The U.S. is on the verge of a economic downturn that could perhaps expense tens of millions of Us residents their careers.

But at least industry bears get to say ‘I explained to you so.’

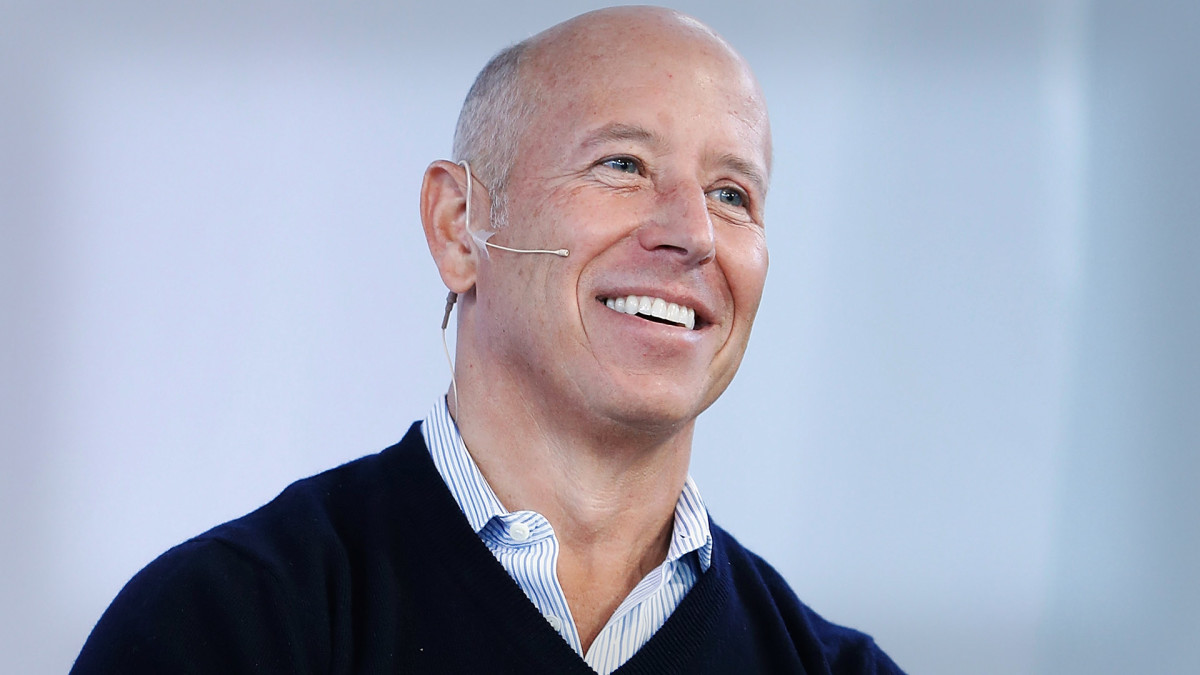

Barry Sternlicht, chairman of investment decision fund Starwood Cash Group, went on CNBC to give a timeline of when he thinks the whole recession will strike.

“You’re going to have a recession in the third or fourth quarter. The shopper is type of out of dough. His financial savings prices are at all time lows…He is on credit rating playing cards,” Sternlicht, who is reportedly truly worth $4 billion, reported on CNBC Thursday.

But it can be not all undesirable for the U.S. in 2023, as Sternlicht expects inflation to go detrimental before the recession hits in the again 50 percent of the year.

“1 matter about inflation…it really is not totally mounted,” he mentioned. “Inflation will subside at any time more as the offer chain continues to resolve itself. Inflation will go negative in May well or June.”

He expects inflation to go down to 2% by the close of the year, signaling a earn for the Federal Reserve and its technique of steep curiosity level improves.

Possibilities of a Economic downturn Are High

Sternlicht is considerably from the only economist predicting a economic downturn in 2023.

The National Association of Business Economics (NABE) Company Circumstances Study for January, which polled 60 business enterprise economists, contained some downbeat results.

Income margins keep on being underneath strain, registering a -25 web increasing index (NRI) in the study, down from -10 in the October. NRI steps the share of panelists reporting climbing gain margins minus the percentage reporting slipping financial gain margins.

This is the worst reading because mid-2020. To be guaranteed, the outlook for profit margins about the future three months is bigger, with an NRI of -7, up from -17 in October.

As for their outlook on the financial state, a bit a lot more than 50 percent of respondents set the possibility of a recession around the up coming year at 50% or better.

Higher curiosity costs and expenditures are the largest threats, the economists said. But the upside opportunities are reduce interest charges and expenses, improved labor force participation and improved source chains.