The FTX debacle is reverberating by the crypto market and finance in common.

The collapse of this crypto exchange, which in February was valued at $32 billion, stunned every person.

FTX submitted for Chapter 11 personal bankruptcy on Nov. 11 mainly because it ran out of funds to meet the needs of its panicked buyers. And that has prompted regulators to open investigations into the crypto empire of Sam Bankman-Fried, the founder of FTX.

In addition, regulators are rising their scrutiny of the crypto area, where transparency is practically nonexistent.

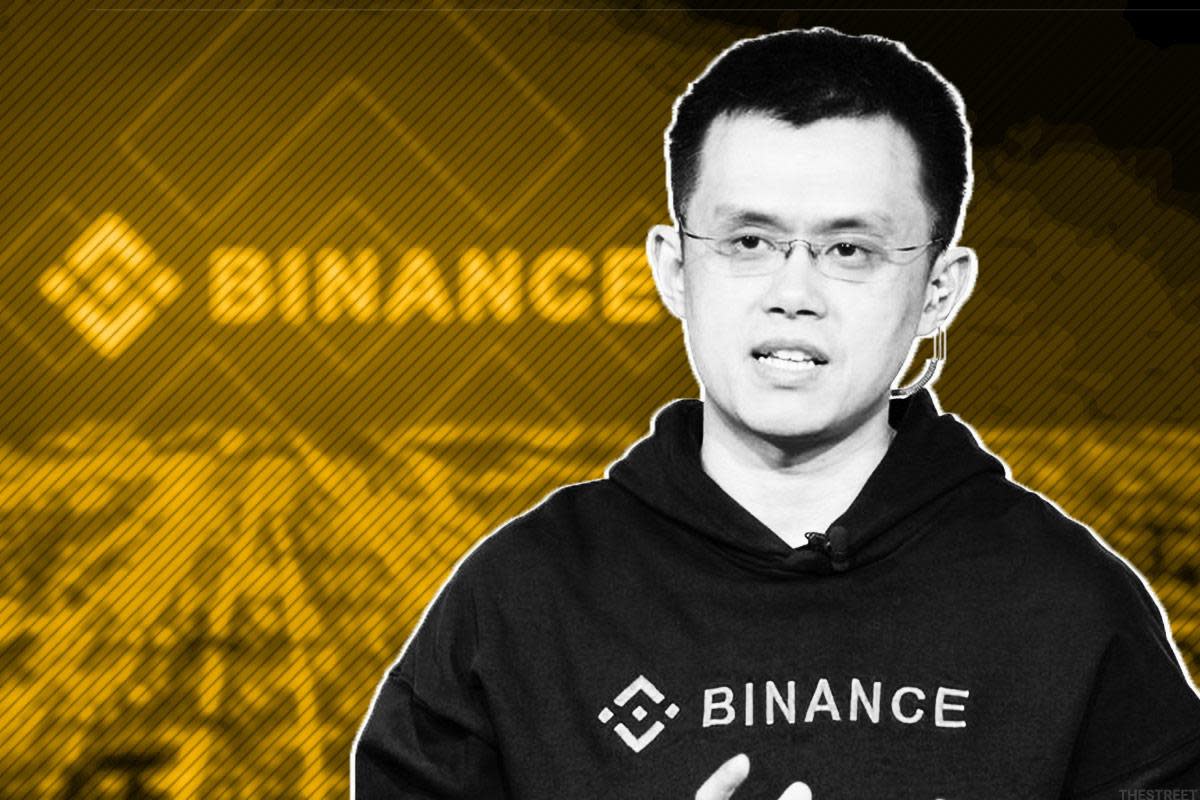

The Singapore marketplace authority has just introduced that it is conducting an investigation into Binance, the world’s biggest cryptocurrency trade by volume. Binance on Nov. 8 agreed to obtain FTX, then retracted its give the next day.

Binance is suspected of violating procedures connected to payment expert services.

“The Commercial Affairs Department commenced investigation into Binance for doable contravention of the Payment Providers Act,” the Monetary Authority of Singapore claimed on Nov. 21 in a assertion.

The regulator disclosed the investigation although it was responding to inquiries about irrespective of whether it was dealing with Binance.com in different ways from FTX.

Grievances About Binance

“Even though each Binance and FTX are not accredited right here, there is a crystal clear variance concerning the two,” the monetary authority argued. “Binance was actively soliciting consumers in Singapore when FTX was not. Binance in point went to the extent of offering listings in Singapore dollars.”

The Singaporean authorities’ investigation will come as Changpeng Zhao, the CEO of Binance, is rising as the new king of cryptocurrencies following the downfall of Bankman-Fried.

Zhao notably declared the creation of a fund to help crypto providers that ended up likely to come across themselves limited of dollars because of their exposure to FTX. He has however not provided the aspects of this fund.

The regulator claimed it received numerous grievances about Binance concerning January and August 2021. There had been also announcements in various jurisdictions of unlicensed solicitation of buyers by Binance through that period of time.

“With regard to FTX, there was no proof that it was soliciting Singapore buyers exclusively. Trades on FTX also could not be transacted in Singapore bucks. But as in the circumstance of hundreds of other financial and crypto entities that function abroad, Singapore buyers ended up in a position to obtain FTX products and services on the net.”

The monetary authority accused Binance to have solicited Singapore people without a licence.

It mentioned that it expected Binance to cease soliciting Singapore consumers. As a end result, the company place in position many steps such as geo-blocking of Singapore IP addresses and the removing of its cell software from Singapore application merchants.

“These actions were supposed to reveal over and above question that Binance experienced ceased soliciting and offering services to Singapore buyers. Really should Binance choose now to dismantle some of these restrictions, it has to continue on to comply with the prohibition versus soliciting Singapore consumers devoid of a license.”

Binance declined to comment. “Due to confidentiality obligations, we are unable to comment on this,” a spokesperson advised TheStreet.

The investigation is not connected notably to FTX, but it illustrates the stress that regulators are putting on the crypto sector as scandals multiply, creating colossal losses to retail investors and significant buyers.

Final Could, sister cryptocurrencies Luna and UST, or TerraUSD, collapsed, wiping out at minimum $55 billion. That rout induced a credit rating crunch that guide to the liquidation of the hedge fund Three Arrows Cash, or 3AC, and the individual bankruptcy of the crypto creditors Celsius Community and Voyager Electronic amid many others.

Black Friday Sale

Get Action Alerts Furthermore + Quant Ratings investing insights for 1 lower rate.

- Motion Alerts Furthermore: Unlock portfolio assistance, accessibility to portfolio supervisors, and market evaluation each individual investing working day.

- Quant Rankings: Get inventory scores, essential financial metrics, and scores updates and downgrades for your inventory investigation.

Assert this offer now!

:max_bytes(150000):strip_icc():focal(605x417:607x419)/Alabama-Woman-Forced-to-Attend-Jury-Duty-011725-tout-b-2583e44b563f4d4fbeec46beb0a5ee35.jpg)