(Bloomberg) — The Federal Reserve appears to be established to provide a fourth straight tremendous-sized charge maximize with Chair Jerome Powell repeating his resolute message on inflation and opening the door to a downshift — with no necessarily pivoting but.

Most Read through from Bloomberg

The Federal Open Current market Committee is envisioned to elevate premiums by 75 basis factors on Wednesday to a selection of 3.75 to 4%, the maximum degree given that 2008 as the central bank extends its most intense tightening campaign given that the 1980s. The conclusion will be announced at 2 p.m. in Washington and Powell will hold a press meeting 30 minutes later on. No clean Fed forecasts are launched at this assembly.

The central bank chief may well emphasize policymakers keep on being steadfast in their inflation combat, when leaving possibilities open up for their accumulating in mid-December, when markets are break up concerning a further huge shift or a change to 50 foundation factors.

In July, his opinions have been wrongly interpreted by traders as a in the vicinity of-expression policy pivot, with markets rallying in reaction, which eased monetary situations — creating it more difficult for the Fed to curb prices. The chair could want to prevent a misstep, even if he suggests a shift to scaled-down improves at future meetings.

“They may want to go slower just in the interest of financial security,” reported Julia Coronado, the founder of MacroPolicy Perspectives LLC. “It’s a challenge for messaging mainly because they really don’t want to simplicity economical problems noticeably. They have to have tight monetary disorders to maintain cooling the economic climate off. So he doesn’t want to seem dovish, but he may want to go slower.”

Powell is making an attempt to curb the most popular inflation in 40 many years amid criticism he was sluggish to respond to rising selling prices last yr. The hikes have roiled economic markets as traders worry the Fed could trigger a economic downturn.

What Bloomberg Economics Suggests…

“The Fed is extensively envisioned to hike prices by 75 basis factors for a fourth consecutive conference. A lot less selected is how Fed Chair Powell will communicate a potential future downshift in the level-hike pace — the degree of conviction, the pitfalls all-around hike sizing, and implications for the terminal price. We expect that he will current a 50-basis-stage move as the foundation situation and explain that a downshift in the speed of amount hikes does not always mean a decrease terminal fee.”

— Anna Wong, Andrew Husby and Eliza Winger (economists)

Wednesday’s envisioned shift comes fewer than a 7 days right before midterm elections in the US, in which Republicans have made superior inflation a leading difficulty and tried to pin blame on President Joe Biden and his get together in Congress. Last 7 days, two Democratic senators urged Powell to not induce avoidable soreness by raising prices way too significant.

Charges

Economists overwhelmingly forecast the FOMC will elevate 75 foundation factors, though 1 is wanting for a action down to 50 basis details rather. Traders are close to completely pricing in 75 basis points at this Fed meeting, according to interest-fee futures markets.

The Lender of Canada unexpectedly slowed its rate of curiosity-amount hikes to a 50 percent level last week, however economists observed Canada’s bigger share of adjustable-level mortgages enlarge the macroeconomic impact of the central bank’s price raises.

