(Bloomberg) — The Federal Reserve is established to disappoint Wall Avenue as it keeps fees at their peak throughout 2023, dashing hopes markets have priced in for charge cuts in the 2nd fifty percent and producing a economic downturn quite likely.

Most Browse from Bloomberg

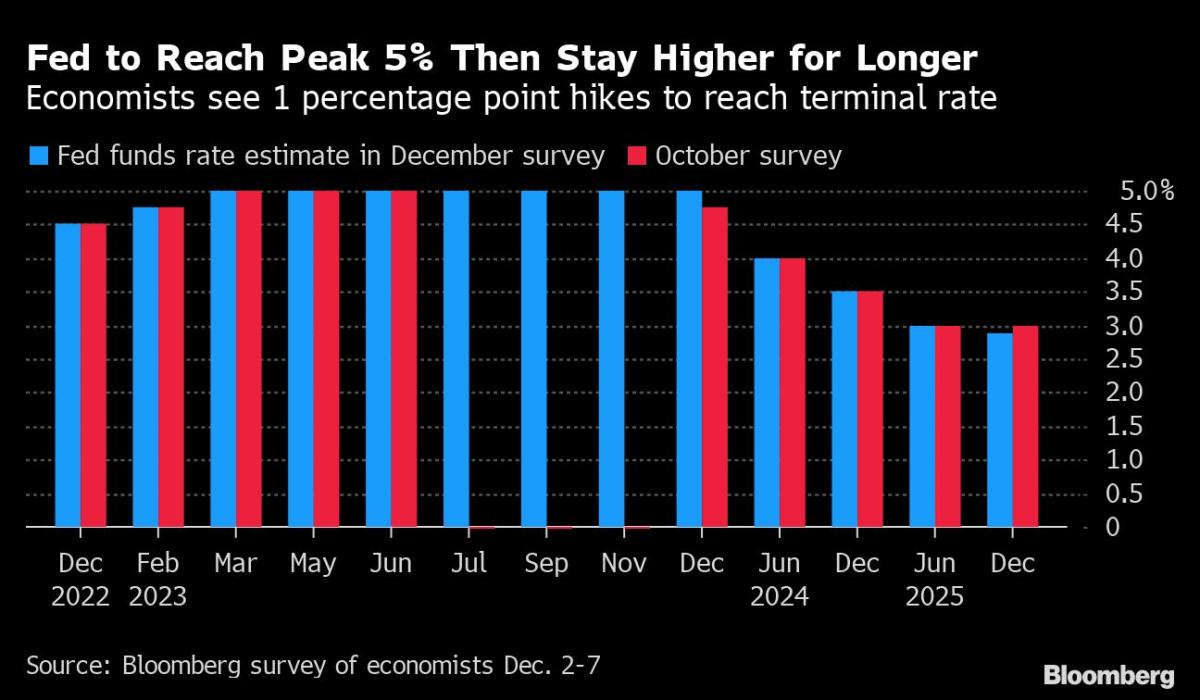

Which is the forecast of economists surveyed by Bloomberg ahead of a final decision and forecasts because of from the Federal Open Market Committee on Wednesday. Policymakers will increase rates by 50 basis factors future week, adhering to four consecutive 75 basis-issue hikes, and by quarter points at the pursuing two meetings, the survey uncovered. Policymakers will announce their conclusion and forecasts at 2 p.m. in Washington.

The FOMC’s median projection is anticipated to display the plan benchmark peaking at 4.9% in 2023 — reflecting a 4.75%-5% concentrate on variety — compared to 4.6% viewed in September. That would deliver a hawkish surprise to investors, who now wager that rates will be minimize by a 50 % share level in the next 50 percent of following calendar year, though they way too see premiums peaking all-around 4.9%.

The study saw the Fed slicing charges to 4% by June 2024 and to 3.5% by the conclude of that calendar year.

Chair Jerome Powell has stated he’s eager for the economic climate to suffer some pain to lower inflation close to 40-calendar year highs and that really should be a bit far more seen in the new forecast.

