It’s been a difficult year in the stock market, but reserve some empathy for semiconductor traders.

The iShares Semiconductor ETF

SOXX

is down 40.5% this yr, in contrast with 19.6% for the benchmark S&P 500

SPX.

You by no means want to give in to schadenfreude, but on the other hand it’s time to convert their soreness into your obtain.

The selloff suggests that bargains in excellent names abound — that is, for any person who is affected person sufficient to believe lengthy term.

“In hindsight, intervals like these are likely to be remarkable buying alternatives,” suggests David Jeffress, a portfolio supervisor at Laffer Tengler Investments.

Just before we get to five preferred stocks of Jeffress and two other chip-sector industry experts, below are three major principles to continue to keep in brain when searching for bargains in the house.

Read: Semiconductor shares have bounced from 2022 lows — and analysts anticipate significant upside next year

1. The good thrown out with the terrible

The most effective information for new traders is that very good names are getting thrown out with the lousy in the existing debacle. “Semiconductor names get painted with a relatively broad brush. But the providers are not all developed equal,” claims Jeffress. “We focus on larger quality, so selloffs like these are huge purchasing opportunities.”

In contrast, be cautious of the tremendous-substantial-development, speculative names with significant client concentration.

2. You just cannot time the cycle

Neglect about striving to call the lows.

“It’s unattainable to handicap when the bottom of the cycle is,” suggests Todd Lowenstein, main fairness strategist at The Private Bank at Union Lender. “Averaging in for the duration of the downturn is the way to go.”

But there are a handful of reasons to consider chip shares might not go much down below their mid-Oct lows. Ongoing consolidation in the sector has greater returns on cash. And the relevant improved diversification and expense chopping recommend chip firms are considerably less cyclical than they made use of to be.

Additionally, any looming economic downturn could not be all that poor. Lowenstein thinks we are heading via a rolling economic downturn that’ll decide off numerous sectors at unique moments. This implies any economic downturn will be shorter and shallow.

3. Chips are starting to be ubiquitous

Semiconductors are infiltrating so many aspects of life, demand from customers for them will recuperate faster or later on, and boost the shares of chip stocks you purchase now.

“Everyone is fearful about what is heading to transpire if we go into economic downturn and what that usually means for chip stocks. But what they lacking is that the need to have for chips is increasing,” says Jeffress.

The big-picture secular need developments like cloud computing, synthetic intelligence, electrical autos, robotics, 5G and the World-wide-web of Items are not going absent.

“Chips are ubiquities. They are the backbone of the modern day economic climate,” says Lowenstein.

Right here are 5 chip stocks that search interesting now simply because they are quality names investing at discounts. They are in alphabetical purchase.

Note that they all spend dividends, which account for a big aspect of trader and industry returns, above time. You get paid out to wait around, as the indicating goes. In simple fact, four of the organizations have bigger payouts than the S&P 500’s 1.8% dividend generate.

1. Analog Devices. Dividend yield: 2.1%

Analog Equipment

ADI

specializes in analog sign processing chips and semiconductors used in electrical power administration. That helps make it a perform on all the things from cars and wireless base stations, to 5G, factory robots and medical products.

“Its chips get made into prolonged-cycle traits in the vehicle and industrial sectors,” claims Lowenstein. That delivers stability and visibility on earnings. So does its really numerous client base.

These characteristics distinguish it from chip firms that are a play on a single or two huge item cycles and current market tendencies that can go out of favor promptly. This in addition a forward price tag-to-earnings (P/E) ratio of 14.8 vs a five-yr typical of 20.7 add up “quality at a fair price” for Lowenstein.

Analog Products has a huge moat mainly because of its proprietary chip types, and for the reason that after its chips get designed into solutions it is high priced for shoppers to change to a further provider, claims Brian Colello, a stock analyst at Morningstar, which places a great deal of emphasis on the great importance of moats in investing. This delivers visibility into revenue traits and pricing electrical power.

Reviews earnings Nov. 22.

