(Bloomberg) — European biotech business Argenx SE is scheduled to launch important drug trial data this summer months. Deal-hungry Massive Pharma is closely looking at.

Most Go through from Bloomberg

Numerous main drugmakers eager to develop in immunology have been learning the $23 billion corporation for some time and have it at the top rated of their wish lists, according to individuals familiar with the matter. Argenx has been operating with JPMorgan Chase & Co. to help determine options in the function of any takeover bid, the people mentioned, inquiring not to be identified simply because the information is private.

Fascination is anticipated to choose up if outcomes in July show that a critical Argenx drug—already accredited for one particular autoimmune disorder—can successfully tackle one more condition, the people today said. The treatment, termed Vyvgart, could at some point crank out up to $10 billion in peak revenue if accredited for all the situations it is being researched for, according to analysts at Robert W. Baird & Co.

“This could be a mega blockbuster drug,” explained Yaron Werber, a senior biotechnology analyst at TD Cowen. “It’s likely to be as well tricky for strategic acquirers to ignore this chance. It is also beneficial, also special, as well profitable, far too strategic.”

‘Best in Class’

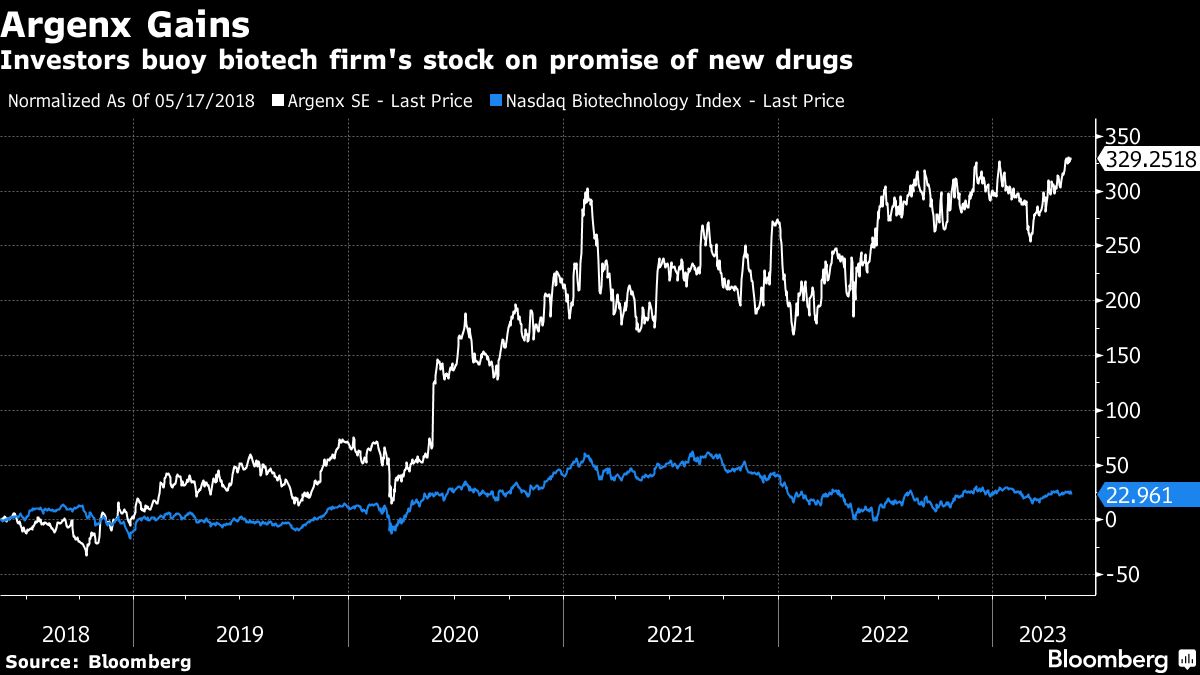

Argenx shares rose as a lot as 5.8% in Brussels buying and selling on Wednesday, their major intraday jump since November 2022. The inventory was up 3.7% at 9:50 a.m. in the Belgian cash, giving the firm a marketplace value of about €21.4 billion ($23.2 billion). The company’s American depositary shares have received about 31% in New York investing around the previous 12 months, outpacing the 15% get in the Nasdaq Biotechnology Index.

