BANGKOK (AP) — Shares rose Monday in Asia in skinny article-Christmas holiday getaway investing, with markets in Hong Kong, Sydney and several other destinations closed.

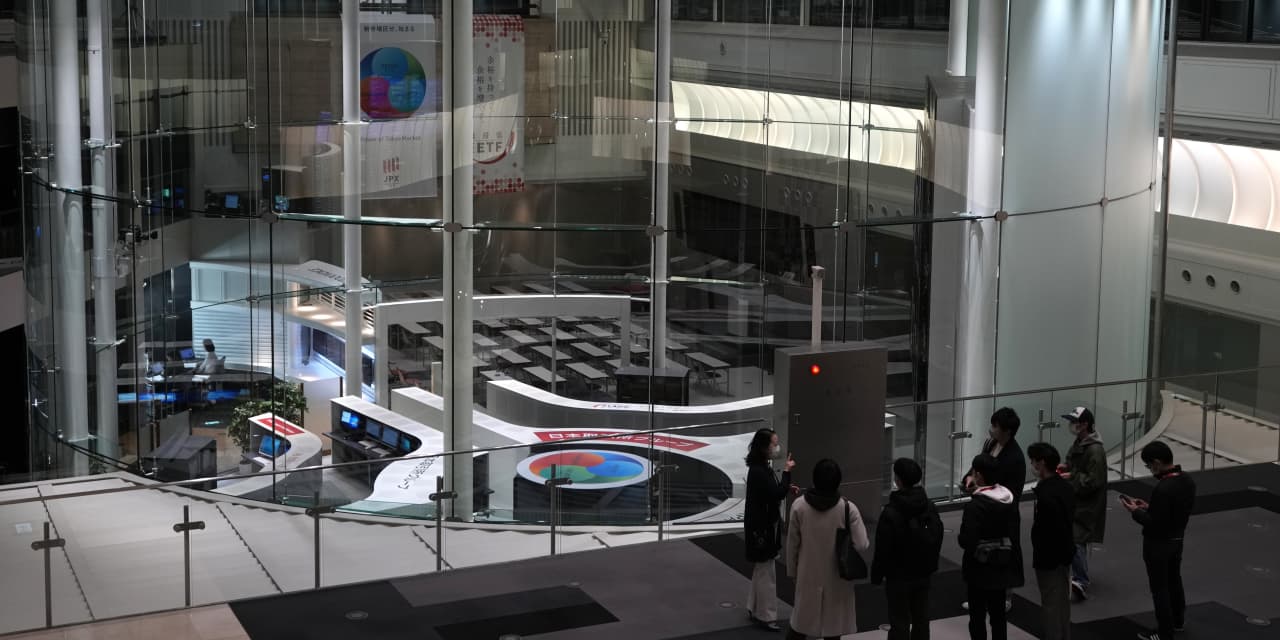

Tokyo’s Nikkei 225 index

NIK,

gained .6% to 26,393.32 and the Kospi

180721,

in Seoul additional .2% to 2,318.54. The Shanghai Composite index

SHCOMP,

rose .5% to 3,061.93 and the Established

Set,

in Bangkok additional .6%.

Lender of Japan Gov. Haruhiko Kuroda indicated in a commonly watched speech Monday that the central bank does not intend to change its longstanding coverage of financial easing to cope with pressures from inflation on the world’s third-biggest financial state.

Final week, markets ended up jolted by a slight adjustment in the concentrate on array for the produce of lengthy-term Japanese government bonds, viewing it as a signal the Bank of Japan may at last unwind its significant support for the financial system as a result of ultra-lower fascination prices and purchases of bonds and other assets.

A widening hole in between fascination costs in Japan and other international locations has pulled the Japanese yen sharply reduce from the U.S. dollar and other currencies and accentuated the effects of larger charges for a lot of imported products and commodities.

But the BOJ has saved its crucial lending amount at minus .1%, cautious more than threats of recession.

Kuroda advised the Keidanren, the country’s most potent business team, that with economies experiencing likely downward tension, and with Japan’s financial state not thoroughly recovered from the impacts of the pandemic, the BOJ “deems it important to perform monetary easing and thus firmly help the financial system. …”

On Friday, the S&P 500

SPX,

reversed a .7% reduction to near .6% higher, at 3,844.82. With 1 week remaining of buying and selling in 2022, the benchmark index is down 19.3% for the 12 months. The Dow Jones Industrial Typical

DJIA,

rose .5% to 33,203.93, whilst the tech-hefty Nasdaq

COMP,

edged .2% higher, to 10,497.86.

Tiny firm shares also rose. The Russell 2000 index

RUT,

picked up .4% to 1,760.93.

Combined economic news weighed on shares early on, but the indexes rebounded by late afternoon amid somewhat gentle trading ahead of the extended vacation weekend. U.S. and European markets will be closed Monday.

Markets are in a tough situation the place fairly solid client paying out and a powerful work sector minimize the risk of a economic downturn but also elevate the danger of higher interest costs from the Federal Reserve as it presses its campaign to crush inflation.

The governing administration noted Friday that a crucial evaluate of inflation is continuing to sluggish, though the inflation gauge in the customer paying report was however much better than any individual wishes to see. Also, expansion in consumer spending weakened final thirty day period by additional than expected, but incomes were a little bit more powerful than expected.

Final week’s reports ended up the last large U.S. financial updates of the calendar year. Buyers will shortly transform their focus to the following round of corporate earnings.

The Fed has reported it will hold raising desire prices to tame inflation, even although the speed of price tag improves has continued to simplicity. The Fed’s critical overnight fee is at its greatest stage in 15 years, following commencing the 12 months at a record minimal of around zero.

The vital lending price, the federal funds rate, stands at a selection of 4.25% to 4.5%, and Fed policymakers have forecast that the fee will arrive at a variety of 5% to 5.25% by the stop of 2023.

Specified the persistence of high inflation, “many are starting up to believe the main tale is that there will be no scope for Fed cuts in the year forward and that central banking companies will maintain these fairly high prices right up until fundamental inflation is definitely cracked — and that method will consider time,” Stephen Innes of SPI Asset Management mentioned in a commentary.

The Fed’s forecast does not connect with for a amount slice in advance of 2024, and the greater rates have elevated problems the overall economy could stall and slip into a economic downturn in 2023. Significant rates have also been weighing heavily on selling prices for stocks and other investments.

In forex dealings, the U.S. dollar

DXY,

slipped to 132.62 Japanese yen from 132.82 yen late Friday. The euro rose to $1.0629 from $1.0614.