(Bloomberg) — Asian stocks were poised to progress and big currencies edged bigger vs . the dollar early Monday amid positive sentiment for riskier property after a rebound on Wall Road and expectations for less intense financial tightening.

Most Read from Bloomberg

Equity futures pointed to gains in Japan and Australia in buying and selling that will be thinner than normal with key facilities which include Hong Kong, Shanghai, Singapore and Seoul shut for Lunar New Year celebrations. Quite a few regional markets will continue being closed until finally midweek and mainland China trading will not resume until Jan. 30.

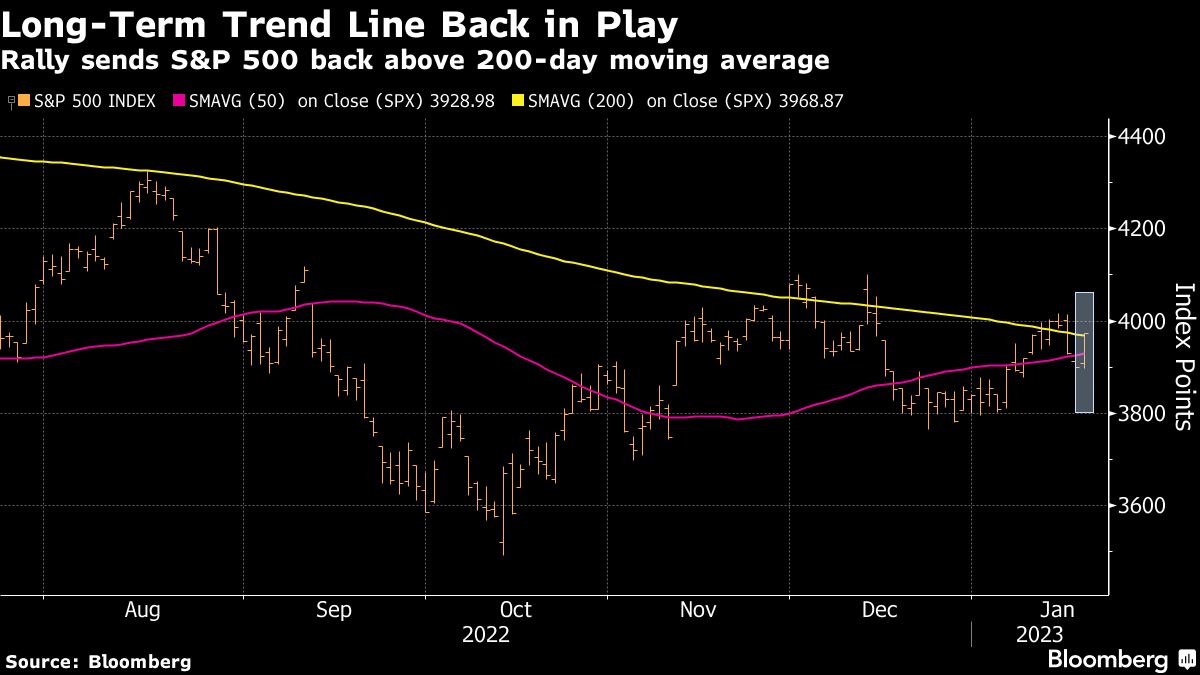

The S&P 500 Index rose for the very first time in 4 days on Friday, with all 11 sectors attaining. Even though the wide benchmark remained down on the week, the most significant 1-day obtain in the tech-heavy Nasdaq 100 because November pushed it into the inexperienced for the time period. Google mum or dad Alphabet Inc. climbed following revealing a approach to reduce 12,000 careers. Netflix Inc. surged right after reporting more robust-than-anticipated subscriber numbers.

Bond yields climbed in Australia and New Zealand on Monday, monitoring moves in US Treasuries. Japan’s benchmark 10-yr generate is because of to open up later nicely below the central bank’s .5% ceiling immediately after ending previous 7 days 10 foundation factors down below that stage.

Traders weighing hazard sentiment had been using their cues from US central bankers Friday. Federal Reserve Governor Christopher Waller mentioned plan appeared really shut to sufficiently restrictive and he backed moderation in the dimension of rate will increase. Philadelphia Fed President Patrick Harker recurring his view for much more incremental techniques in rate hikes and Kansas City Fed main Esther George reported the economic climate can stay away from a sharp downturn.

Oil rallied to the highest given that mid-November Friday, capping off its next straight 7 days of gains on optimism around improved need from China. Gold rose for a fifth week.

Key activities this week:

-

Earnings for the week consist of: Abbott Laboratories, American Airways, American Specific, AT&T, Blackstone, Boeing, Colgate-Palmolive, Freeport-McMoRan, Common Electrical, Intel, International Company Machines, Johnson & Johnson, LVMH Moet Hennessy Louis Vuitton, Mastercard, Nokia, SAP, Southwest Airways, Texas Instruments, Verizon Communications, Visa

-

Euro location customer self confidence, Monday

-

US Convention Board leading index, Monday

-

ECB President Christine Lagarde speaks, Monday

-

PMIs for US, euro spot, Uk, Japan, Tuesday

-

Richmond Fed Producing, Tuesday

-

ECB President Christine Lagarde speaks, Tuesday

-

US MBA home loan programs, Philadelphia Fed non-producing exercise, Wednesday

-

US fourth-quarter GDP, new household gross sales, original jobless promises, great trade balance, sturdy items, wholesale inventories, retail inventories, Thursday

-

Japan Tokyo CPI, Friday

-

US personalized income/shelling out, University of Michigan consumer sentiment, pending property profits, Friday

Right here are some of the main market place moves as of 7 a.m. Tokyo time:

Shares

-

The S&P 500 rose 1.9% Friday and the Nasdaq 100 rose 2.9%

-

Nikkei 225 futures rose 1.4%

-

Australia’s S&P/ASX 200 Index futures rose .5%

Currencies

-

The euro was tiny modified at $1.0866

-

The Japanese yen was tiny modified at 129.49 for every greenback

-

The Australian dollar was minimal changed at $.6966

Bonds

Commodities

-

West Texas Intermediate crude rose 1.3% to $81.64 a barrel on Friday

-

Place gold fell .3% to $1,926.08 an ounce on Friday

This story was developed with the support of Bloomberg Automation.

–With aid from Stephen Kirkland.

Most Browse from Bloomberg Businessweek

©2023 Bloomberg L.P.