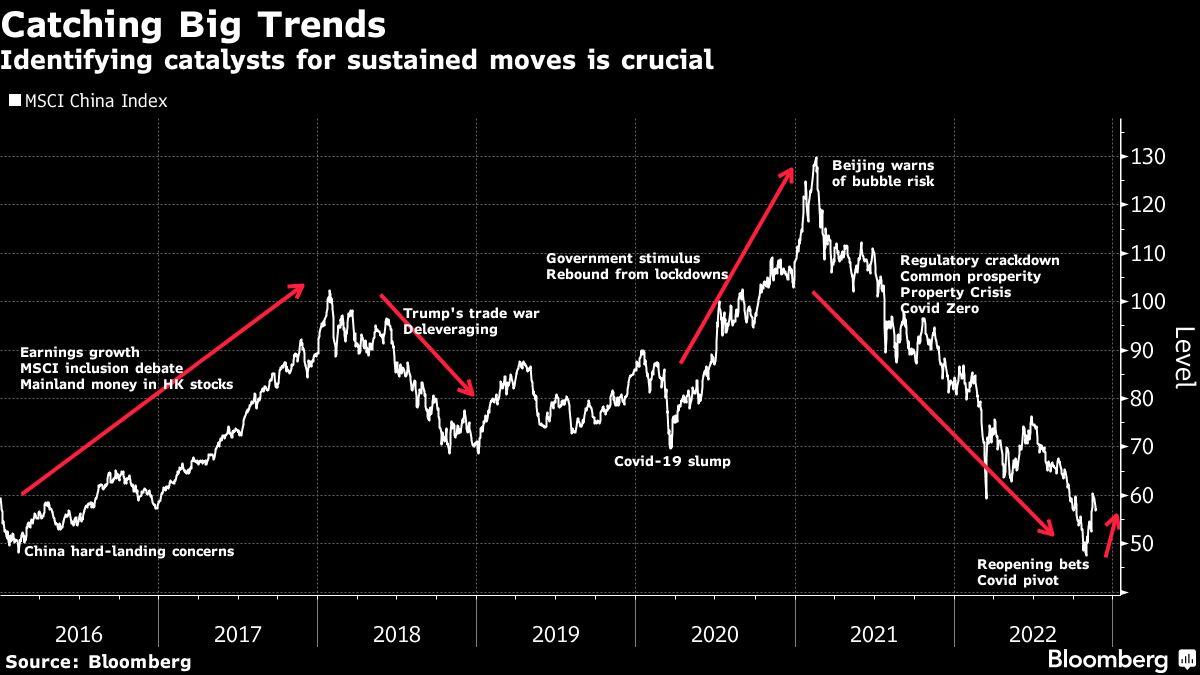

(Bloomberg) — With Chinese marketplaces vulnerable to sharp turning points followed by extensive and highly effective tendencies, timing when to obtain is pretty much as important as picking out what to obtain.

Most Read from Bloomberg

Investors who jumped into Chinese shares on Nov. 11 when Beijing lower Covid-19 quarantine intervals and dialed back testing have shared in a rally that is added virtually $370 billion to the value of equities in the MSCI China Index.

Others are even now ready for clearer indicators immediately after Wall Street obtained it so completely wrong this time very last yr. Goldman Sachs Group Inc., JPMorgan Chase & Co. and BlackRock Inc. have been amongst those who proposed piling into the industry then, only to see extra than $4 trillion in value ruined above the 10 months via October.

“Chinese insurance policies are like a large freight prepare coming down the track,” claimed John Lin, a portfolio manager for China equities at AllianceBernstein in Singapore. “What you do first is get out of the way. Really don’t keep on the monitor! Then the immediate that you can, soar onto the coach.”

Forward of the Curve

Abrdn Plc is amongst those people who by now see prospects in the nation’s company bonds just after the Covid plan adjustments and a sweeping package of actions to aid the house sector.

Traders can also placement proper absent to get gain of a probable steepening in China’s authorities bond generate curve as the overall economy reopens from Covid, in accordance to Ray Sharma-Ong, portfolio supervisor of multi-asset and expenditure remedies at abrdn.

