(Bloomberg) — Traders offloaded far more shares of BYD Co. on Monday just after a 2nd submitting confirmed Warren Buffett’s Berkshire Hathaway Inc. experienced further more trimmed its stake in the enterprise.

Most Read from Bloomberg

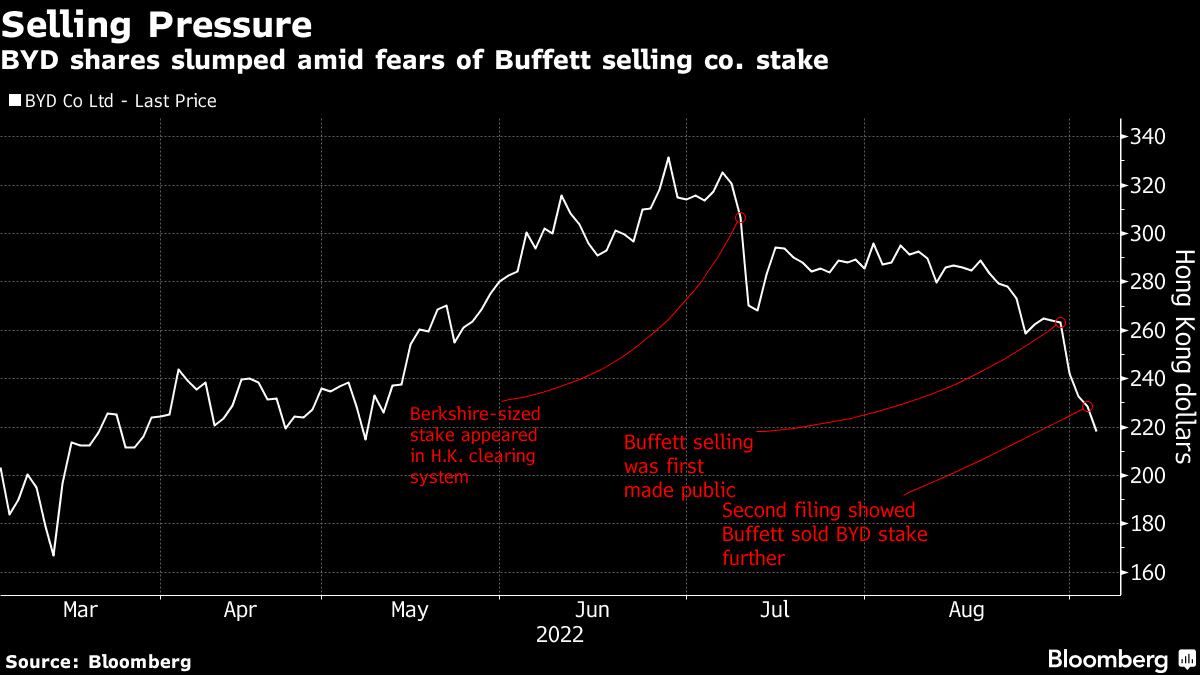

The Chinese automaker’s stock dropped as substantially as 6.8% to the least expensive amount given that May 10 in Hong Kong. The selloff prolonged the shares’ losses to practically 30% due to the fact a BYD stake that matched Berkshire’s stake appeared in Hong Kong’s clearing and settlement system in July.

Berkshire’s waning desire in the inventory, coupled with the prospect of the firm’s eventual exit, has outweighed news that BYD is now the world’s 2nd most significant electric-vehicle battery supplier. A calendar year-on-calendar year surge in new-power car income volume in August also unsuccessful to raise sentiment.

“We do hope Berkshire Hathaway to fully exit its placement,” mentioned Kelvin Lau, an analyst at Daiwa Capital Markets Hong Kong Ltd. “Even although we assume the fundamentals of the corporation to continue to be reliable, we count on the stake sale from Berkshire Hathaway would impose in the vicinity of-term share-cost strain.”

Theories about Buffett’s programs for the bellwether Chinese electric car or truck corporation have swirled since a 20.49% stake — similar to the size of Berkshire’s final claimed BYD position in Hong Kong as of stop-June — entered the Central Clearing and Settlement Technique in July.

BYD Inventory Sale Is an Outdated-University Value-Investing Go by Buffett

Berkshire has now disposed of about 18 million BYD shares and it nonetheless retains an 18.87% stake, or about 207 million shares, as of final Thursday, in accordance to a Hong Kong stock exchange filing.

(Updates with a lot more facts in the next paragraph.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.