(Bloomberg) — Central financial institutions all-around the world need to be steadfast in their inflation combat even while economies will undergo as a outcome, the OECD explained this 7 days.

Most Browse from Bloomberg

The firm boosted its 2023 inflation estimates and claimed it expects price raises the following 12 months will remain previously mentioned the targets set by a lot of global central banking companies. Though economies will slow mainly because of tighter monetary policies, the OECD did not forecast a recession.

Nevertheless a survey of US makers showed a fifth month of shrinking activity, another report indicated a nutritious boost in business enterprise expenditure. A study of the euro location firms indicated that any downturn may possibly not be severe as initially predicted.

Meantime, the Financial institution of China eased reserve requirements for banking institutions to help bolster the world’s next-greatest economy.

In this article are some of the charts that appeared on Bloomberg this week on the most up-to-date developments in the world-wide economic system:

Environment

The world’s central banking institutions have to maintain raising fascination fees to combat pervasive inflation, even as the world-wide economy sinks into a sizeable slowdown, according to the OECD. The organization raised inflation projections for up coming 12 months and claimed that although the world wide economy will go through a “significant expansion slowdown,” it is not forecasting a economic downturn.

This week observed more significant level hikes throughout the entire world, with 75 foundation-issue hikes in Sweden, New Zealand and South Africa and complete share-point moves in Pakistan and Nigeria. Turkey went the reverse way, cutting prices by 150 basis points.

US

Small business action contracted for a fifth thirty day period in November as need faltered, when inflationary pressures continued to little by little relieve. The S&P International flash composite acquiring managers’ index slid to the second-least expensive stage given that the speedy aftermath of the pandemic.

Orders placed with US factories for organization machines rebounded in October, suggesting capital shelling out programs are holding up in the face of higher borrowing prices and broader financial uncertainty. Core cash goods shipments jumped the most given that the start off of the year, suggesting a good start to fourth-quarter gross domestic merchandise.

Europe

Euro-location companies see tentative indicators that the region’s economic slump may be easing as record inflation cools and expectations for upcoming generation make improvements to. A gauge measuring exercise in producing and companies unexpectedly rose in November, in accordance to S&P World wide.

Sweden’s home-price tag decline accelerated in October, as the Nordic nation gripped by the most critical housing slump in 3 decades exhibits what could lie in advance for lots of other designed economies.

Asia

For the second time this year, China’s central bank cut the sum of money loan companies must keep in reserve, ramping up assistance for an economy racked by surging Covid conditions and a ongoing assets downturn. The People’s Bank of China lessened the reserve necessity ratio for most banking institutions by 25 basis details.

Indications are rising in China that neighborhood govt debt burdens are getting unsustainable. China’s 31 provincial governments have a stockpile of exceptional bonds which is near to the Ministry of Finance’s hazard threshold of 120% of income. A major trigger of the money squeeze is the house disaster.

