(Bloomberg) — China’s economic climate continued to slow in December as the huge Covid-19 outbreak unfold across the nation, with activity slumping as additional persons remain property to check out and stay clear of having sick or to get well.

Most Study from Bloomberg

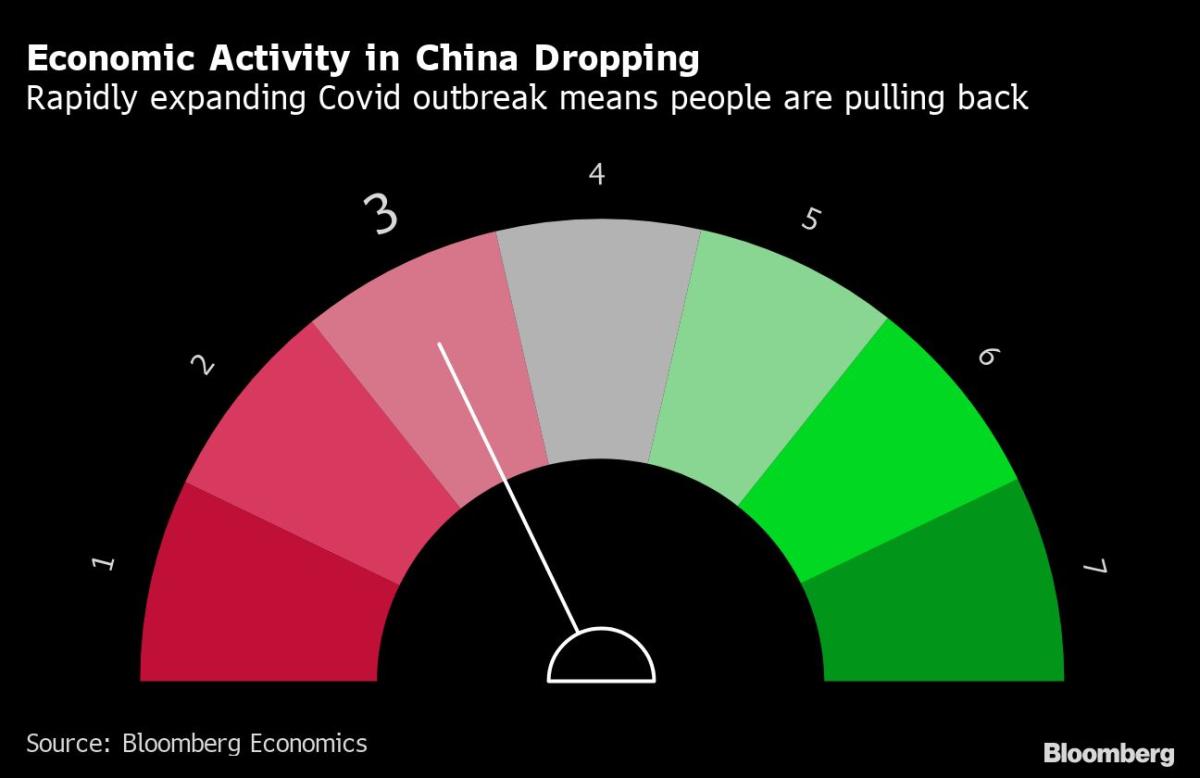

Bloomberg’s mixture index of eight early indicators showed a contraction in action in December from an already weak rate in November and the outlook is grim for the new calendar year.

Whilst there is no reliable details on the extent of the spread of the virus or the number of sick and dead now, it had attained each province prior to the conclude of in depth and typical screening. The canceling of pretty much all domestic limitations now signifies the virus can circulate freely.

Even in advance of the curbs ended up lifted, China’s overall economy was struggling, with a slump in shopper investing deepening and industrial output increasing the slowest due to the fact the spring lockdowns.

The condition was even even worse for shops and dining establishments in Beijing than it was throughout the country as a total, with retail gross sales in the metropolis dropping nearly 18% in November as both equally cases and limits in the funds amplified.