2. ASML Holding. Dividend yield: 1.4%

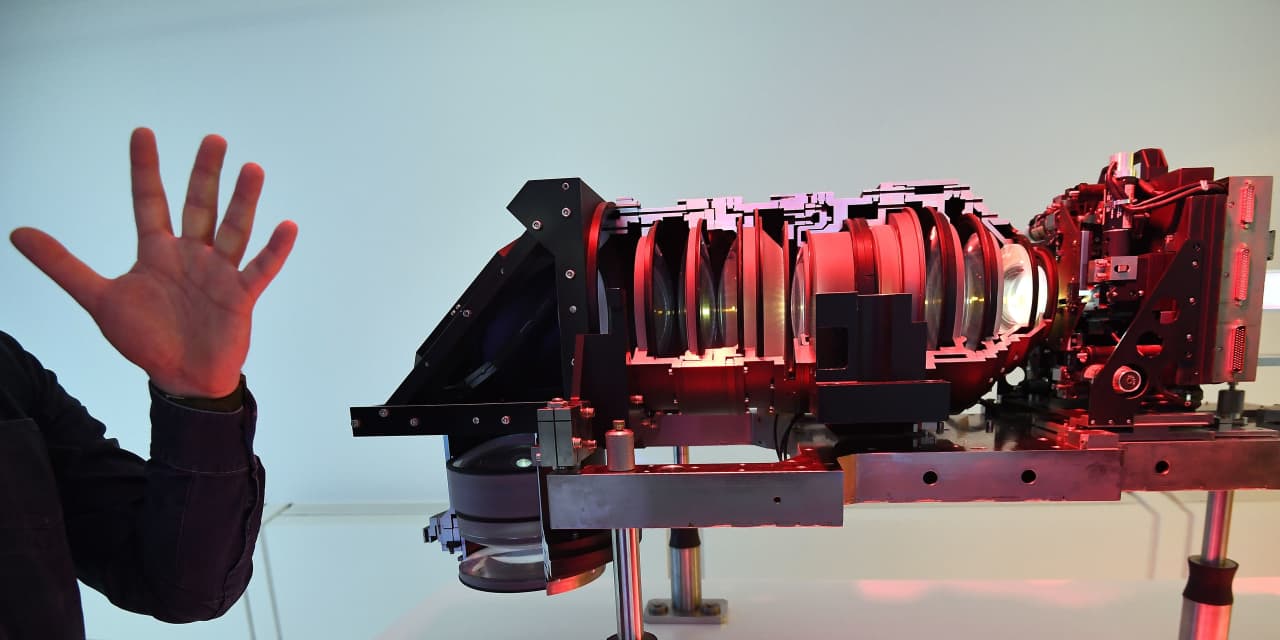

Chip makers use photolithography to etch styles on to semiconductors in approaches that raise the number of transistors they can cram on the same quantity of silicon.

The most popular iteration of this is known as extraordinary ultraviolet (EUV) lithography. ASML

ASML

is the primary provider of photolithography tools that does EUV lithography. This tools is so essential, ASML’s leading a few consumers — Intel

INTC,

Samsung Electronics and Taiwan Semiconductor

TSM

— took fairness stakes in ASML to assistance fund EUV enhancement investigate.

ASML trades at a forward P/E of 23.8 which is not affordable as opposed to an S&P 500 P/E of 16.5.

“ASML is pretty and reasonably valued. But if you are going to shell out up for a small business, ASML is the a person to pay out up for,” suggests John Rotonti, who handles the chip sector for the Motley Fool. “They have guided for 11% compound once-a-year revenue progress about upcoming ten years. That is what the industry is pricing in.”

That explained, ASML does basically appear low-cost relative to its personal historical past. The existing forward P/E of 23.8 is nicely-underneath the trailing 5-year common of 33.9. ASML has a huge financial moat primarily based on its proprietary knowhow that is far in advance of what competitors have. At a time when tech organizations are reporting weaker gross sales developments, ASML upped its 2022 profits advancement estimate to 13% from 10% when it noted earnings Oct. 19.

Reviews earnings Jan. 25.

3. Broadcom. Dividend produce: 3.5%

Broadcom

AVGO

sells radio frequency filters employed in smartphones to deal with various facts streams and filter out interference. Apple

AAPL

is its primary customer.

This helps make it a enjoy on 5G. It also sells chips employed in networking switches, broadband, business storage, and wireless connectivity. Broadcom’s various merchandise line stems from a collection of mergers around the years and one particular extra is pending — the acquisition of VMware

VMW.

