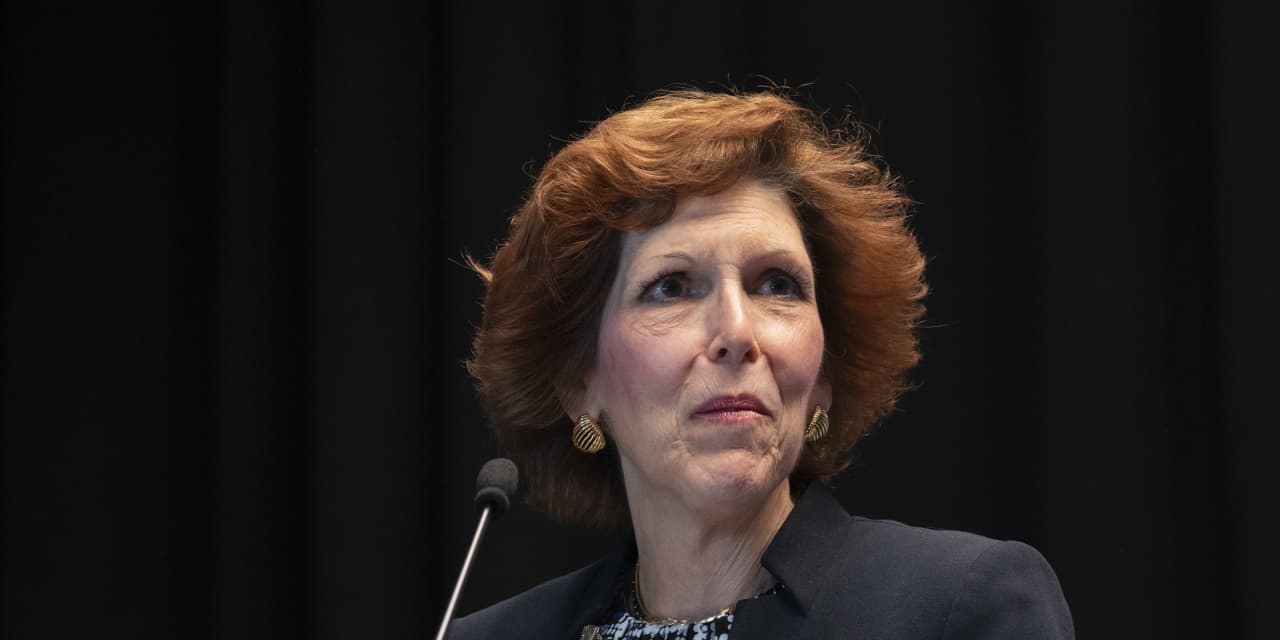

With tiny or no progress produced on bringing inflation down, the Federal Reserve demands to continue on boosting interest costs, Cleveland Fed President Loretta Mester claimed Tuesday.

“At some point, you know, as inflation arrives down, them my hazard calculation will change as well and we will want to possibly sluggish the amount increases, maintain for some time and assess the cumulative impact on what we have finished,” Mester advised reporters soon after a speech to the Economic Club of New York.

“But at this issue, my fears lie more on – we haven’t witnessed development on inflation , we have observed some moderation- but to my brain it usually means we even now have to go a small little bit even further,” Mester mentioned.

In her speech, the Cleveland Fed president mentioned the central bank necessary to be wary of wishful contemplating about inflation that would lead the central lender to pause or reverse program prematurely.

“Given recent economic ailments and the outlook, in my look at, at the place the more substantial dangers occur from tightening far too minimal and permitting really high inflation to persist and develop into embedded in the overall economy,” Mester reported.

She stated she thinks inflation will be additional persistent than some of her colleagues.

As a end result, her preferred route for the Fed’s benchmark price is a little greater than the median forecast of the Fed’s “dot-plot,” which points to premiums finding to a assortment of 4.5%-4.75% by following year.

Mester, who is a voting member of the Fed’s interest-price committee this year, recurring she doesn’t be expecting any cuts in the Fed’s benchmark rate up coming yr. She pressured that this forecast is based on her existing reading of the economic system and she will modify her views centered on the financial and economical data for the outlook and the dangers close to the outlook.

Viewpoint: Fed is lacking signals from foremost inflation indicators

Mester mentioned she doesn’t count solely on govt details on inflation mainly because some of it was backward wanting. She said supplements her investigate with talks with enterprise contacts about their selling price-placing ideas and makes use of some economic versions.

The Fed is also helped by some actual-time knowledge, she included.

“I don’t see the signals I’d like to see on the inflation,” she additional,

Mester stated she did not see any “big, pending risks” in conditions of economic balance considerations.

“There is no evidence that there is disorderly market operating going on at current,” she reported.

U.S. shares ended up mixed on Tuesday afternoon with the Dow Jones Industrial Regular

DJIA,

up a little bit but the S&P 500 in unfavorable territory. The yield on the 10-year Treasury be aware

TMUBMUSD10Y,

inched up to 3.9%