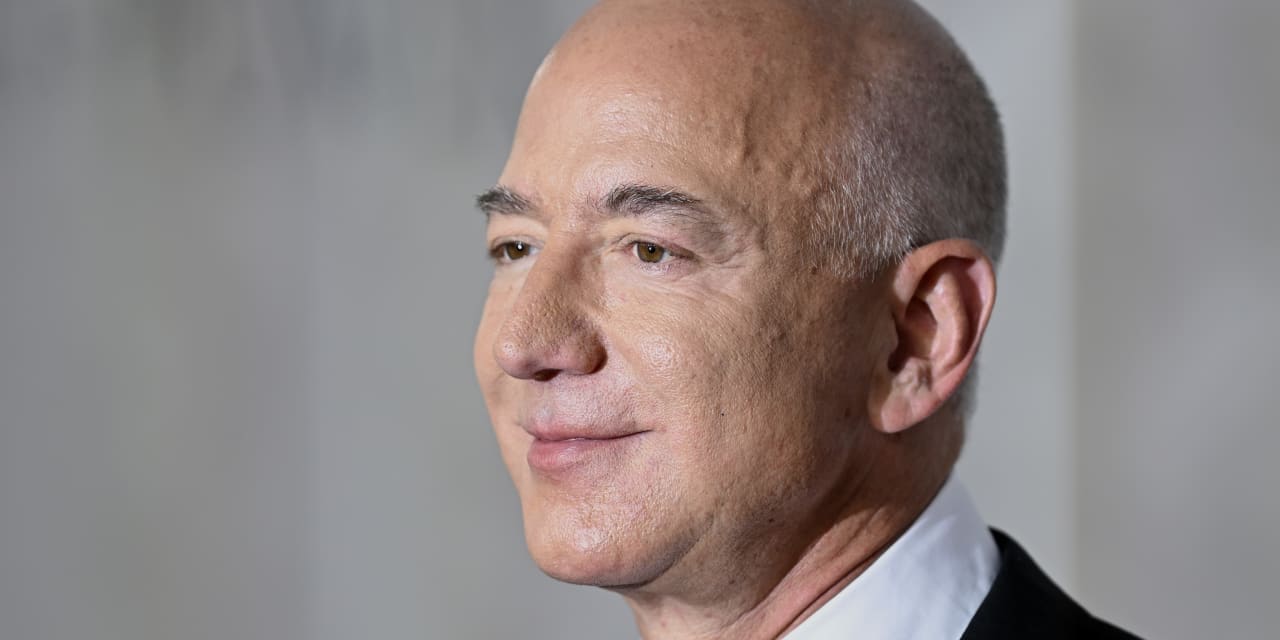

Billionaire Jeff Bezos, who launched the e-retail behemoth Amazon, has some shelling out strategies as Us residents equipment up for a vacation searching period — amid four-decade substantial inflation and recession problems.

Here’s what he reported:

“‘If you’re an person and you are thinking about acquiring a significant-screen Tv, perhaps slow that down, maintain that money, see what takes place. Same issue with a refrigerator, a new vehicle, whichever. Just choose some hazard off the table.’”

Bezos built the comments in a CNN

WBD,

interview that aired this week, the exact same interview wherever he pledged to give away most of his fortune in his life span.

Why did Bezos offer you the tip for individuals and little small business to go effortless on large-ticket goods? He gave 1 huge explanation.

“If we’re not in a recession appropriate now, we’re most likely to be in just one incredibly quickly,” he reported in the job interview, choosing up on his cautionary tweet last thirty day period that “the possibilities in this economy notify you to batten down the hatches.”

Bezos is now govt chair at Amazon

AMZN,

transitioning to the position final yr as Andy Jassy took the reins as CEO.

Later this 7 days, Amazon confirmed it was laying off some of its personnel in its product and providers business — joining a expanding record of tech businesses, together with Fb mother or father Meta

META,

— that is laying individuals off. Amazon’s occupation cuts could amount around 10,000, according to the Wall Road Journal.

“Critics have taken intention at these words of thrift coming from a man — now worth roughly $120 billion — who developed Amazon into the on-line browsing bonanza.”

To be confident, Bezos is not on your own is his anxieties about a potential recession as the Federal Reserve and other central banking companies combat bigger costs by hiking curiosity rates.

But his guidance prompted some guffaws on social media. In a nutshell, critics say these are text of thrift coming from a guy — now really worth around $120 billion — who created Amazon into the on-line buying bonanza that lets consumers seamlessly shell out revenue.

As Joshua Becker, a proponent of minimalism wrote on Twitter: “I did not listen to him point out refraining from Amazon’s Key Working day offers or Black Friday delivers, but I advocate adding individuals products to your list as properly.”

Regardless of how any one feels about hearing shelling out tips, significantly from one particular of the world’s richest individuals, there are some points to think about as functions like Black Friday and Cyber Monday strategy.

For a person detail, possibly there are discretionary fees the place people can minimize again. A lot of People in america are however shelling out briskly, as Walmart

WMT,

third-quarter earnings and October’s retail-income quantities lately affirmed. Holiday break-paying out projections paint the exact picture.

Us citizens will invest between $942.6 billion and $960.4 billion on getaway-season sales this yr, according to projections from the Nationwide Retail Federation. Previous year’s holiday break revenue totaled $889.3 billion, the trade association mentioned.

“Throughout the 3rd quarter, Americans’ credit score-card balances climbed to $930 billion, the most important yearly improve in more than 20 several years, according to the National Retail Federation.”

But Individuals are setting up for the vacations when credit history-card balances are escalating — probable for the reason that credit cards are supporting them preserve up with soaring expenditures.

Through the third quarter, Americans’ credit score-card balances climbed to $930 billion, the greatest yearly boost in a lot more than 20 decades, in accordance to Federal Reserve Bank of New York data.

While balances develop, so do credit rating-card desire costs. The yearly proportion amount (APR) on new credit rating-card offers averaged 19.14% in mid-November, in accordance to Bankrate.com. That beats the aged history on APRs for new cards, established at 19% a few decades back.

The holiday break shopping time is usually when Us citizens accumulate credit score-card debt, pay the money owed in the early portion of the coming calendar year and repeat the getaway-year debt the pursuing calendar year.

This yr, the stakes could be better if significant credit-card expenses get there and a recession-induced work reduction follows.

“It’s not the time to overspend and have a difficulty with shelling out your expenditures afterwards,” Michele Raneri, vice president of economic services analysis and consulting at TransUnion

TRU,

one of the country’s a few main credit history bureaus, earlier instructed MarketWatch. “We know the economy is sending mixed messages.”