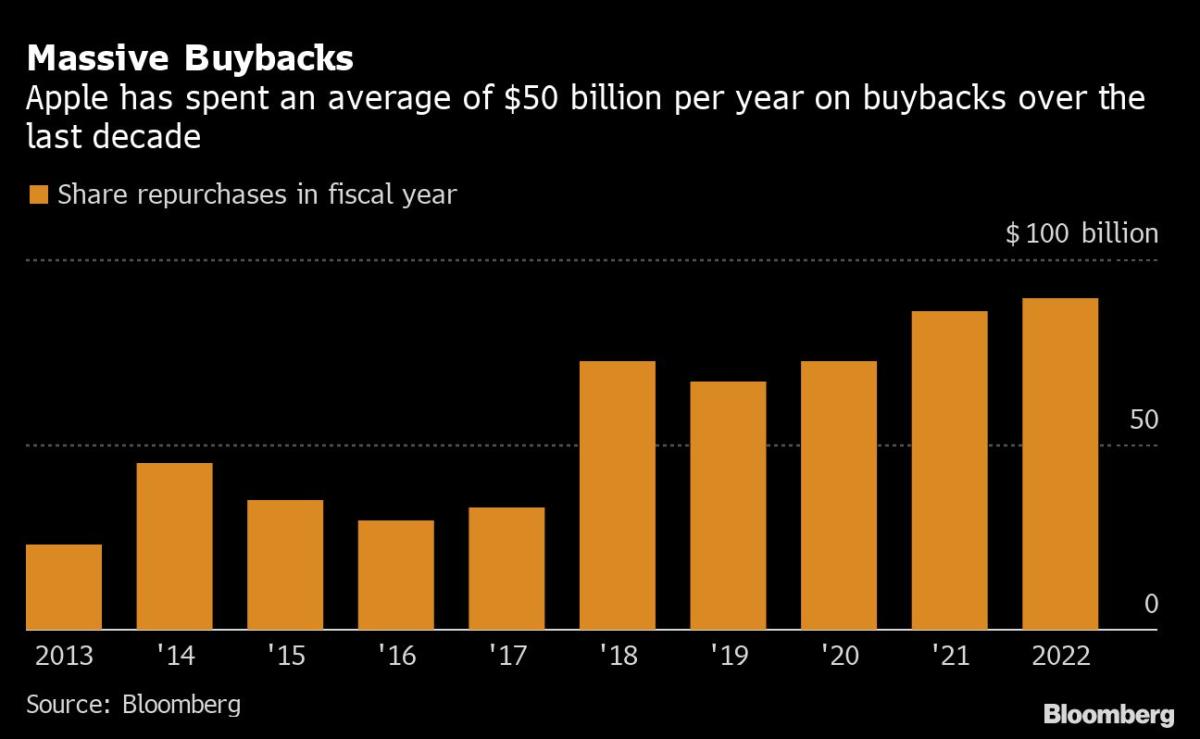

(Bloomberg) — Apple Inc. has shelled out extra than $550 billion obtaining back its personal shares around the earlier 10 years, additional than any other US enterprise, and the know-how juggernaut shows no symptoms of slowing down.

Most Read from Bloomberg

Even with the stock under stress the earlier several times since of production delays for its latest handsets, Apple has fared much better than other megacap tech businesses in this year’s bear current market. Solid earnings and generous buybacks have turn into a central section of the expenditure thesis, building the stock a lot more eye-catching through turbulent moments.

Shares fell .4% on Tuesday.

“That’s how they get the protected haven, the gold normal check out from buyers,” said Gene Munster, who protected Apple all through a 21-12 months occupation as an analyst right before co-founding venture-cash company Loup Ventures. “When they just keep demonstrating up and creating the variety of money they do and obtaining their individual stock again, it sends a potent message and I imagine they’ll proceed to do that as substantially as they can.”

The following signpost for buyers about Apple’s appetite for its have inventory will appear in April, which is when the enterprise normally tops up its repurchase authorization. It’s added $90 billion to the application in each of the past two many years. It is continue to creating the earnings to replenish its bank account: It was the only megacap to rally in the wake of its outcomes this quarter, and the report stored analysts from radically slashing estimates, in distinction to common cuts at its friends.

Web Cash Neutral

Even with economies slowing close to the earth, desire is nonetheless powerful for Apple’s most pricey iPhones, analysts say. The problem now is producing delays because of Covid lockdowns in China, top to what analysts say are report wait periods for deliveries just as the holiday getaway procuring year kicks off. Although that may well cause a short-time period strike to income, there’s no sign it’s denting the longer-time period situation for the inventory.

Apple accumulated income for years beneath co-founder Steve Careers, and Main Executive Officer Tim Cook has been doing the job on means to far better invest the dollars and return it to shareholders. Apple, which ended past quarter with $169 billion in money and marketable securities, aims to have internet dollars — cash minus financial debt superb — of zero in the future.

