces growing levels of competition in the battle to deliver chips to energy the computing infrastructure guiding synthetic intelligence courses, Wood claimed, citing corporations like Tesla Inc., Meta Platforms Inc., and Alphabet Inc. that are establishing their very own chips.

While Wood’s flagship fund dropped its holdings to Nvidia, some of the firm’s “more specialized portfolios,” like the ARK Up coming Technology World wide web ETF (ARKW) and the ARK Fintech Innovation ETF (ARKF), nonetheless keep some exposure to the organization.

“We have not gotten a great deal pushback,” she explained relating to the decision to fall Nvidia, which she describes as “a check-the-box inventory.”

ARKK has climbed 25% so significantly this 12 months, outpacing the S&P 500’s 9.4% obtain. The Nasdaq 100 Index that houses the megacap tech businesses that have driven the market’s gains in 2023 is up extra than 30%.

Nvidia has been one particular of the key beneficiaries of the AI boom, seeing its revenue surge on desire for chips. Marvell Technologies Inc. rallied 29% Friday soon after stating its income from AI solutions would double in the present-day fiscal year. ARKK holds neither.

“We’re just pivoting to yet another set of performs that most persons have not discovered nevertheless,” Wooden claimed. “Much like they did not recognize that Nvidia was an AI perform, definitely, until finally quite not too long ago.”

Wooden stated Meta’s strategy of concentrating on AI was very good, whilst the firm does not look in the firm’s flagship portfolio.

Meta’s LLaMA AI language product is “able to produce superior models” employing significantly less computing electrical power and more knowledge, she stated.

“Meta is appealing to us,” she stated, introducing that she likes “the simple fact that Mark Zuckerberg is now prioritizing synthetic intelligence as opposed to the metaverse, which was actually what he was concentrated on previous calendar year.”

Most Go through from Bloomberg Businessweek

©2023 Bloomberg L.P.