(Bloomberg) — Britain’s program to fix its damaged public finances and sector trustworthiness will ultimately arise this 7 days in the wake of knowledge exhibiting an intensifying cost-of-living shock in a recession-stricken financial state.

Most Browse from Bloomberg

Expending cuts and tax increases might attribute intensely in the method that Chancellor of the Exchequer Jeremy Hunt will unveil on Thursday. He is expected to announce steps totalling at least £50 billion ($59 billion) to bridge a funds chasm.

Compounding the obstacle is an ever-worsening financial squeeze. A prolonged economic downturn is now possible under way, as signaled by gross domestic products facts produced final Friday, and inflation figures for October owing on Wednesday will in all probability display the maximum end result but noticed in the existing energy crisis. The median forecast is for a bounce in client-price development to 10.7%.

The alternatives taken by Hunt and Key Minister Rishi Sunak will ascertain how considerably Britain can weather that storm, and also go on from its exceptional money-market place debacle of the latest months.

A bundle of unfunded tax cuts unveiled by former Chancellor Kwasi Kwarteng and then-leading Liz Truss in September prompted a loss of confidence in the United kingdom financial framework that has develop into a parable for other countries to stay away from.

The new authorities that took office environment following them has two several years still left to restore perceptions of the ruling Conservative Party’s financial competence at a time when some voters are progressively questioning the knowledge of its signature coverage, exiting the European Union. The subsequent normal election is thanks by January 2025.

In the meantime, the Bank of England is very likely to retain boosting desire premiums to provide inflation underneath manage. Clues on its intentions may well arise on Wednesday as Governor Andrew Bailey testifies in Parliament alongside a few of his colleagues.

What Bloomberg Economics Suggests:

“The BOE probably will not be relaxed getting its foot off the brake right until products and services inflation demonstrates signals of dropping back towards its lengthy-operate average.”

–For complete evaluation, click listed here

Somewhere else, reviews that may well clearly show continuing US retail-profits progress, accelerating Japanese inflation, and the European Central Bank’s most recent money-stability assessment will also aim traders in the coming days.

Bloomberg’s New Financial state Discussion board operates Tuesday to Thursday, counting Singapore’s Deputy Prime Minister Lawrence Wong, Singapore Senior Minister Tharman Shanmugaratnam, US Trade Consultant Katherine Tai and CEOs which include Bill Winters of Regular Chartered, Noel Quinn of HSBC, Shou Chew of TikTok as amid the essential speakers and panelists.

Click on listed here for what took place final 7 days and underneath is our wrap of what else is coming up in the world wide overall economy.

US Financial state

In the US, retail income figures will provide clues on the health and fitness of purchaser desire entering the last quarter of the 12 months. Economists undertaking a stable boost in the price of Oct purchases, powered by motor motor vehicle sales and indicating sustained spending despite high inflation.

The facts will assist shape economists’ estimates of fourth-quarter economic progress in the wake of large amount increases from the Federal Reserve. The Atlanta Fed’s GDPNow estimate has gross domestic product or service climbing an annualized 4% during the time period, reflecting 4.2% development in personalized usage.

Other studies this coming 7 days include the government’s Oct producer value index, which is forecast to keep momentum on a month-to-month foundation. The figures follow the release of consumer price knowledge that indicated inflationary pressures are beginning to average.

Reviews on industrial manufacturing, housing starts and existing-residence income are also on tap. The housing facts will likely underscore the strike to demand and building from this year’s swift rise in borrowing expenses.

Asia

China releases its newest retail product sales, industrial manufacturing, financial investment and employment data on Tuesday, with economists anticipating another lean month as Covid restrictions cap activity.

Japan’s article-pandemic recovery most likely slowed in the third quarter as pent-up desire eased and a weak yen and higher import selling prices weighed on usage and trade.

The GDP figures out Tuesday will possibly be overshadowed by inflation figures later in the week exhibiting a more acceleration in price progress exacerbated by the slide in the forex.

Lender of Japan Governor Haruhiko Kuroda’s comments through the 7 days will be closely scrutinized for any hint of alter in his staunch easing situation.

Minutes from the Reserve Lender of Australia’s November meeting will additional flesh out the board’s wondering on policy. That stance may will need revisiting if wage info on Wednesday surprises or careers figures on Thursday present a shock.

On Thursday, the central financial institutions of Indonesia and the Philippines are envisioned to go on their financial tightening.

Europe, Middle East, Africa

Various euro-zone plan makers will communicate this 7 days at occasions around the euro area and as considerably away as Tokyo. Among the highlights will be ECB President Christine Lagarde, who is scheduled to make remarks twice in coming times.

ECB officials’ half-yearly assessment of monetary steadiness, on Wednesday, and an announcement on early repayments of prolonged-time period loans, on Friday, will also draw investors’ interest.

The calendar for details is comparatively mild, with German trader self-assurance on Tuesday a likely highlight at a time when the state is noticed enduring a further economic downturn than its neighbors.

Last readings of third-quarter GDP and October inflation for the euro space will be produced on Tuesday and Thursday respectively.

In the Nordic area, economists forecast that Swedish yearly client-price development likely surged additional to 11% in October. All those info are because of on Tuesday, even though Norwegian GDP on Friday is found very likely to demonstrate ongoing development.