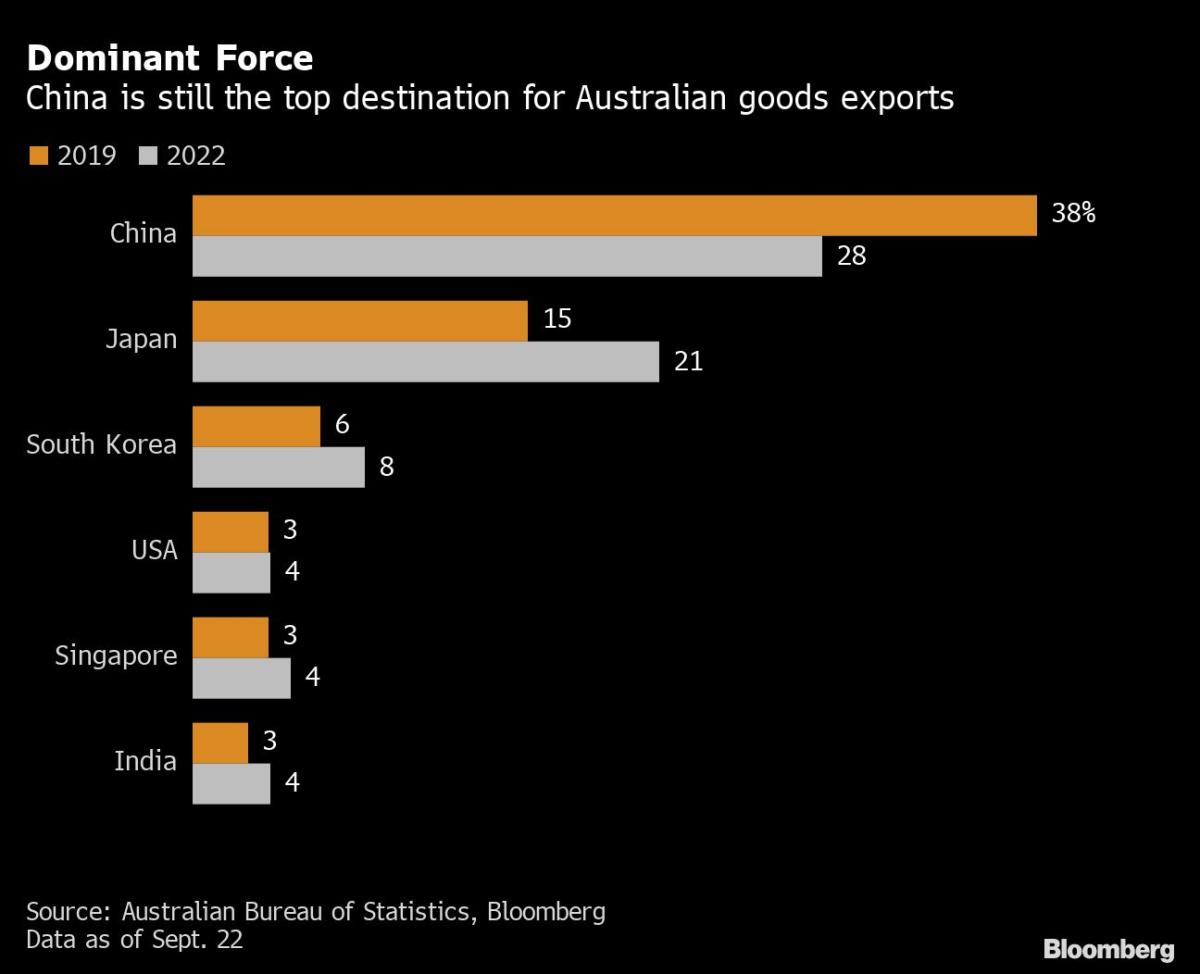

Australia has invested major to appeal to swathes of Indian holidaymakers to its shores, signed a cost-free-trade deal with submit-Brexit Britain and uncovered new Middle East marketplaces through its 30-month trade rift with China. However, outside iron ore and other crucial commodities, there’s been sizeable discomfort for exporters.

Emerging Marketplaces

Chile is established to guide the globe into a steep interest charge-cutting cycle future yr as inflation slows and its economy goes from increase to bust, in accordance to swap markets. Traders are forecasting much more than 5 share factors in cuts in the following 12 months immediately after a shock inflation print very last thirty day period and as the financial state teeters on the edge of recession.

Shipments of boats, autos and pc sections are leading Mexico’s export increase, demonstrating rising US demand from customers for industrial solutions from its southern neighbor. The export of boats manufactured in Mexico improved 266% in September in comparison to a year ago, the swiftest-expanding item between Mexican exports worth much more than $100 million.

–With aid from Maya Averbuch, Sebastian Boyd, Valentina Fuentes, Sybilla Gross, William Horobin, John Liu, Yujing Liu, Swati Pandey, Reade Pickert, Jana Randow, Niclas Rolander, Zoe Schneeweiss and Ben Westcott.

Most Browse from Bloomberg Businessweek

©2022 Bloomberg L.P.