(Bloomberg) — China criticized expanded US restrictions on its accessibility to semiconductor engineering, saying they’ll damage supply chains and the planet financial state.

Most Read through from Bloomberg

President Joe Biden administration introduced the export curbs on Friday, escalating tensions among the two international locations and incorporating complications for an business confronted with slumping need.

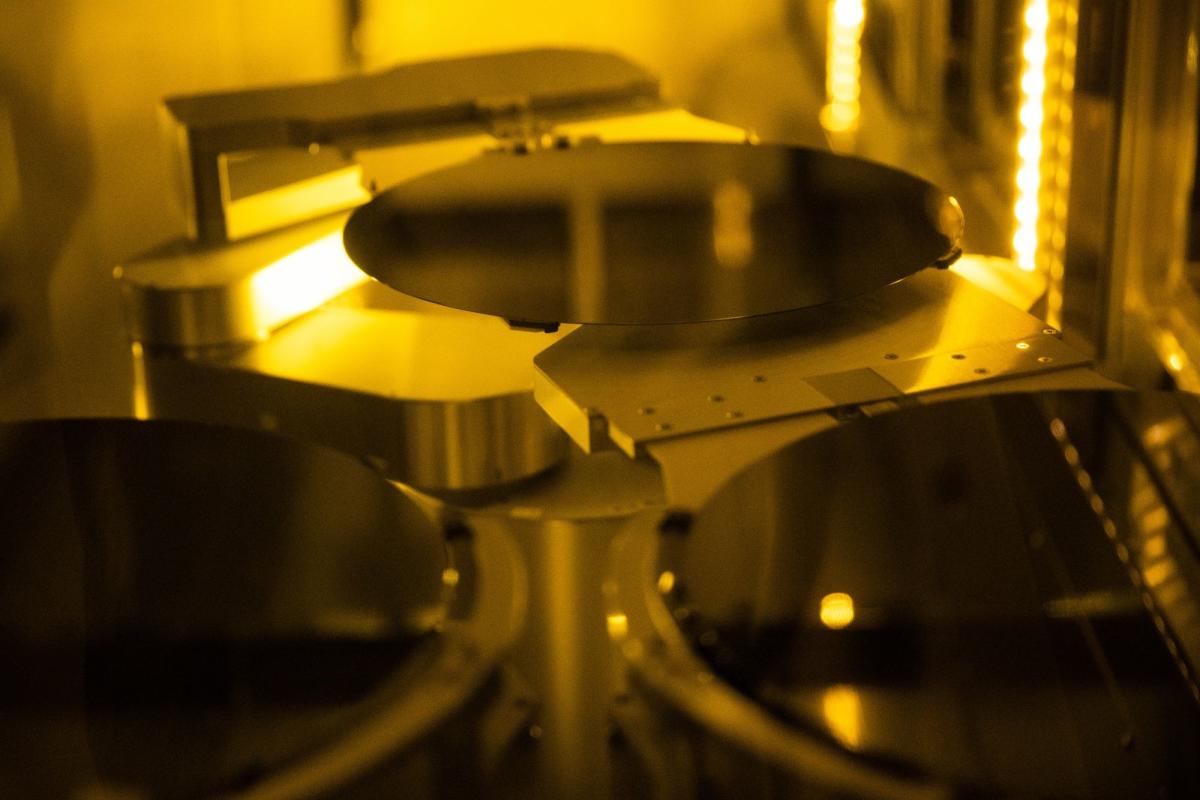

The measures seek out to end China’s drive to develop its individual chip industry and progress its military services abilities. They incorporate constraints on the export of some forms of chips utilized in synthetic intelligence and supercomputing and tighten regulations on the sale of semiconductor production tools to any Chinese organization.

China “has poured methods into establishing supercomputing capabilities and seeks to turn into a earth leader in artificial intelligence by 2030,” claimed Assistant Secretary of Commerce for Export Administration Thea D. Rozman Kendler. “It is applying these abilities to watch, keep track of and surveil their very own citizens, and gasoline its armed service modernization.”

Chinese Overseas Ministry spokesperson Mao Ning said Saturday that the actions, which begin to enter into drive this month, are unfair and will “also harm the passions of US organizations,” according to an official briefing transcript. They “deal a blow to international industrial and source chains and earth financial recovery,” she reported.

