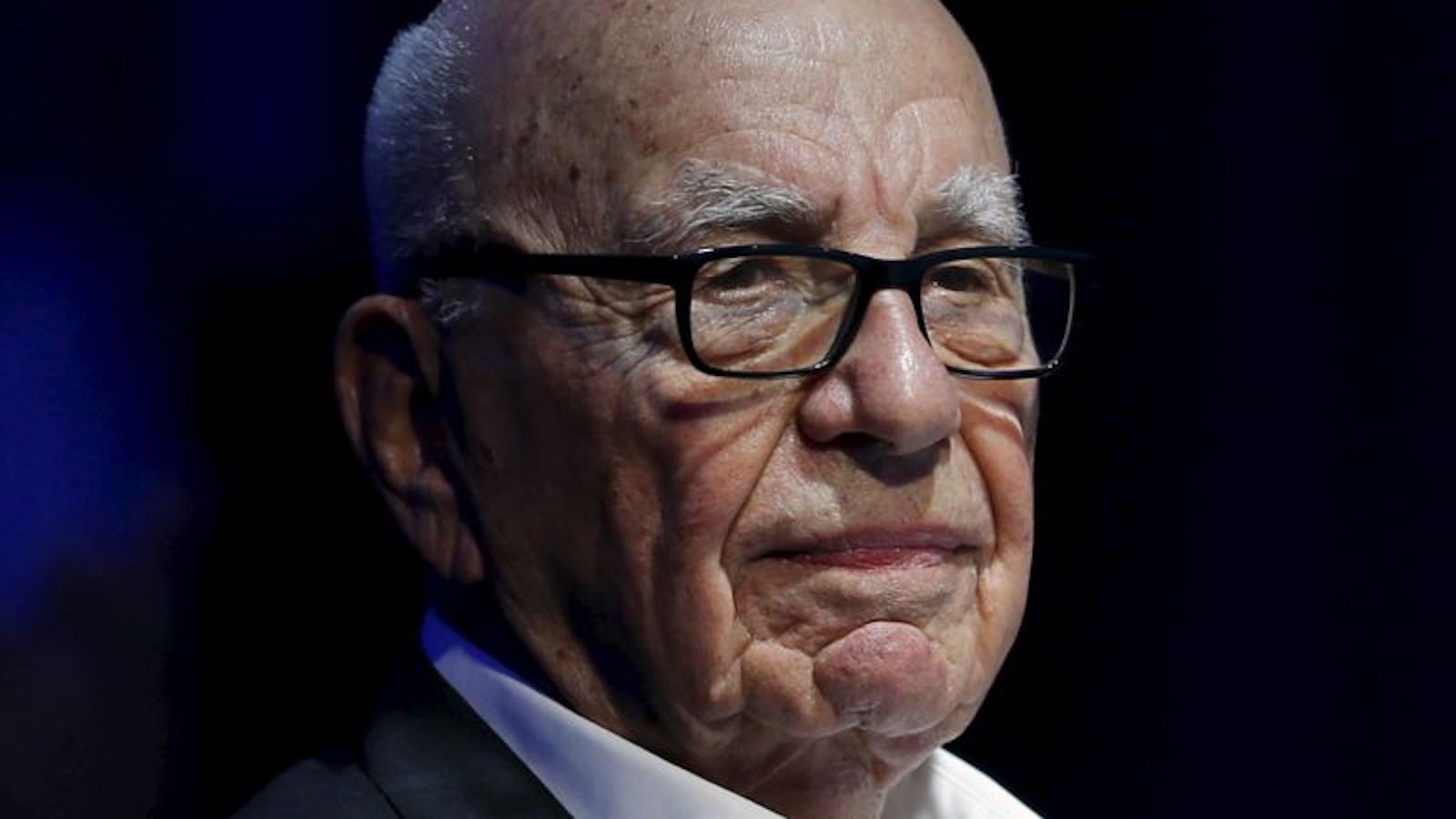

© Reuters.

By Peter Nurse

Investing.com – The US dollar stabilized at the start of trading on Wednesday in Europe as spokesmen tried to decipher the possible path of the Federal Reserve’s monetary policy by taking in economic data and statements from policymakers. monetary policy.

By 08:00 AM ET (0800 GMT), the , which tracks the currency against a basket of six other major currencies, was up 0.1% at 101.510, recovering after a 0.4% drop in the previous day.

The president of the Federal Reserve Bank of St. Louis, James Bullard, said in an interview with Reuters on Tuesday that he favored continuing to raise interest rates to counter persistent inflation, which could push rates up to between 5.5% and 5.75%.

However, his colleague Atlanta Fed Chairman Raphael Bostic suggested that a further 25 basis point interest rate hike to the 5.00-5.25% target range should be enough for the stop and assess the extent to which inflation is returning to target.

The US Treasury yield has hit a near-month high of 4.231% overnight, and is hovering around 4.21% at the start of the day in Europe, suggesting that Bullard’s remarks have had more impact on the markets.

Federal Reserve members will closely monitor economic data ahead of their upcoming meeting in May, and today’s release could provide investors with more clarity on economic conditions across the country.

The dollar was lower on Tuesday after reports that the US had expanded 4.5% year-on-year in the first quarter, up sharply from 2.9% in the previous quarter, boosting risk sentiment.

However, the losses were limited, “perhaps for two reasons: i) China’s 4.5% yoy GDP growth was always on a low base and ii) industrial data was weak, suggesting that the manufacturing sector could be struggling against the weakening of external demand”, explain the analysts of ING (AS:) in a note.

The pair fell 0.1% to 1.0966, after rising 0.4% the previous day, awaiting the release of the latest Eurozone inflation data for March.

The is expected to rise 0.9% in monthly terms in March, representing 6.9%, a drop from the 8.5% registered in February.

However, everything points to , excluding volatile food and energy prices, rising 5.7% annually, up from 5.6% the previous month, suggesting that it will continue to raise prices. interest rates in May.

The pair is aiming for a 0.1% rise to the 1.2431 level, and Wednesday’s data indicates that the pace of gains slowed less than expected in March and remained very high, at an exorbitant 10 ,1%.

The magnitude of the Bank of England’s task to curb inflation has favored sterling, which hit a 10-month high last week.

On the other hand, the pair rises 0.1% to the 0.6725 level, the points up 0.3% to 134.44, after the new governor of the Bank of Japan, Kazuo Ueda, reiterated that the central bank will maintain its ultra-relaxed monetary policy, while he points up a rise of 0.1% to 6.8822.