The Fed’s summary of financial projections are probably to show that coverage makers are seeking for weaker US development and a bit larger unemployment than they had been anticipating in September. They may downgrade 2023 development estimates to .8% in comparison to 1.2% in September though observing unemployment climbing to 4.6%. The US jobless charge stood at 3.7% last thirty day period.

What Bloomberg Economics Says

“The Fed has signaled the terminal level will probably be about 5% — we feel an upper sure of 5% — attained in early 2023. To get there, the central financial institution will possible raise fees by 50 basis details at its December 2022 assembly, followed by two much more 25-bp hikes in 2023. We then see it keeping at 5% during the yr.”

—Anna Wong and Eliza Winger (economists)

The study of 44 economists was done Dec. 2-7 in advance of the Dec. 13-14 meeting.

Facts released on Friday confirmed US small-phrase inflation anticipations unexpectedly declined to the lowest level in far more than a year whilst producer prices rose in November by additional than forecast.

“The resilience of consumer expending and the labor market place destinations upward tension on inflation and as a outcome heightens the upside hazards to our terminal amount forecast” of 5%-5.25%, claimed Kathy Bostjancic, main economist of Nationwide Life Insurance policy Co.

Less than 50 percent of the economists are seeking for price cuts in 2023. All those who do are hunting for the unemployment fee to jump to 5% from 3.7%, and most see rising joblessness and recession as the main cause of the reversal.

Powell has argued that higher fees are essential for for a longer period, even amid economic weak point, to push down price ranges pressures and that he doesn’t want to err by relenting prematurely in the inflation battle. Which is the error created back again in the 1970s and early 1980s that fostered the persistently superior inflation which led the Fed to inflict a extreme recession to carry them back again down.

The Fed chair on Nov. 30 claimed price hikes could be moderated at the upcoming assembly, signaling the downshift to a 50 percent-issue transfer, but that is “far much less significant” than the peak that fees accomplish and how extensive they continue to be there.

“This will be a very demanding interval for policymakers at all degrees,” explained Hugh Johnson, chairman of Hugh Johnson Economics LLC. When the Fed evidently dreams to maintain rates at the peak all through the year, “These selections are fairly evidently information dependent and will be challenged if, as we suspect, the economic system contracts and inflation fees continue on to average as a result of the to start with fifty percent of 2023.”

The committee in its forecasts is very likely to see inflation as remaining rather a lot more elevated than its September check out at 5.6% in 2022 and 2.9% up coming 12 months. The Fed targets 2% inflation measured by the personal use expenses rate index, which rose by considerably less than expected in Oct, even though it has been larger and extra persistent than forecast for much of the calendar year.

While Fed officers see a narrow path for a delicate landing, a expanding consensus of 81% of economists see a US recession as most likely. Most of the rest see a challenging landing with a time period of contraction or zero progress that falls just shorter of a formally declared downturn. A worldwide economic downturn is also viewed as probable by 76% of the economists.

There’s “a significant hazard of monetary-coverage slip-up,” explained Thomas Costerg, senior US economist at Pictet Wealth Administration. “Taking into account the lags, even though express in the Fed’s assertion, look nevertheless to be taking a back seat when it will come to real determination-making. The notion of a tender landing is acquiring fewer and a lot less probable.”

The FOMC statement is predicted to retain its language providing advice on desire charges that pledges ongoing will increase to a ‘’sufficiently restrictive” amount to return inflation to target. That was tweaked at the past conference in early November to admit the impact of cumulative tightening and the time lags with which monetary coverage impacts the genuine financial system.

One particular quarter of economists count on a dissent at the meeting, which would be the third of 2022. Kansas Town Fed President Esther George dissented in June in favor of a smaller hike, warning that far too-abrupt modifications in fascination rates could undermine the ability of the Fed to attain its planned price route. St. Louis Fed President James Bullard dissented in March as a hawk.

(Updates with PPI and UMich facts in paragraph eight.)

Most Browse from Bloomberg Businessweek

©2022 Bloomberg L.P.