This will broaden their products supplying still the moment once again. Broadcom has a very good track history for obtaining business leaders and selling off their non-main companies.

All of this assists demonstrate why Broadcom is one of Jeffress’ “12 ideal suggestions,” primarily favored shares that are section of Laffer Tengler Investments concentrated equity strategy. He also likes the huge purchase backlog.

“It’s possibly authentic, and not the outcome of deliberate double purchasing which can develop profits growth air pockets,” states Jeffress. That is mainly because Broadcom asks clients to demonstrate they will need the stock they get.

“The growing backlog and their breadth of chip providing indicates Broadcom will weather conditions an financial slowdown,” says Jeffress. “The need for their items is insatiable. They see demand from customers continuing to accelerate as the details center buildouts continue on.”

Jeffress argues that Broadcom is low-priced, citing its historically higher dividend yield. Dividend yields rise when inventory price ranges sink. When stocks fall more than enough these kinds of that dividend yields increase to rather high amounts, this is a very good indication of price.

Reports earnings Dec. 7.

4. Taiwan Semiconductor Production. Dividend yield: 3%

Taiwan Semiconductor

TSM

is the world’s chip supplier. Its crops provide chips employed in virtually all units. This makes it a play on anything from smartphones and artificial intelligence, to the Online of Issues and the cloud.

Taiwan Semiconductor also advantages from two sector trends. A single is that chip makers are likely fabless to leave the manufacturing to someone else. Next, clients are demanding more and more complicated chips. Taiwan Semiconductor has the innovative technologies that gets the work completed. Its knowhow and size give it a extensive moat.

Taiwan Semiconductor looks cheap buying and selling at a forward P/E of 12.8 as opposed to an typical of 21.4 about the earlier five years and 16.5 for the S&P 500.

“That valuation can make no sense to me,” suggests Motley Fool’s Rotonti. “Taiwan Semiconductor is the most attractively-priced semiconductor enterprise that I am interested in nowadays. It is particularly undervalued.”

He assignments earnings and totally free dollars move will expand at a mid-teenager proportion rate around the subsequent five decades.

The low valuation is notably odd due to the fact it appears to value in a cyclical downturn for the small business.

“Demand for Taiwan Semiconductor’s fabs is incredibly strong and lengthy-phrase in character. I do not think Taiwan Semiconductor’s company will be pretty cyclical likely forward,” states Rotonti.

Stories earnings Jan. 11.

5. Texas Instruments. Dividend produce: 3.1%

Like Analog Equipment, Texas Devices

TXN

is in analog chips. Its premier conclusion industry is the industrial sector, and the car sector in specific. Providers with publicity to these cyclical spots of the financial system get strike when recession worries abound. This points out why Texas Instruments’ stock is cheap. It trades with an historically superior dividend produce, notes Jeffress.

Texas Instruments does have challenges in close proximity to term. While it posted 13% 12 months-around-year gross sales gains for the third quarter, it presented negative fourth quarter guidance. This is since industrial sector demand is shockingly weak.

But this close to-phrase steering isn’t a massive offer since Texas Devices is a high-quality chip-sector name, suggests Jeffress. We know this in aspect for the reason that the inventory has executed comparatively properly this year, he says. It is down 14.5% vs. 19.6% for the S&P 500 and 40% for the iShares Semiconductor ETF.

Next, Texas Devices has a huge backlog of orders.

“We consider the organization is more resilient than other traders are supplying them credit history for,” claims Jeffress.

And it is returning cash to shareholders through buybacks and its dividend, which it just hiked.

“Management only improves dividends when they have a substantial diploma of confidence they can weather the economic ecosystem,” he says.

Texas Instruments also has a wonderful financial moat mainly because of its proprietary analog chips, and the actuality that it prices consumers a large amount to change suppliers as soon as they have built the chips into their solutions.

Stories earnings Jan. 23.

Michael Brush is a columnist for MarketWatch. At the time of publication, he owned SOXX and ADI. Brush has instructed ADI, INTC and TXN in his stock e-newsletter, Brush Up on Stocks. Adhere to him on Twitter @mbrushstocks.