Hunting south, Israel’s inflation info on Tuesday will be intently monitored for indications of whether or not a slowdown in price tag rises ongoing in Oct. The Bank of Israel has entrance-loaded level improves this 12 months, and could commence slowing the speed of hikes if inflation continues to weaken.

With the tempo of buyer-cost gains exceeding the National Lender of Rwanda’s forecast, its monetary policy committee may perhaps be persuaded to elevate fees for a third consecutive meeting on Tuesday.

On the exact day, Nigerian inflation is expected to continue being at more than double the 9% ceiling of the central bank’s target band for a fifth straight month, as the naira carries on to plunge on the greatly applied black marketplace, and the worst floods in a 10 years drive up meals costs.

Latin The usa

Brazil’s GDP-proxy figures for September are anticipated to demonstrate additional recovery in the country’s providers sector even as the thirty day period-on-month reading through falls for a second thirty day period.

Chile’s third-quarter GDP report need to place to the remarkable slowing in the economic climate in excess of the final calendar year as the result of pension withdrawals subsides. Seeking forward, worries abound as sticky double-digit inflation presents the central bank small room to relieve file significant curiosity rates whenever before long.

Uruguay’s central financial institution will possible hike its vital level for an 11th straight conference in a tightening campaign that is pushed up borrowing fees 625 foundation points to 10.75%.

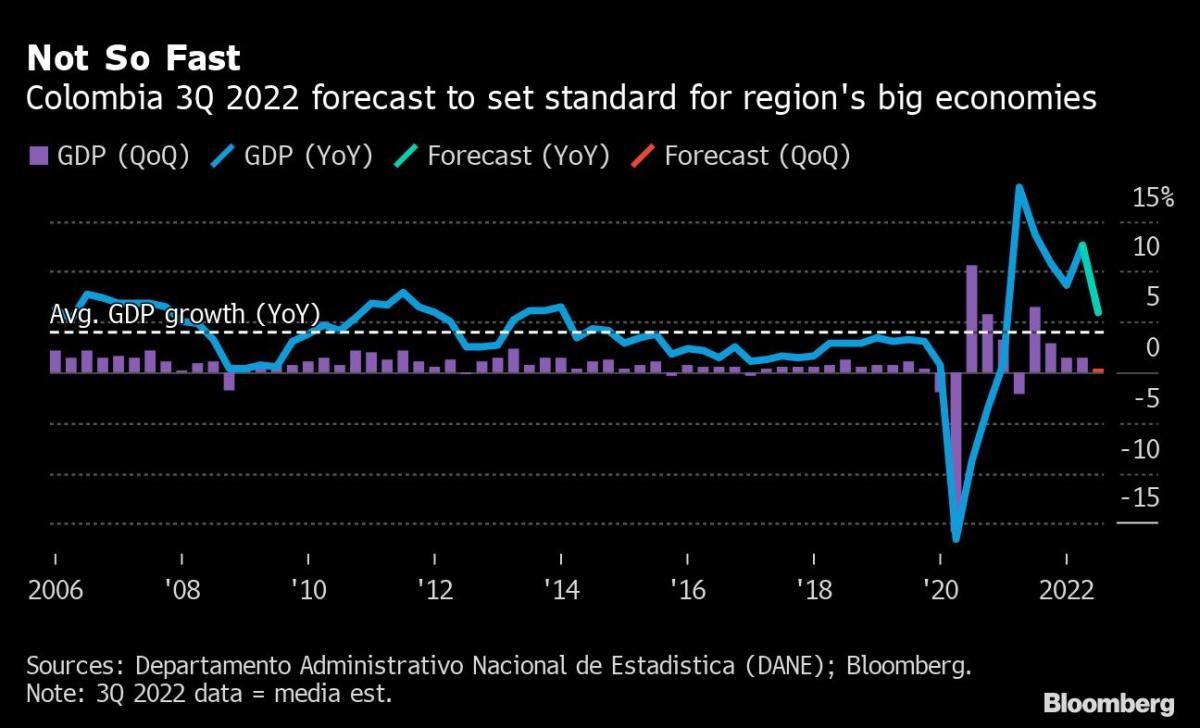

In Colombia, import and trade harmony knowledge for September may possibly mirror some of the economy’s slowing need immediately after the previous strike a history in August and the latter posted an all-time deficit.

Seem for the country’s 3rd-quarter GDP report to present output slowed from the blistering rate found in April-June, when effortlessly remaining the region’s hottest big financial system.

Amid Group of 20 economies, only Turkey’s once-a-year inflation of 85.51% exceeds Argentina’s 83%. Details posted Friday in Buenos Aires might see the two swap positions, but if not then, most economists see it happening by 12 months-conclude.

–With support from Andrew Atkinson, Vince Golle, Robert Jameson, Malcolm Scott, Monique Vanek and Sylvia Westall.

Most Read through from Bloomberg Businessweek

©2022 Bloomberg L.P.

:max_bytes(150000):strip_icc():focal(997x476:999x478)/ethan-slater-ex-wife-lilly-jay-main-121924-90b8f972f2c44d0f8d177ca74905feb8.jpg)