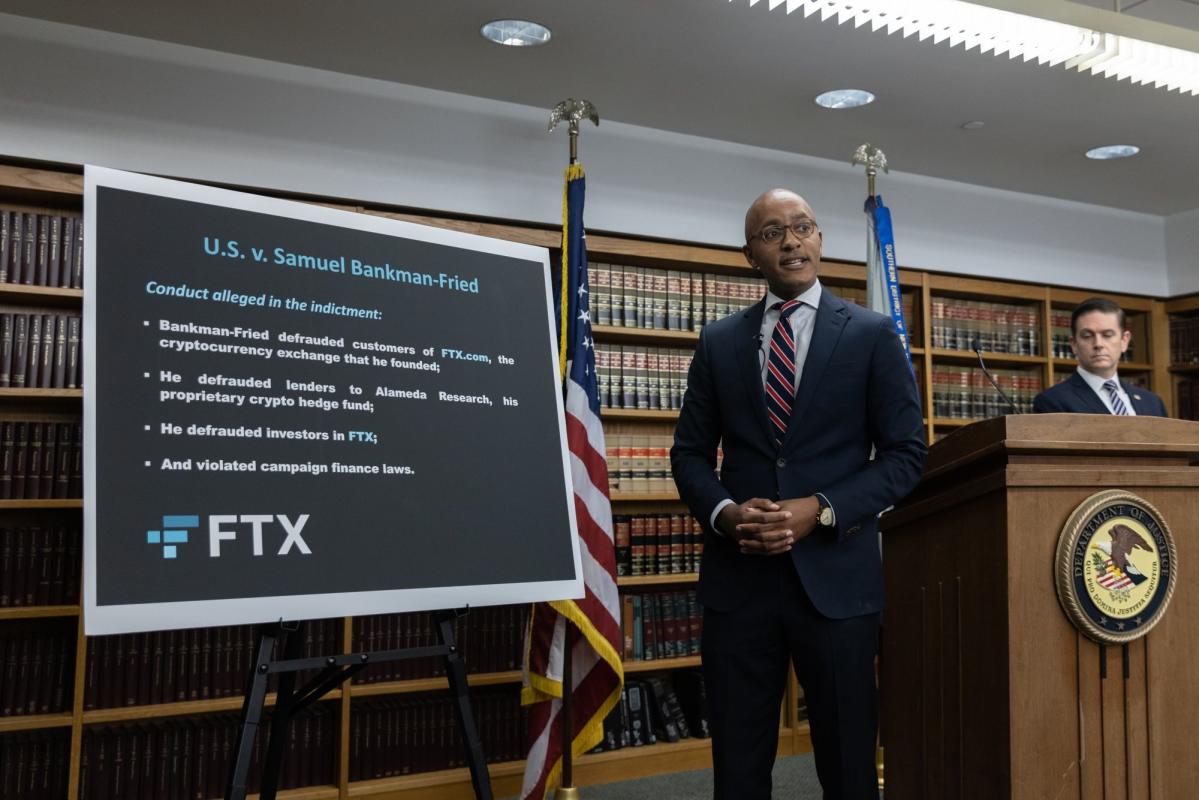

(Bloomberg) — FTX cryptocurrency exchange founder Sam Bankman-Fried is liable for “one of the greatest financial frauds in American history” and the investigation of the alleged scheme is “very substantially ongoing,” Manhattan US Lawyer Damian Williams claimed Tuesday.

Most Read through from Bloomberg

Bankman-Fried was billed with eight prison counts, including conspiracy and wire fraud, before in the working day, for allegedly misusing billions of dollars in customer funds to prop up his Alameda Investigate crypto fund. Bankman-Fried was arrested Monday in the Bahamas, in which he was living.

When the 30-12 months-outdated Bankman-Fried might not in good shape the usual profile of an individual who cheats buyers, “you can commit fraud in shorts and t-shirts in the sun —that’s achievable much too,” Williams stated in the course of a push meeting in New York. The alleged scheme concerned “dirty money” that was “used in company of Bankman-Fried’s motivation to get bipartisan affect and impact the route of public policy in Washington,” the federal prosecutor explained.

“While this is our very first community announcement it will not be our previous,” Williams said.

Prosecutors claim Bankman-Fried employed tens of hundreds of thousands of pounds of the proceeds for unlawful contributions to political strategies.

“He preyed on his shoppers, the victims of this circumstance, abusing the rely on put in not only his company but himself as the direct of that business,” FBI New York Assistant Director in Charge Michael Driscoll said. “I want to be obvious: this situation is about fraud. Fraud is fraud.”

If convicted, Bankman-Fried could deal with as very long as 20 several years in jail for each and every of the wire fraud and funds-laundering rates, and 5 many years on each and every of the commodity and securities fraud prices and marketing campaign-finance fraud, the US Department of Justice mentioned in a assertion. White-collar defendants, if convicted, not often provide statutory highest sentences.

The US Securities and Trade Fee and the Commodity Futures Buying and selling Fee sued Bankman-Fried individually on Tuesday for his alleged job in the collapse of FTX.

Considering that the inception of FTX in 2019, Bankman-Fried “began secretly and improperly diverting client funds to his crypto hedge fund Alameda exploration,” SEC Enforcement Director Gubir Grewal explained at the push conference. “Bankman-Fried’s household of cards began to crumble as crypto charges plummeted in 2022.”

The collapse reveals that trading on a non-compliant buying and selling system poses dangers for traders and does not give protections from fraud, Grewal explained. “It’s imperative that non-compliant platforms arrive into compliance” with US regulators, he claimed.

“The runway is finding shorter for them to appear in and to sign up with us, and for those people who do not, the enforcement division stands all set to get motion,” Grewal said.

Study A lot more: Bankman-Fried Balks at Extradition as US Sketches Scenario for Fraud

–With help from Bob Van Voris.

(Updates with highest sentences for alleged crimes.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.