The company has developed a new course of drug intended to block and take away particular unsafe antibodies from the blood, focusing on health conditions the place a person’s immune program attacks their very own system. The technological know-how tends to make Argenx a tempting focus on for corporations which includes Roche Holding AG, Novartis AG, Eli Lilly & Co., AstraZeneca Plc, Merck & Co. and AbbVie Inc., Werber said.

Argenx will launch info from a pivotal trial in July that will show no matter if Vyvgart is an helpful treatment for long-term inflammatory demyelinating polyneuropathy, or CIDP, where nerve injury can impair patients’ ability to walk. Success could result in hopes that the drug, now accepted for generalized myasthenia gravis, may be used to a wide range of other conditions with several or no persuasive treatment options.

“Having a drug that’s initial in course, most effective in class, but on leading of that obtaining indications that are reasonably large—you really don’t get individuals opportunities each and every day,” explained David Nierengarten, a controlling director on Wedbush Securities Inc.’s study crew. “I believe that does enhance the probability of it acquiring purchased.”

There’s usually a chance that Argenx could opt to start engaging with suitors in advance of the launch of the topline CIDP knowledge predicted in July, some of the individuals mentioned. Continue to, the company has not decided on a possible sale, and its presently lofty valuation may deter some potential bidders, they reported.

“We are centered on continuing to create benefit for sufferers and our shareholders,” a spokesperson for Argenx said, declining to remark on any likely deals. “We are well-positioned and keep on being dedicated to continuing to do that independently.”

Representatives for JPMorgan, AstraZeneca, Eli Lilly, Merck, Novartis and Roche declined to comment. A spokesperson for AbbVie didn’t promptly answer to a ask for for remark.

Pharma providers have been progressively fascinated in therapies for autoimmune and inflammatory disorders since a single drug can usually be made use of for lots of distinct purposes. In April, Merck agreed to get autoimmune drug developer Prometheus Biosciences Inc. for about $10.8 billion.

Substantial Selling price

Probable acquirers researching Argenx would want to hold out for the July data from the CIDP trial just before moving forward to prevent any embarassment, claimed Joel Beatty, a senior research analyst at Baird. A good outcome could provide in an more $1.3 billion of peak product sales for Argenx, he reported.

“It would make it a large amount simpler for substantial pharma or other biotech businesses to pay back a comparatively significant price,” Beatty reported.

Argenx is producing solutions for a host of ailments ranging from immune thrombocytopenia, a serious bleeding ailment, to pemphigus vulgaris, a significant condition that triggers blisters on the skin and in the mouth.

It is led by co-founder Tim Van Hauwermeiren, a bioengineering expert who beforehand labored as a business enterprise development govt at Ablynx NV and Procter & Gamble Co. The firm can take its identify from the Argonauts, the band of heroes in ancient Greek mythology who teamed up to uncover the Golden Fleece.

Argenx, which also trades in Brussels, has beforehand formed partnerships or performed licensing deals with drugmakers which include AbbVie, Eli Lilly, LEO Pharma A/S, Shire Plc and Boehringer Ingelheim GmbH.

To be absolutely sure, latest moves by US regulators could have a chilling impact on what until now has been a robust time for overall health treatment dealmaking.

The Federal Trade Commission sued Tuesday to block Amgen Inc.’s $27.8 billion acquisition of Horizon Therapeutics Plc, arguing the tie-up would stifle competition for the improvement of remedies for major illnesses. The go produced alarm that the governing administration will upend huge drugmakers’ regular playbook of snapping up more compact businesses to establish up their pipelines.

The other critical concern will be irrespective of whether any likely acquirer can influence Argenx to do a offer. While the founder doesn’t have a significant sufficient stake to block a bid, the board could decide to wait for an even bigger value prior to welcoming overtures.

“The inventory is heading to get a good deal far more highly-priced and will involve a significant quality. And we really do not believe this administration staff or board are interested sellers,” TD Cowen’s Werber said. “I believe they are fascinated in creating a wonderful firm on their have.”

–With support from Suzi Ring, Naomi Kresge, Nacha Cattan and Angelica Peebles.

(Provides shares in fifth paragraph.)

Most Examine from Bloomberg Businessweek

©2023 Bloomberg L.P.