(Bloomberg) — Chip-associated stocks in Japan, South Korea and Taiwan slumped, contributing to a wipeout of extra than $240 billion from the sector’s world wide marketplace price just after the Biden administration imposed curbs on China’s accessibility to semiconductor know-how.

Most Read from Bloomberg

Taiwan Semiconductor Production Co., the world’s most significant agreement chipmaker, plunged a document 8.3% on Tuesday. Samsung Electronics Co. and Tokyo Electron Ltd. also tumbled on issue US endeavours to ensure global cooperation will crimp their ability to export to China.

The selloff distribute to forex markets. South Korea’s won slumped additional than 1.6% versus the buck although the Taiwan greenback dropped .7% amid losses in their stock marketplaces.

“We imagine small-phrase uncertainties about foundry demand will improve, as China is the world’s second-largest cloud computing current market,” Phelix Lee, an fairness analyst at Morningstar Inc., wrote in a note. “The new shock may possibly more dampen sentiment in a sector that is now ravaged by weak consumer electronics desire.”

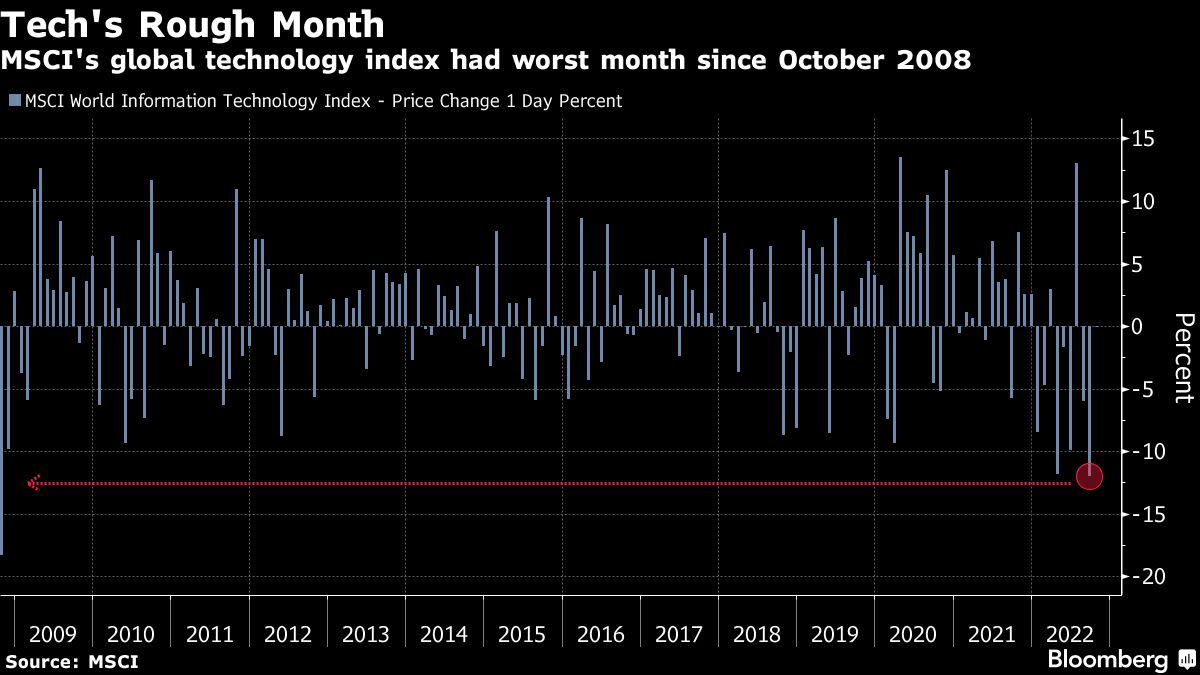

The curbs are predicted to have considerably-reaching implications. For businesses with plants in China — such as non-US kinds — the guidelines will make extra hurdles and need federal government signoff. The go is also set to gas a knock-on effect throughout the sector’s supply chain and insert to a growing listing of worries for technology shares which includes a hawkish Federal Reserve and tensions across the Taiwan Strait.

The US introduced the export curbs Friday, and there have been ideas that similar steps may perhaps be deployed in other nations around the world to be certain intercontinental cooperation. The announcement spurred a two-day rout of above 9% in the Philadelphia Inventory Exchange Semiconductor Index that observed it close Monday at its cheapest level considering that November 2020. Marketplaces in Korea, Japan and Taiwan had been shut that day for holiday seasons.

Samsung misplaced as a great deal as 3.9%, the most in a calendar year. South Korea’s SK Hynix Inc., one of the world’s most significant makers of memory chips that has amenities in China — is component of a supply community that sends factors all-around the world. Its shares slid 3.5% in advance of paring losses.

The present rout has by now wiped out extra than $240 billion from chip shares around the world considering the fact that Thursday’s close, according to information compiled by Bloomberg.

The curbs are a “big setback to China” and “bad news” for world wide semiconductors, Nomura Holdings Inc. analyst David Wong wrote in a note Monday. China’s localization endeavours could also be “at hazard as it might not be equipped to use innovative foundries in Taiwan and Korea,” he wrote.

Shares of Chinese chipmakers prolonged their recent losses on Tuesday, with Morgan Stanley stating that the broader restrictions about supercomputers and multinational cash investment in China could be “disruptive.”

Chinese condition media and officers have responded to Biden’s transfer in new days, warning of economic implications and stirring speculation about possible retaliation.

“The latest US shift would prompt China to go speedier in fostering the domestic chip industry,” explained Omdia analyst Akira Minamikawa. “Japanese corporations must be ready for a long run — it’s possible in a decade or two — when they drop all the Chinese clients as a consequence of the existing tension dialing up velocity of the Chinese efforts.”

The steps search for to quit China’s generate to acquire its very own chip field and advance its army abilities. They contain limitations on the export of some styles of chips utilised in artificial intelligence and supercomputing and tighten procedures on the sale of semiconductor production devices to any Chinese corporation.

The US is trying to find to make sure that Chinese firms do not transfer technological innovation to the country’s armed forces and that chipmakers in China never develop the capability to make sophisticated semiconductors by themselves.

“With the hottest measure, it would develop into complicated for China to manufacture and establish semiconductors due to the fact most semiconductor gear are dominated by US and its allies,” this sort of as Japan and Netherlands,” Chae Minsook, an analyst at Korea Financial commitment & Securities, wrote in a report. “It is extremely hard to retain the chip marketplace with no adopting sophisticated equipments.”

(Updates throughout)

Most Go through from Bloomberg Businessweek

©2022 Bloomberg L.P.