(Bloomberg) — Soon after two straight a long time of significant gains, vitality shares could outperform the marketplace all over again in 2023, but this time it will be increased dividends rather than oil that will spur appetite for the sector.

Most Read through from Bloomberg

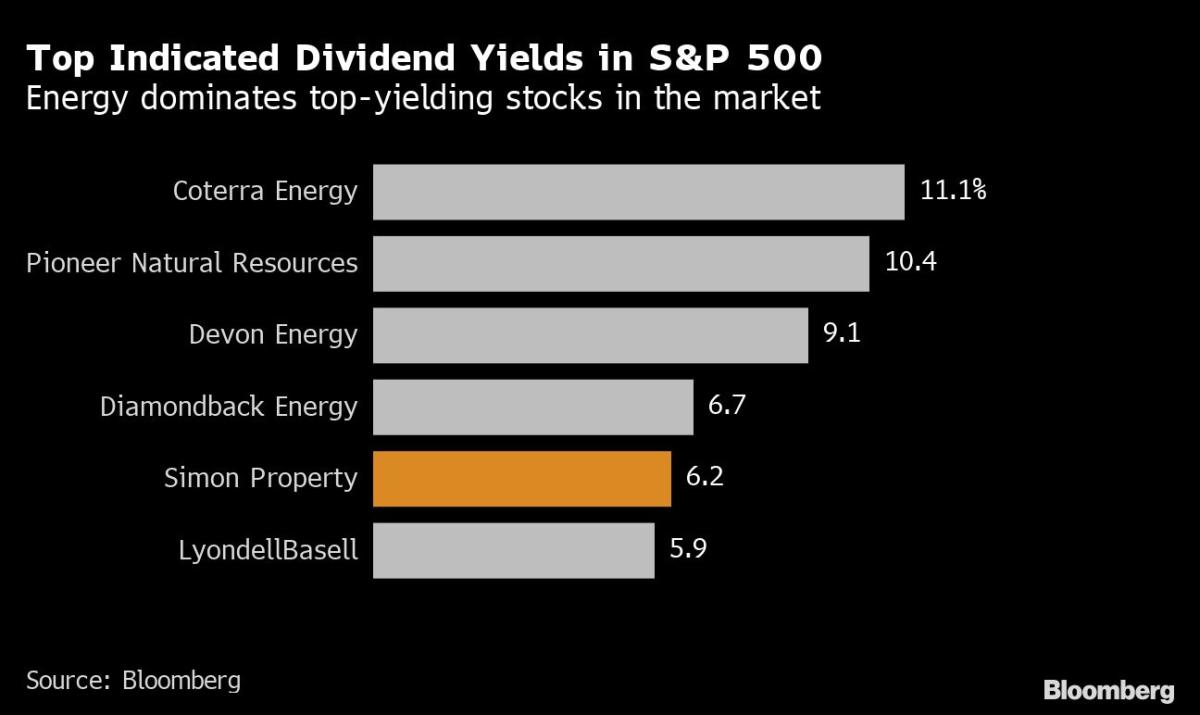

In an effort and hard work to entice money traders, electricity companies have aggressively boosted dividends about the past 12 months. Diamondback Electrical power Inc. enhanced its payout 412% in the span, the most of any S&P 500 member. Five of the index’s 10 major dividend boosts have appear from the energy sector, which includes APA Corp.’s 355% hike, Pioneer Purely natural Methods Co.’s 276% elevate and Halliburton Co.’s 167% improve.

These supersized payouts will look even much more attractive if the US financial state slips into a recession upcoming calendar year, which would enhance the attract of cash. Serious US gross domestic merchandise is poised to shrink to meager .3% growth in 2023, down from 1.9% in 2022, according to facts compiled by Bloomberg.

“In a economic downturn, I want to see the funds,” Electricity Earnings Companions Main Executive Officer James Murchie mentioned, incorporating that his investment business was released during the bursting of the dot-com bubble mainly because buyers had been trying to find “real cash flow and true belongings.” He expects the very same dynamic to participate in out in a potential recession in 2023, driving fairness positioning in dividend-having to pay shares in electricity and utilities.

“We want serious property rather than vaporware in our portfolio,” Murchie said.

Traders will look for whole returns somewhat than just share selling price gains in 2023, Bank of America’s head of equity and quantitative system Savita Subramanian claimed in a Bloomberg Tv interview this week. Subramanian was also bullish on the energy sector, which she said has demonstrated investing restraint regardless of larger oil costs.

The S&P 500 Vitality Index’s overall return so much in 2022 is approaching 63%, which breaks down to 57% value appreciation and one more 6% from produce. By distinction, the broader S&P 500 has posted a whole unfavorable return of 17% — just a very little much better than its 19% rate decline many thanks to payouts by index associates.

The group of power stocks in the US equity benchmark climbed about 2% in New York Wednesday.

Traders are likely to hurry into dividend-paying out shares in a recession in search of income whilst the overall economy crashes close to them and pounds are more challenging to earn. But investors really should search further and screen providers for cost-free money move, somewhat than dividends, if they are looking for reliable income streams through a economic downturn, SPEAR Invest’s Ivana Delevska reported.

“That’s the vital extra broadly for the marketplace — hard cash stream technology,” the firm’s chief financial commitment officer observed said, incorporating that her fund likes commodities and industrial shares heading into 2023 for the reason that of their totally free dollars profile and since they are affordable. “The reason we like commodities and industrials in a recession is because a recession is by now priced into them.”

However, buyers that go on the lookout for cost-free cash movement era commonly uncover significant dividend payers. “Most of the organizations that have the maximum hard cash circulation produce, have the greatest dividends,” Siebert Williams Shank analyst Gabriele Sorbara stated.

(Adds buying and selling)

Most Examine from Bloomberg Businessweek

©2022 Bloomberg L.P.