“Go alongside on the front-conclusion of the curve although heading quick on the back-close,” stated Sharma-Ong. In his look at, a improved outlook for expansion will force up again-conclude charges although China’s supportive financial coverage will contain front-conclusion costs.

Greenback-denominated Chinese company bonds currently provide options with yields around 8%, he additional. Investing in local currency company bonds will come with a reward of 2% good carry right after buyers hedge back again the yuan to the dollar, according to Sharma-Ong, who expects the Chinese currency to preserve strengthening.

Attractive Equities

M&G Investments (Singapore) Pte. and Eastspring Investments Singapore Ltd. are in the current market acquiring Chinese shares. Eastspring argues that they just cannot get considerably less costly although M&G likes domestic-facing client brand name names, original equipment suppliers for electric and conventional motor vehicles, and factory automation.

“We are quite close to trough valuations and quite, incredibly shut to trough assumptions on earnings as effectively,” mentioned Invoice Maldonado, main expense officer at Eastspring, which oversees $222 billion. “You’d be buying now and expecting factors to form of rebound on a a few-to-6-month foundation.”

Catherine Yeung, expense director at Fidelity Global, explained so a great deal unfavorable news movement has already been factored into the price tag of Chinese stocks that the worst is probably around for buyers.

December Insights

For people even now on the sidelines, a Politburo meeting in early December, followed before long soon after by the once-a-year Central Financial Perform Conference, might offer beneficial indicators.

Jason Liu at Deutsche Bank AG’s worldwide personal financial institution plans to retain a eager eye on condition media all around this time. Information from the closed-doorway operate meeting, which will carry policymakers alongside one another to evaluation the financial state this year and established ambitions and responsibilities for 2023, may be a catalyst for even further re-opening trades.

“We may well see some alerts from the major management,” stated Liu, who expects in close proximity to-phrase volatility in Chinese property and a “very gradual” shift absent from Covid Zero more than the upcoming couple of quarters.

Liu recommends on the lookout previous the probably choppiness and having a wide place in Chinese equities, together with the technological know-how sector, to profit from a gradual shift in market sentiment.

He also sees the yuan as appealing supplied possible appreciation through the initially 50 percent of up coming 12 months. Liu doesn’t recommend credit history at the second, cautioning that it may perhaps choose more time for the home market place to improve.

Any early hints at the financial growth focus on for future calendar year — seen as about 4.8% in accordance to economists surveyed by Bloomberg — will help guideline sector sentiment.

Spring Pivot

Morgan Stanley is amongst those people with superior hopes for an acceleration of China’s economic opening in spring, when the weather conditions turns far more friendly, vaccinations may raise and the National People’s Congress in March looms as a critical party for industry-relocating developments.

Buyers who have been underweight in Chinese belongings may well change to neutral positions about this time, in accordance to Andrew Sheets, main cross-asset strategist at Morgan Stanley.

China’s domestically-concentrated consumer firms stand to advantage, according to Morgan Stanley.

“If traders are introduced with a pausing Fed and China reopening, and advancement being more powerful in the next half of 2023, I believe they’ll look at that as a beneficial backdrop for a lot of diverse emerging-industry assets,” stated Sheets.

The Future

Reopening of the economic system from Covid could push a positive swing of inflows to China’s equities markets in 2023 equivalent to 1% of gross domestic product or service, in accordance to Bloomberg News macro strategist Simon Flint. This in turn will buoy the yuan, he explained.

James Leung, head of multi-asset for Asia Pacific at Barings, suggests aligning China stock portfolios with the government’s plan priorities by investing in the electric powered car or truck sector, renewable strength and the components engineering supply-chain.

Like Barings, AllianceBernstein sees stocks in strength and technology safety as small-hanging fruit for investors, so lengthy as the organizations are aligned with the government’s goals.

The sector has improved from the era right before the pandemic and the regulatory crackdown, when traders would hunt for the newest tech and biotech darlings “and then watch the cash grow 10 situations, 100 situations,” stated AllianceBernstein’s Lin. “Now you can even now come across progress, but it has to be coverage-sensitive type of lookup.”

–With help from Ruth Carson, Sofia Horta e Costa, Ishika Mookerjee and Abhishek Vishnoi.

Most Go through from Bloomberg Businessweek

©2022 Bloomberg L.P.