“This is an intense guess that they designed, anything that Steve Work would have by no means performed, and it is compensated off properly for the firm and its buyers in element for the reason that the inventory has finished very well during that period,” Munster mentioned of the share repurchases.

Apple, the world’s largest business with a market price of virtually $2.3 trillion, also is in a league of its very own when it arrives to share buybacks.

In two of the past 5 many years, it has outspent the second-best repurchaser by the very least $50 billion. It invested practically $90 billion previous calendar year, about equivalent to the marketplace worth of Citigroup Inc.

Investors like buybacks since they reduce a company’s share depend and thus give a lift to earnings for each share. The danger is that a enterprise overpays, buying at a time when the stock is overvalued. Apple, nevertheless, states it’s paid out an common price tag of $47 a share due to the fact it began shopping for again stock a ten years back, when compared with the existing share price tag of $143.63.

Apple has steered obvious from working with its funds pile to make substantial acquisitions, at a time when scrutiny of the size and clout of megacap tech companies is growing. Bulls say buybacks have been a excellent system for the firm, until it turns its means to a new product or service classification like automotive, which could show far more capital intensive.

“In typical, investors would like to see funds currently being used to make progress,” stated Lewis Grant, senior portfolio supervisor for global equities at Federated Hermes Ltd. “But when you look at a business the size of Apple and the total of money that we’re really conversing about, deploying tens of billions of dollars every single calendar year to crank out progress is probably extremely ambitious.”

Apple also pays a hard cash dividend, but it is nearly an afterthought. The quarterly payout of 23 cents a share equals .6% of the inventory rate, a person of the most affordable yields in the S&P 500 index. Apple raised the payout by a penny in May perhaps and claimed it is committed to annual raises.

However, traders do not appear to be extremely anxious how the organization chooses to return cash, as lengthy as they proceed to do so.

“We truly do not care which way you mail the money back to us,” said Mark Stoeckle, Adams Funds’ main government officer, introducing that Apple would have to increase its dividend by “an great amount” to get to a generate that would make any difference. “We just never see that happening, so we’re just as delighted with the inventory buyback.”

Tech Chart of the Day

Activision Blizzard Inc. analysts are escalating more beneficial on the video clip-match maker, viewing price in the stock even as Microsoft Corp.’s prepared acquisition appears to be more and more dicey. At the very least 6 companies have upgraded their rankings in November, which include three on Monday.

The trend has lifted the Bloomberg consensus score on the inventory — a ratio of its invest in, hold and provide ratings — to 4.6 out of 5, its highest since January, and up from an April reduced of 3.94. This has made Activision just about as properly appreciated between Wall Avenue analysts as Take-Two Interactive Computer software Inc., which features a consensus ranking of 4.57, and above Electronic Arts Inc., which has a consensus rating of 4.29.

Leading Tech Stories

-

Apple’s manufacturing spouse is attempting nonetheless one more unique payout to workers in China to soothe unrest and restore output at the world’s biggest Iphone manufacturing unit, a flashpoint in Beijing’s endeavours to sustain its economic climate though combating Covid infections.

-

Elon Musk’s tumultuous month atop Twitter Inc. has already included firing most of the company’s employees, tinkering with vital functions and restoring banned accounts. Now he’s embarking on what could be his riskiest gambit however: a war with Apple.

-

An activist team will launch an advert campaign Tuesday featuring a faux video clip of Meta Platforms Inc. Chief Govt Officer Mark Zuckerberg thanking Congress for failing to choose action against the largest tech organizations.

-

European tech unicorns these kinds of as Revolut, Klarna and N26 are already generating the upcoming wave of startups as previous employees start their very own providers. There are now extra than 1,000 enterprises started by ex-staffers from the biggest privately-funded tech companies in Europe and Israel, in accordance to enterprise fund Accel and details platform Dealroom.

-

Market-side analyst feeling on SoftBank Group Corp. has tumbled to a 6-12 months reduced as the Japanese engineering big refrains from new inventory buybacks amid ongoing investment losses.

-

Amazon.com Inc.’s cloud-computing device is rolling out new chips built to ability the maximum-close of computing, supporting duties this kind of as temperature forecasting and gene sequencing.

-

Sony Group Corp.’s most recent gadget is a established of wearable motion trackers intended to bring users into the metaverse on their phones.

-

Snap Inc. Chief Government Officer Evan Spiegel informed staff that he expects them to be in the social media company’s workplaces in particular person 80% of the time setting up in February.

–With help from Tom Contiliano, Kit Rees and Ryan Vlastelica.

(Updates to market place open.)

Most Browse from Bloomberg Businessweek

©2022 Bloomberg L.P.