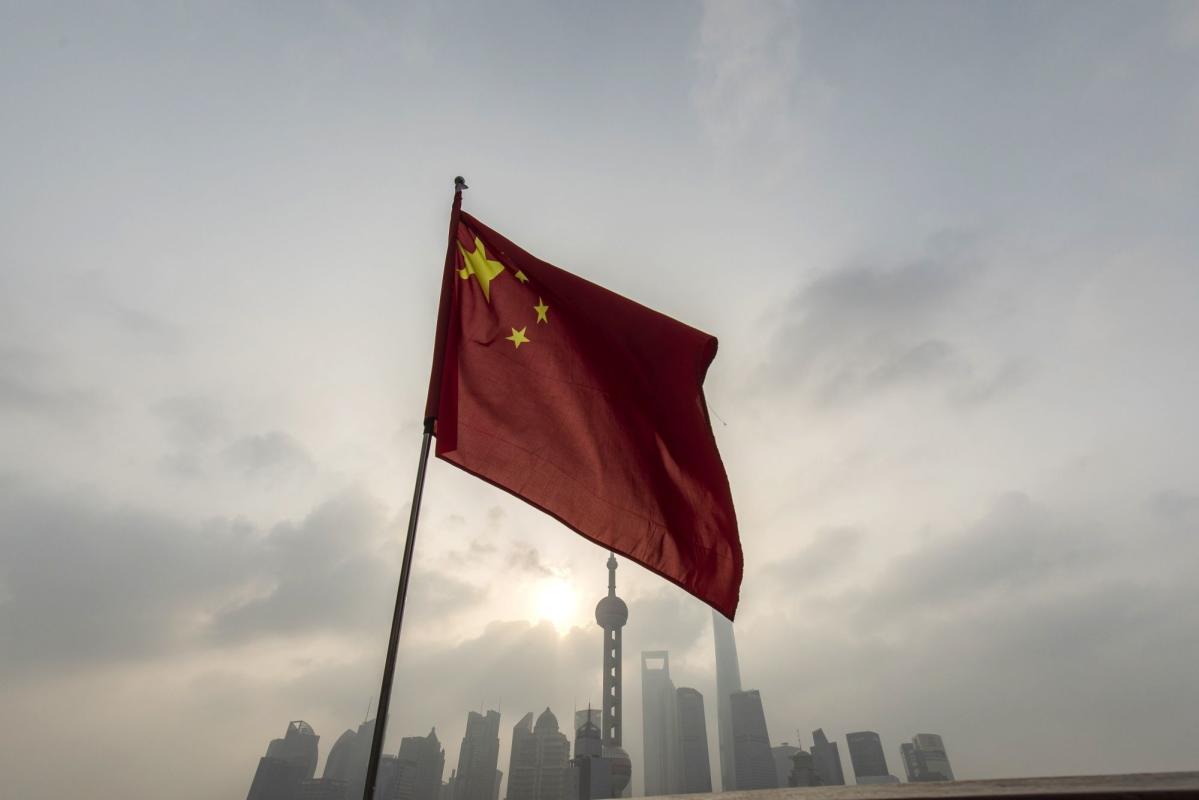

(Bloomberg) — Investing desks throughout China have grow to be inundated with unverified speak of a change in Xi Jinping’s Covid Zero policy, sparking an epic rally in shares and underscoring just how desperate buyers have turn out to be for signals that the country’s $6 trillion industry rout is ending.

Most Study from Bloomberg

Various display screen photographs purporting to show the world’s next-major overall economy is relocating closer to a reopening have been circulating on Twitter, WeChat and other social media platforms due to the fact late Monday.

Even though none of them have been confirmed — and all outward indicators from Chinese officialdom are that the Covid Zero policy stays intact — traders have propelled the Cling Seng China Enterprises Index to an 8.4% two-working day get in Hong Kong, paring its slide considering that February 2021 to 56%. Investing volumes have soared, and the Chinese yuan has strengthened from a 15-12 months very low in opposition to the greenback.

“It’s all hearsay, and there’s no way to either confirm the rumors true or untrue in the brief time period,” stated Du Kejun, lover at Beijing Gelei Asset Administration Heart Constrained Partnership. “At the stop of the working day, it is just that people are eager to acquire the selloff.”

Even by the criteria of a marketplace infamous for rumor-fueled swings, this week’s frenzied moves stand out — notably from a backdrop of continued lockdowns and virus flareups across China.

Examine: China Locks Down Spot All over Foxconn’s ‘IPhone City’ Plant (1)

The sector gains have been stoked by hope that Xi will relent on Covid Zero to rescue the ailing financial state right after he solidified his grip on power at past month’s Get together Congress. But the most strong Chinese leader given that Mao Zedong has provided no public indicator of a change, and specialists have cautioned that the place has created far too tiny progress on vaccination to reopen without a surge in deaths.

For traders apprehensive about missing out on a rally when it does last but not least arrive, the stakes are likely massive. When Chinese shares surged from their lows in the wake of the 2008 worldwide monetary crisis, the bulk of the gains happened during the span of a couple months, followed by yrs of choppy trading.

“It just displays that there is a good deal of pent up need for Chinese equities, which have been overwhelmed to demise in the very last 6 months,” claimed Manish Bhargava, fund supervisor at Straits Investment decision Holdings in Singapore. The market “could phase a huge rally if Beijing does announce a gradual reopening,” he mentioned.

The Cling Seng China Enterprises Index received as much as 3.2% on Wednesday prior to buying and selling in Hong Kong was halted thanks to an approaching tropical storm. Reopening shares including vaccine makers, airways and casino shares led the progress, with CanSino Biologics Inc. mounting 63% in Hong Kong.

Wild Swings

The sector frenzy was first activated by social media posts that a committee was remaining fashioned to assess means to exit Covid Zero. A further unconfirmed document created the rounds on Wednesday, purporting to present that China is envisioned to hold a conference on Friday to announce a slew of changes such as shortening mandatory quarantine.

“It appears to be to me that persons are sort of deciding upon to consider what is out there,” explained Hao Hong, a lover at Expand Investment decision Team, who has circulated some of the speculation on Twitter. “The market place has been so oversold. Individuals have to protect their shorts, and individuals who really do not have positions would dread to miss out on out the rally. And that is why men and women are participating.”

Beijing’s stringent Covid limits have been the largest concern for investors, generating the marketplace delicate to the slightest signals of a change in the coverage. Covid curbs and lockdowns have created China inventory actions some of the world’s worst performers this year.

Even with expanding marketplace speculation, China has demonstrated tiny signals of loosening its Covid constraints. Authorities locked down an spot where by Foxconn’s Apple iphone plane is positioned on Wednesday afternoon. On Tuesday, Chinese Foreign Ministry spokesman Zhao Lijian stated he’s “not aware” of a committee to evaluate Covid Zero exit situations.

“People might have misunderstood when they see the headline that it is about entirely opening up, but in our check out it is fairly unlikely for China to completely abandon Zero Covid,” explained Zerlina Zeng, senior credit history analyst at CreditSights. “It is politically sensitive to do absent with it since in the course of the party congress, the rhetoric close to Zero Covid has been so potent.”

–With support from Ishika Mookerjee, Charlotte Yang, Wenjin Lv, Lorretta Chen and Yuling Yang.

Most Study from Bloomberg Businessweek

©2022 Bloomberg L.P.