Text size

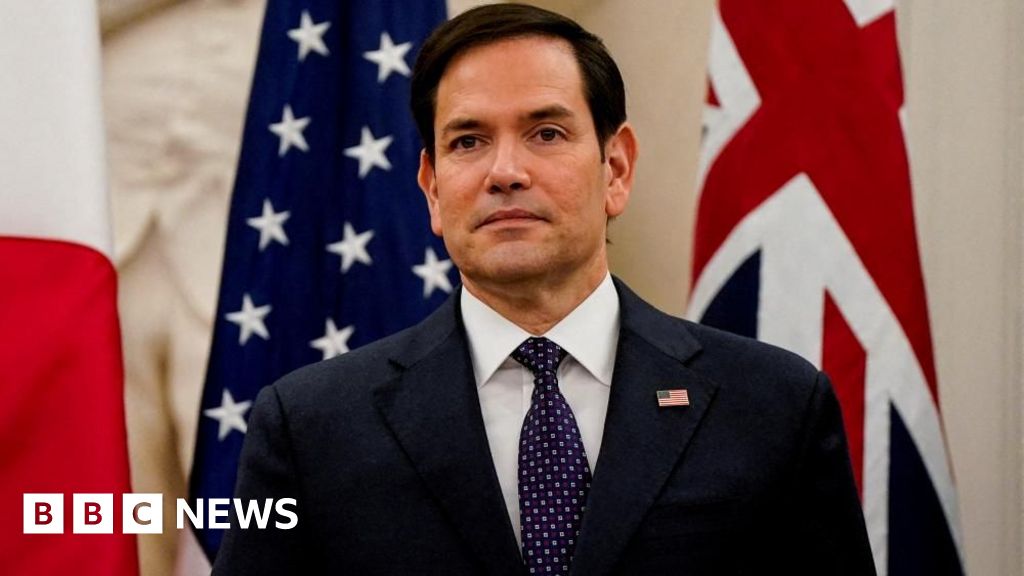

United Auto Workers President Shawn Fain said the union and auto makers Ford, General Motors, and Stellantis were still very far apart as negotiations continued ahead of a strike deadline.

Frederic J. Brown/AFP via Getty Images

Stock futures pointed higher Thursday even as U.S. producer prices rose more than expected in August.

These stocks were poised to make moves Thursday:

Ford

(ticker: F) was down 0.2% and

General Motors

(GM) rose 0.2% ahead of a deadline late Thursday for a strike by the United Auto Workers union. Shawn Fain, the head of the UAW, said late Wednesday the union and the Big Three automakers, including

Stellantis

(STLA), were still “very far apart” on the union’s key priorities for wage increases, and that the UAW was preparing to strike all three companies using new tactics after 11:59 p.m. on Thursday.

The initial public offering of Arm Holdings was priced at $51 a share, at the top of the expected range, giving the chip design company a valuation of $54.5 billion on a fully diluted basis.

Arm

shares will begin trading Thursday on the Nasdaq under the stock symbol “ARM.” Ahead of Arm’s debut, shares of fellow chip makers traded higher.

Nvidia

(NVDA) rose 0.9%, U.S.-listed shares of

Taiwan Semiconductor Manufacturing

(TSM) gained 1.1%,

Intel

(INTC) was up 0.6%, and

Qualcomm

(QCOM) rose 0.9%.

AMC Entertainment

(

AMC

) gained 8.5% after the movie-theater chain completed an at-the-market equity offering, raising about $325.5 million.

Etsy

(ETSY) rose 5.8% to $68.30 after the online marketplace was upgraded to Outperform from Peer Perform at Wolfe Research with a price target of $100.

HP Inc.

(HPQ) was down 4.4% after Warren Buffett’s

Berkshire Hathaway

(BRK.B) disclosed it sold 5.5 million shares of the maker of personal computers and printers. It was the first sale of stock in

HP

Inc.

since Berkshire Hathaway accumulated a 12% stake in the company in the early part of 2022.

Delta Air Lines

(DAL) gained 2.3%. The airline cut its third-quarter earnings guidance to a range of $1.85 to $2.05 a share from a prior range of $2.20 to $2.50 but its revenue outlook was upbeat.

Norwegian Cruise Line

(NCLH) and

Carnival

(CCL) were upgraded to Buy from Neutral at Redburn. Norwegian shares rose 2% in premarket trading and Carnival was up 2.2%. The Redburn analysts maintained their recommendation on

Royal Caribbean

(RCL) at Neutral.

Royal Caribbean

gained 1%.

First Solar

(FSLR) gained 2.1% in premarket trading after the solar technology company was upgraded to Outperform from Market Perform at BMO Capital. The stock fell 5.8% on Wednesday.

Semtech

(SMTC), the semiconductor supplier, forecast a fiscal third-quarter loss of 9 cents to 22 cents a share on revenue of $190 million to $210 million. Analysts had been estimating adjusted earnings of 12 cents a share on revenue of $247.7 million. The stock, however, was rising 1% in premarket trading after falling earlier in the session.

Earnings reports are expected after the closing bell Thursday from software company

Adobe

(ADBE), home builder

Lennar

(LEN), and online auto auctioneer

Copart

(CPRT).

Write to Joe Woelfel at joseph.woelfel@barrons.com