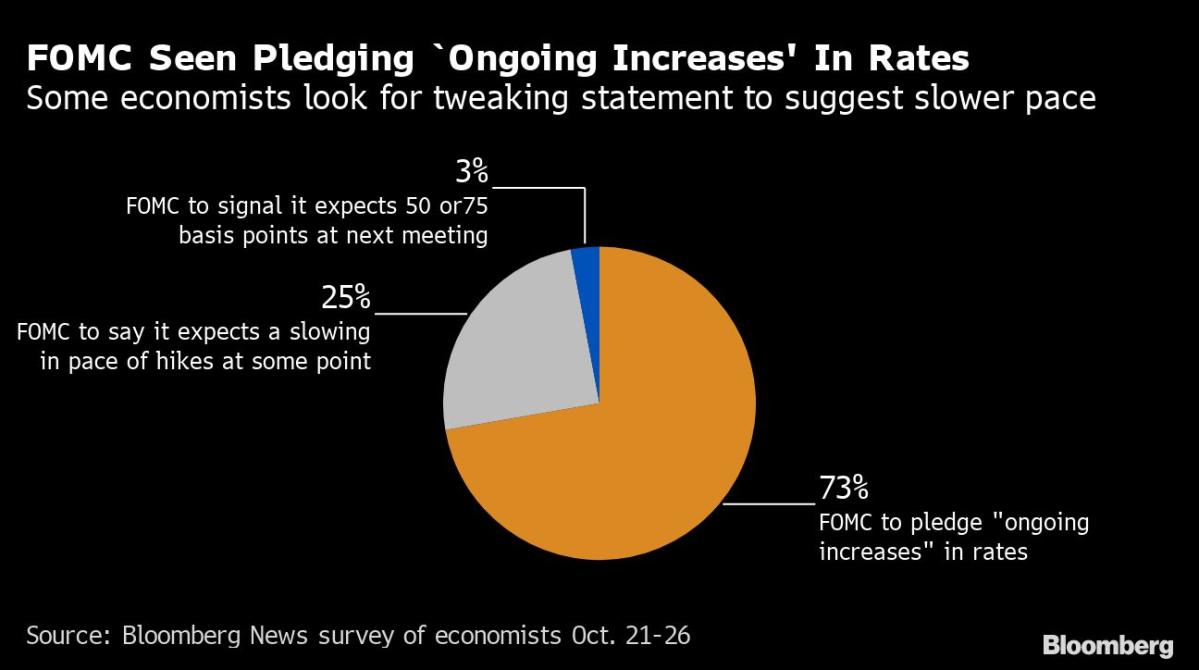

FOMC Statement

The assertion is most likely to retain its pledge of “ongoing increases” in fascination rates, but that could be “modestly tweaked in some way to indicate that you’re closer to the end” of hikes, claimed Michael Feroli, main US economist at JPMorgan Chase & Co. 1 choice would be to say “some even more improves,” he stated.

Push Convention

Powell considering the fact that July has claimed it will be necessary to sluggish the speed of hikes at some place, and he’s probable to reiterate that, even though leaving alternatives open in December depending on incoming details. There will be two work experiences and two buyer-price studies ahead of the Dec. 13-14 assembly.

“Markets want some sign that the Fed’s heading to downshift,” reported Drew Matus, main industry strategist with MetLife Financial investment Administration. “This entire issue of downshifting and relocating to a slower speed of hikes is because you really don’t know how a great deal you have to do. So if it is raining outside and I am driving, I am slowing down.”

Dissents

About a 3rd of economists expect a dissent at the assembly. The most possible candidates would be Kansas Metropolis Fed President Esther George, who dissented in June in favor of a more compact hike, and St. Louis Fed President James Bullard, who dissented in March as a hawk.

Equilibrium Sheet

The Fed is likely to reiterate its ideas to shrink its massive balance sheet at a rate of $1.1 trillion a yr. Economists job that will bring the balance sheet to $8.5 trillion by year stop, dropping to $6.7 trillion in December 2024.

No announcement is envisioned on profits of mortgage-backed securities.

Economical Stability

A report on monetary security is possible to be offered for the duration of the assembly, according to Nomura’s economists, and Powell may well be requested no matter whether the speed of hikes and most likely a US recession could bring about worldwide spillovers or disruptions in US credit history markets. 3-month Treasury yields topped the 10-yr produce final 7 days, a so-named inversion that is frequently noticed as a signal of a economic downturn.

“We are not conditioned in the US to be dealing with a 4.5% federal cash charge,” mentioned Troy Ludtka, senior US economist at Natixis North The usa LLC, and there are concerns credit history marketplaces could be disrupted. “Internationally is even scarier. Europe seems horrible. China is not in recession, but I feel it’s their slowest expansion in a extensive, extended time.”

Ethics Queries

Powell also could be asked about the hottest incidents to increase queries about ethics specifications at the central financial institution.

Atlanta Fed President Raphael Bostic not long ago exposed he violated central financial institution coverage on economic transactions, foremost Powell to ask the Fed’s inspector general to overview his economic disclosures.

In a separate incident, Bullard past month attended a Citigroup-hosted assembly in Washington to which media have been not invited and at which he mentioned financial coverage. The St. Louis Fed has given that claimed it would believe in different ways about accepting these types of invites in the foreseeable future.

Most Examine from Bloomberg Businessweek

©2022 Bloomberg L.P.