(Bloomberg) — Chinese semiconductor stocks slumped soon after clean US curbs on China’s accessibility to American know-how added to a disappointing get started to the earnings time, stoking problems that the industry’s downturn is significantly from about.

Most Read through from Bloomberg

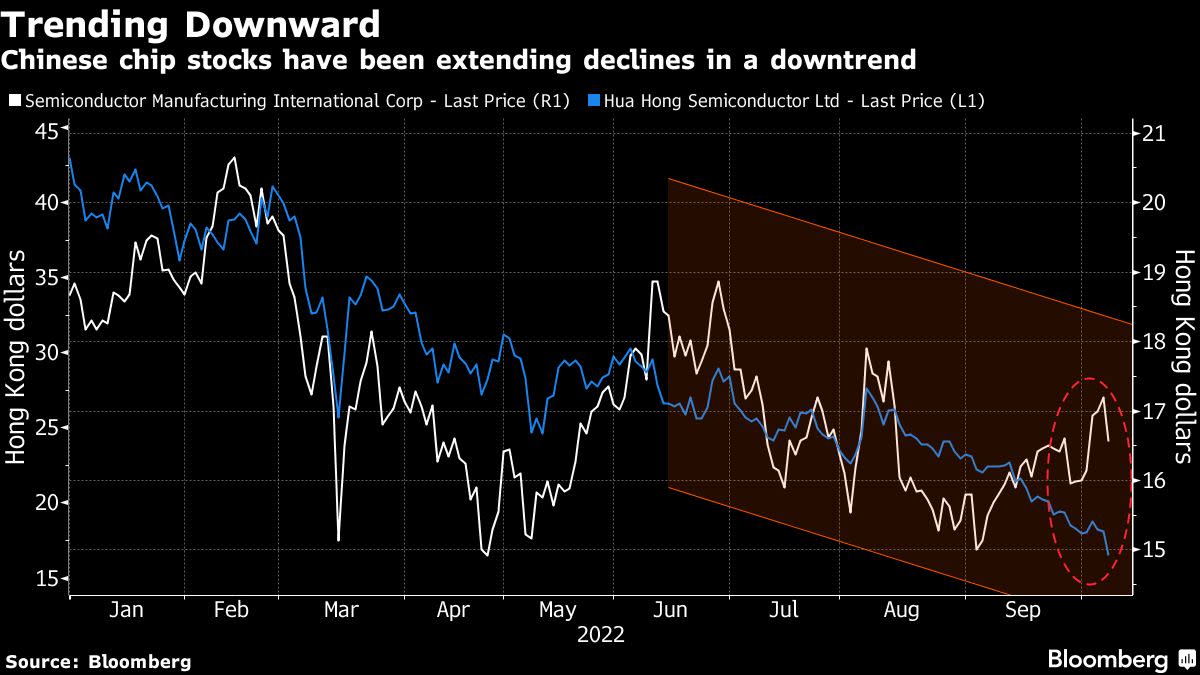

Bellwether Semiconductor Producing Global Corp. fell as substantially as 5.2% in Hong Kong on Monday, the most since Aug. 15. Declines have been steeper in scaled-down shares. Hua Hong Semiconductor Ltd. plunged 10%, whilst Shanghai Fudan Microelectronics Team Co. plummeted 25%, the most in seven a long time. Will Semiconductor Co. and Maxscend Microelectronics Co. dropped additional than 6% just about every.

The US actions consist of restrictions on the export of some types of chips made use of in synthetic intelligence and supercomputing, and also tighter rules on the sale of semiconductor products to any Chinese firm. Separately, the US also added additional Chinese corporations to a list of organizations that it regards as “unverified,” which signifies US suppliers will face new hurdles in selling systems to these entities.

The new system implies that Washington aims to “freeze in” China at its current stage, enabling the US to increase its guide, claimed Gabriel Wildau, an analyst at advisory agency Teneo Holdings LLC.

Chinese Overseas Ministry spokesperson Mao Ning claimed Saturday that the actions, which are established to enter into drive this thirty day period, are unfair and will “also harm the passions of US organizations.” They “deal a blow to international industrial and source chains and entire world financial restoration,” she claimed.

What Bloomberg Intelligence Suggests

“SMIC’s income could mature at a 50% slower pace vs. our anticipations in 2023 on the US’s stricter gear export license specifications, as 48% of its new ability to be installed by upcoming year is in 28- or smaller nanometer node sophisticated chip producing.”

— Charles Shum, analyst

Click below for the complete analysis

The slide in the chip shares also adopted a 6.1% drop in the Philadelphia Semiconductor Index on Oct. 7, right after strong labor current market facts reinforced anticipations for far more aggressive desire amount hikes by the Federal Reserve.

The new US regulations occur at a time when the chip field is currently grappling with an ominous get started to the earnings period and has gone from a throughout the world shortage of chips to a glut in a matter of months thanks to the growth-and-bust character of semiconductor desire.

Samsung Electronics Co., the world’s premier memory-chip maker, and Pc-processor maker Innovative Micro Units Inc. claimed success very last week that instructed a further-than-feared slowdown in advance.

The curbs are a “big setback to China” and “bad news” for worldwide semiconductors, Nomura Holdings Inc. analyst David Wong wrote in a note. China’s localization attempts may well also be “at threat as it may well not be in a position to use superior foundries in Taiwan and Korea,” he wrote.

Between other stocks, Naura Engineering Team Co., plunged by the each day limit of 10% on the mainland, though Superior Micro-Fabrication Devices Inc. and ACM Research Shanghai Inc. fell a lot more than 16% each and every.

The US Commerce Section has included Beijing Naura Magnetoelectric Know-how Co., a subsidiary of Naura in its Unverified Record, the corporation reported in a filing.

To be absolutely sure, the intensifying Sino-American tensions could spur Beijing to action up assist for homegrown corporations in a bid to reach its purpose of turning out to be an impartial chip powerhouse.

The drop in Chinese chip stocks may well forged a pall more than the sector globally. Marketplaces in Japan, South Korea, Taiwan and Malaysia will get a chance to react on Tuesday as they are closed on Monday.

“This will not only be adverse to the Chinese semiconductor market but also indirectly effects worldwide semiconductor makers’ business enterprise opportunities more time time period,” Citigroup analysts which include Laura Chen wrote in a take note.

Broader Chinese fairness market place also observed declines on Monday just after returning from the Golden Week holiday break, damage by a world-wide equities selloff and bleak holiday-shelling out information that deepened worries about an economic recovery.

Go through: China Shares Slide as Traders Return From Golden 7 days Getaway

(Updates with analyst comments during.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.