The US is trying to find to be certain that Chinese firms really don’t transfer technological know-how to the country’s armed service and that chipmakers in China really do not acquire the ability to make highly developed semiconductors by themselves.

The rules arrive at a difficult time for the chip field, which is struggling a steep fall in desire for own-pc and smartphone parts. Shares of many of the world’s biggest semiconductor makers tumbled on Friday subsequent experiences that the slump may well be even even worse than considered.

The government’s actions insert an additional layer of uncertainty for traders previously seeking to work out how considerably need for semiconductors could shrink. Companies these types of as Used Products Inc. and Intel Corp. can’t very easily wander away from China, the largest one sector for their products and solutions and a vital portion of a worldwide source chain for electronics made use of everywhere in the entire world.

Chipmaker stocks have struggled all over 2022, pursuing a few straight many years where by the team climbed among 40% and 60%. The Philadelphia Inventory Exchange Semiconductor Index is down approximately 40% so far this 12 months, on keep track of for its major yearly drop considering the fact that 2008, and it recently fell to its least expensive degree considering that November 2020.

Prevalent Losses

The losses have been common, with virtually just about every component of the market benchmark index in detrimental territory this calendar year. Nvidia Corp. and Advanced Micro Products Inc. have declined nearly 60%. AMD claimed preliminary 3rd-quarter profits on Thursday that was weaker than anticipated. AMD and Nvidia have presently disclosed that the China-linked restrictions on AI chips will damage their profits.

Nvidia stated Friday that the broader polices will not have “a product effect on our enterprise,” which is previously limited by prior export controls.

When the new regulations occur into power, it will be more difficult for providers of chips utilized in Chinese supercomputers and similar gear to get permission to fill orders. They ought to presume requests will be denied, according to senior Commerce Office officials.

Commerce also place a raft of restrictions on providing US equipment that’s capable of earning innovative semiconductors. It’s heading soon after the kinds of memory chips and logic parts that are at the heart of condition-of-the art styles.

Though there will be extra latitude for overseas organizations needing engineering for their possess operations in China — or for get-togethers that can show they’re generating points there for immediate export elsewhere — Commerce mentioned it will implement the procedures and also reduce off assist for present deployments of machinery included by the limitations.

Although the US is dwelling to the largest block of corporations that layout important digital parts and give the elaborate machinery to manufacture them, other locations have abilities that could undermine some of the government’s initiatives.

Commerce Division officials acknowledged that overseas cooperation is vital to stay away from hampering the initiatives and mentioned there are talks with other parties underway about the planet on the subject.

Chipmaking gear restrictions deal with output of the pursuing:

-

Logic chips working with so-termed nonplanar transistors made with 16-nanometer engineering or something a lot more superior than that. Generally speaking, the scaled-down the nanometers, the far more capable the chip.

-

18-nanometer dynamic random accessibility memory chips.

-

Nand-model flash memory chips with 128 layers or more.

For organizations with plants in China, like non-US companies, the principles will build more hurdles and demand government signoff.

South Korea’s SK Hynix Inc. is 1 of the world’s biggest makers of memory chips and has facilities in China as part of a supply network that sends components all-around the world.

“The new measures prohibit sale of gear for memory goods of sure stage of technology or over, but allow for Korean chipmakers to export if they have a license from the Commerce Department,” the firm reported in a assertion. “SK Hynix is prepared to make its utmost efforts to get the US government’s license and will intently work with the Korean federal government for this.”

Independently, Commerce added far more names to a record of firms that it regards as “unverified,” this means it does not know exactly where their solutions conclusion up currently being used. The 31 additions are all Chinese. That signifies that US suppliers will facial area new hurdles in marketing systems to these entities.

The largest name to be additional to the listing is Yangtze Memory Systems Co. The memory-chip maker is widely regarded as becoming the greatest guess China has of breaking through into the entrance ranks of the business and has made development with innovative products for chip-dependent storage.

The US chip marketplace has expressed issue that shifting as well aggressively could put domestic providers at a disadvantage. They stress that shedding China income will harm their capability to devote on innovation and probably help competition overseas.

The Semiconductor Sector Association, which represents all of the premier US chipmakers, said it is evaluating the effect of the new export controls and will ensure compliance.

A monthly bill signed by Biden in August promises to infuse about $52 billion into the US semiconductor sector.

(Updates with reaction from Chinese overseas ministry in sixth paragraph.)

Most Examine from Bloomberg Businessweek

©2022 Bloomberg L.P.