Even so even while individuals are now free to go close to there is been minimal rebound in movement so significantly this month, according to significant-frequency details on subway and highway use.

The 3.6 million outings manufactured on the Beijing subway past Thursday had been 70% down below the stage on the same day in 2019, and targeted traffic congestion on the city’s streets was only 30% of the level in January 2021, in accordance to BloombergNEF. Other big cities this sort of as Chongqing, Guangzhou, Shanghai, Tianjin and Wuhan are seeing a very similar drop.

That looks to be impacting dwelling and car or truck product sales, which both of those fell in the initially months of this thirty day period. Vehicle revenue experienced been supported by federal government subsidies and ended up a dazzling spot for shopper shelling out this calendar year, but started dropping last month as consumers pulled again. That in change strike industrial output, with creation of automobiles dropping for the very first time since May, when many factories have been forced to near.

Having said that as opposed to in the spring when it was the Covid Zero coverage which prompted a scarcity of car or truck areas and shuttered some crops, now it is the virus itself which is impacting manufacturing, with businesses getting to offer with more staff receiving ill.

The spread of the virus throughout China has undermined the initial euphoria seen in the inventory and commodity marketplaces at the reopening. The Shanghai Composite Index has fallen again close to the level it was at just before authorities started out stress-free curbs on Nov. 11 and has dropped for the previous two months.

The value of iron ore was also headed for a modest weekly drop as a surge in Covid instances clouded the around-phrase desire outlook and undermined the outcome of latest announcements of aid for the actual-estate sector. Chinese metal mills are currently reducing output, Guangfa Futures explained in a note, with facts from an field affiliation displaying output slipping and stockpiles rising in the center of this month.

The drop in marketplaces mirrors the lousy confidence between modest corporations, which was in contractionary territory for a 3rd straight thirty day period in December, according to Standard Chartered Plc. Even though there was a modest advancement from November, the primary indexes still showed more compact corporations weren’t optimistic about the latest problem or the future.

The producing sector observed some advancement, with a rise in new orders, profits and manufacturing from November “likely reflecting the positive influence of the rest of Covid regulate,” the firm’s economists Hunter Chan and Ding Shuang wrote in the report.

Nonetheless, “services SMEs continued to deal with headwinds from weak shopper sentiment amid increasing Covid circumstances,” they wrote in a report previous 7 days.

There’s minor very good news for Chinese firms abroad, with the drop in world-wide trade extending into December, in accordance to early Korean info. That signifies that China’s exports might tumble for a third straight month.

The pretty much 27% drop in Korean exports to China in the 1st 20 days of this month exhibits the weakness of Chinese desire for semiconductors, which has been slipping thanks to a slump in domestic and abroad demand from customers for smartphones and other units.

Early Indicators

Bloomberg Economics generates the general activity reading by aggregating a 3-month weighted common of the monthly variations of eight indicators, which are centered on business surveys or market price ranges.

-

Major onshore stocks – CSI 300 index of A-share shares shown in Shanghai or Shenzhen (via sector shut on the 25th of the thirty day period).

-

Whole floor location of dwelling gross sales in China’s 4 Tier-1 metropolitan areas (Beijing, Shanghai, Guangzhou and Shenzhen).

-

Inventory of metal rebar, made use of for reinforcing in building (in 10,000 metric tons). Slipping inventory is a sign of soaring demand from customers.

-

Copper rates – Spot selling price for refined copper in Shanghai current market (yuan/metric ton).

-

South Korean exports – South Korean exports in the initial 20 times of every thirty day period (yr-on-yr modify).

-

Factory inflation tracker – Bloomberg Economics-designed tracker for Chinese producer prices (year-on-calendar year improve).

-

Little and medium-sized small business self-assurance – Study of firms performed by Common Chartered.

-

Passenger auto revenue – Month to month consequence calculated from the weekly typical sales info introduced by the China Passenger Automobile Affiliation.

Most Read through from Bloomberg Businessweek

©2022 Bloomberg L.P.